Coeur Mining (NYSE:CDE - Get Free Report)'s stock had its "buy" rating restated by Roth Mkm in a report released on Friday,Benzinga reports. They presently have a $8.50 price objective on the basic materials company's stock, down from their prior price objective of $9.00. Roth Mkm's price objective would suggest a potential upside of 28.98% from the company's previous close.

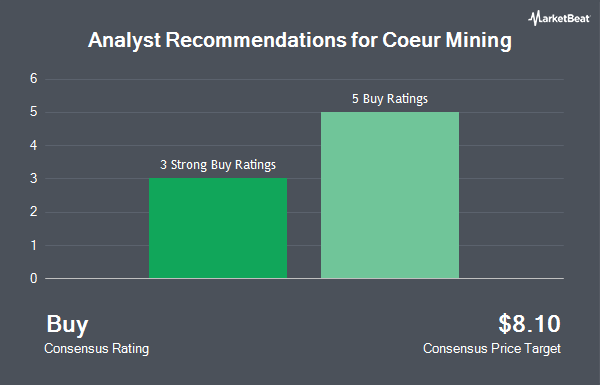

A number of other equities research analysts have also issued reports on the company. Raymond James increased their price target on Coeur Mining from $6.25 to $7.00 and gave the company a "market perform" rating in a research report on Friday, September 20th. Cantor Fitzgerald lowered shares of Coeur Mining from an "overweight" rating to a "neutral" rating in a research note on Thursday, August 8th. Canaccord Genuity Group lifted their price target on shares of Coeur Mining from $7.00 to $7.75 and gave the stock a "buy" rating in a research note on Tuesday, October 8th. Finally, BMO Capital Markets increased their price objective on shares of Coeur Mining from $7.50 to $8.00 and gave the company an "outperform" rating in a research report on Monday, September 23rd. Three investment analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $7.81.

View Our Latest Research Report on Coeur Mining

Coeur Mining Stock Performance

CDE remained flat at $6.59 during trading hours on Friday. 11,276,124 shares of the company traded hands, compared to its average volume of 7,836,467. The stock has a market cap of $2.63 billion, a price-to-earnings ratio of -219.67 and a beta of 1.65. Coeur Mining has a 1 year low of $2.00 and a 1 year high of $7.72. The company has a debt-to-equity ratio of 0.59, a quick ratio of 0.45 and a current ratio of 1.20. The stock's 50-day moving average price is $6.56 and its 200 day moving average price is $6.02.

Coeur Mining (NYSE:CDE - Get Free Report) last posted its quarterly earnings data on Wednesday, November 6th. The basic materials company reported $0.12 earnings per share for the quarter, topping analysts' consensus estimates of $0.07 by $0.05. The business had revenue of $313.50 million for the quarter, compared to analyst estimates of $289.19 million. Coeur Mining had a negative return on equity of 4.59% and a negative net margin of 8.33%. The company's revenue was up 61.1% on a year-over-year basis. During the same quarter in the prior year, the company earned ($0.05) earnings per share. As a group, research analysts expect that Coeur Mining will post 0.14 EPS for the current fiscal year.

Institutional Trading of Coeur Mining

A number of large investors have recently made changes to their positions in CDE. BNP Paribas Financial Markets lifted its stake in Coeur Mining by 149.1% in the first quarter. BNP Paribas Financial Markets now owns 323,988 shares of the basic materials company's stock valued at $1,221,000 after buying an additional 193,912 shares during the last quarter. SG Americas Securities LLC raised its position in Coeur Mining by 247.7% in the 1st quarter. SG Americas Securities LLC now owns 113,038 shares of the basic materials company's stock valued at $426,000 after purchasing an additional 80,531 shares during the last quarter. Swiss National Bank boosted its stake in Coeur Mining by 8.5% during the 1st quarter. Swiss National Bank now owns 755,500 shares of the basic materials company's stock worth $2,848,000 after purchasing an additional 59,500 shares during the period. Fore Capital LLC purchased a new position in Coeur Mining during the 1st quarter worth $211,000. Finally, Russell Investments Group Ltd. increased its stake in Coeur Mining by 32.4% in the first quarter. Russell Investments Group Ltd. now owns 24,337 shares of the basic materials company's stock valued at $92,000 after purchasing an additional 5,956 shares during the period. 63.01% of the stock is owned by institutional investors and hedge funds.

Coeur Mining Company Profile

(

Get Free Report)

Coeur Mining, Inc explores for precious metals in the United States, Canada, and Mexico. The company primarily explores for gold, silver, zinc, and lead properties. It markets and sells its concentrates to third-party customers, smelters, under off-take agreements. The company was formerly known as Coeur d'Alene Mines Corporation and changed its name to Coeur Mining, Inc in May 2013.

Featured Stories

Before you consider Coeur Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coeur Mining wasn't on the list.

While Coeur Mining currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.