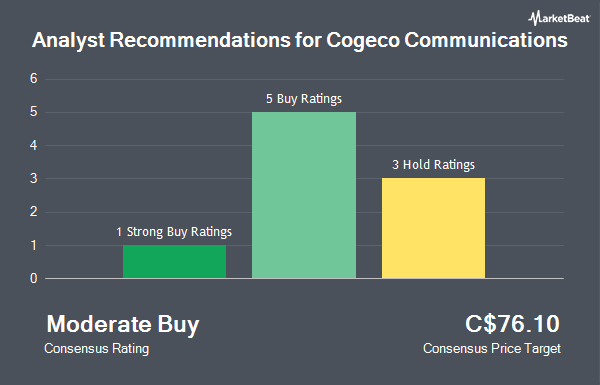

Shares of Cogeco Communications Inc. (TSE:CCA - Get Free Report) have been given an average recommendation of "Moderate Buy" by the nine ratings firms that are currently covering the firm, Marketbeat Ratings reports. Three analysts have rated the stock with a hold recommendation, five have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is C$76.10.

Several research firms recently commented on CCA. Canaccord Genuity Group lifted their price target on shares of Cogeco Communications from C$76.00 to C$77.00 and gave the company a "buy" rating in a research report on Friday, April 11th. Scotiabank set a C$75.00 target price on shares of Cogeco Communications and gave the company a "sector perform" rating in a report on Thursday, April 17th. Royal Bank of Canada upped their price target on shares of Cogeco Communications from C$77.00 to C$78.00 and gave the stock a "sector perform" rating in a research report on Wednesday, April 9th. Finally, CIBC cut their price objective on Cogeco Communications from C$73.00 to C$71.00 in a research report on Wednesday, January 15th.

Get Our Latest Stock Analysis on Cogeco Communications

Cogeco Communications Trading Up 0.3 %

Shares of TSE CCA traded up C$0.21 during midday trading on Monday, hitting C$64.58. The stock had a trading volume of 46,254 shares, compared to its average volume of 104,377. The company has a quick ratio of 0.49, a current ratio of 0.37 and a debt-to-equity ratio of 159.35. Cogeco Communications has a 1-year low of C$50.82 and a 1-year high of C$75.09. The company has a market capitalization of C$2.71 billion, a price-to-earnings ratio of 7.82, a PEG ratio of 4.77 and a beta of 0.59. The company has a fifty day moving average price of C$66.43 and a 200 day moving average price of C$67.27.

Cogeco Communications Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, May 7th. Stockholders of record on Wednesday, May 7th will be paid a $0.922 dividend. The ex-dividend date of this dividend is Wednesday, April 23rd. This represents a $3.69 dividend on an annualized basis and a dividend yield of 5.71%. Cogeco Communications's dividend payout ratio (DPR) is presently 41.40%.

Cogeco Communications Company Profile

(

Get Free ReportCogeco Communications Inc operates as a telecommunications corporation in Canada and the United States. It operates in two segments, Canadian Telecommunications and American Telecommunications. The company offers Internet, video, and Internet protocol (IP) based telephony services to residential and small business customers through its two-way broadband fiber networks.

Recommended Stories

Before you consider Cogeco Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cogeco Communications wasn't on the list.

While Cogeco Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.