Investment analysts at TD Securities assumed coverage on shares of Coeur Mining (NYSE:CDE - Get Free Report) in a research report issued to clients and investors on Tuesday,Briefing.com Automated Import reports. The firm set a "buy" rating and a $7.00 price target on the basic materials company's stock. TD Securities' price objective would indicate a potential upside of 36.59% from the company's previous close.

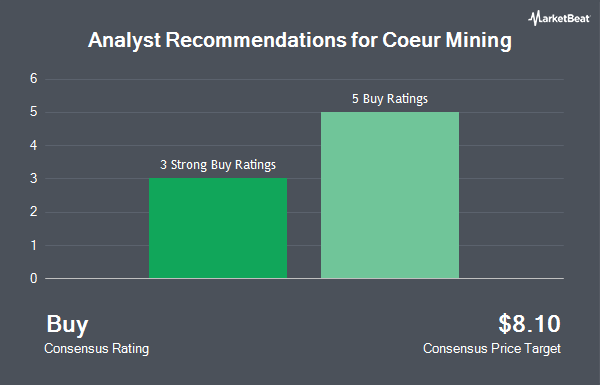

Other equities research analysts have also issued research reports about the stock. Roth Mkm cut their price target on shares of Coeur Mining from $8.50 to $8.25 and set a "buy" rating for the company in a report on Friday, February 21st. BMO Capital Markets began coverage on shares of Coeur Mining in a report on Tuesday, February 18th. They issued an "outperform" rating and a $9.00 price target for the company. Cormark raised shares of Coeur Mining to a "moderate buy" rating in a report on Thursday, February 20th. Finally, Raymond James raised shares of Coeur Mining from a "market perform" rating to an "outperform" rating and cut their price target for the stock from $8.75 to $8.25 in a report on Friday, February 21st. One investment analyst has rated the stock with a hold rating, six have given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, Coeur Mining currently has a consensus rating of "Buy" and a consensus price target of $8.05.

Get Our Latest Report on CDE

Coeur Mining Stock Down 8.0 %

CDE stock opened at $5.13 on Tuesday. The company has a quick ratio of 0.39, a current ratio of 0.83 and a debt-to-equity ratio of 0.50. Coeur Mining has a 52 week low of $2.98 and a 52 week high of $7.72. The firm has a 50 day moving average of $6.17 and a 200 day moving average of $6.36. The stock has a market capitalization of $3.27 billion, a PE ratio of 42.71 and a beta of 1.51.

Coeur Mining (NYSE:CDE - Get Free Report) last announced its quarterly earnings data on Wednesday, February 19th. The basic materials company reported $0.11 EPS for the quarter, meeting the consensus estimate of $0.11. The business had revenue of $305.40 million during the quarter, compared to analysts' expectations of $314.32 million. Coeur Mining had a net margin of 5.59% and a return on equity of 6.59%. Sell-side analysts forecast that Coeur Mining will post 0.58 earnings per share for the current year.

Insider Activity

In other news, CFO Thomas S. Whelan purchased 10,000 shares of the stock in a transaction dated Wednesday, February 26th. The shares were purchased at an average price of $5.25 per share, with a total value of $52,500.00. Following the transaction, the chief financial officer now owns 668,450 shares in the company, valued at $3,509,362.50. The trade was a 1.52 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Corporate insiders own 1.56% of the company's stock.

Institutional Inflows and Outflows

A number of large investors have recently bought and sold shares of CDE. Two Sigma Advisers LP lifted its position in Coeur Mining by 404.6% in the fourth quarter. Two Sigma Advisers LP now owns 5,089,100 shares of the basic materials company's stock valued at $29,110,000 after buying an additional 4,080,600 shares during the last quarter. Jacobs Levy Equity Management Inc. acquired a new position in Coeur Mining in the fourth quarter valued at about $21,224,000. Vanguard Group Inc. lifted its position in Coeur Mining by 8.5% in the fourth quarter. Vanguard Group Inc. now owns 40,700,218 shares of the basic materials company's stock valued at $232,805,000 after buying an additional 3,178,785 shares during the last quarter. Marshall Wace LLP lifted its position in Coeur Mining by 12,934.3% in the fourth quarter. Marshall Wace LLP now owns 2,971,679 shares of the basic materials company's stock valued at $16,998,000 after buying an additional 2,948,880 shares during the last quarter. Finally, Two Sigma Investments LP lifted its position in Coeur Mining by 57.8% in the fourth quarter. Two Sigma Investments LP now owns 7,210,595 shares of the basic materials company's stock valued at $41,245,000 after buying an additional 2,641,310 shares during the last quarter. Institutional investors and hedge funds own 63.01% of the company's stock.

Coeur Mining Company Profile

(

Get Free Report)

Coeur Mining, Inc explores for precious metals in the United States, Canada, and Mexico. The company primarily explores for gold, silver, zinc, and lead properties. It markets and sells its concentrates to third-party customers, smelters, under off-take agreements. The company was formerly known as Coeur d'Alene Mines Corporation and changed its name to Coeur Mining, Inc in May 2013.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Coeur Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coeur Mining wasn't on the list.

While Coeur Mining currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.