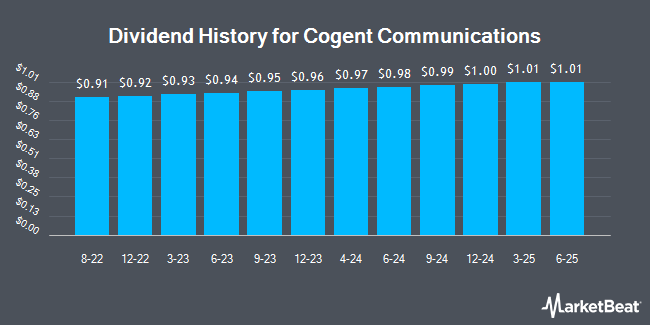

Cogent Communications Holdings, Inc. (NASDAQ:CCOI - Get Free Report) declared a quarterly dividend on Thursday, November 7th,Zacks Dividends reports. Investors of record on Friday, November 22nd will be paid a dividend of 0.995 per share by the technology company on Friday, December 6th. This represents a $3.98 dividend on an annualized basis and a yield of 4.75%. The ex-dividend date is Friday, November 22nd. This is a positive change from Cogent Communications's previous quarterly dividend of $0.99.

Cogent Communications has increased its dividend by an average of 10.7% annually over the last three years and has raised its dividend annually for the last 13 consecutive years. Cogent Communications has a dividend payout ratio of -111.6% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Analysts expect Cogent Communications to earn ($3.33) per share next year, which means the company may not be able to cover its $3.94 annual dividend with an expected future payout ratio of -118.3%.

Cogent Communications Trading Down 1.9 %

NASDAQ:CCOI traded down $1.60 during mid-day trading on Friday, reaching $83.75. 473,268 shares of the company's stock traded hands, compared to its average volume of 441,070. The company has a 50 day moving average price of $77.11 and a 200-day moving average price of $67.50. Cogent Communications has a 12-month low of $50.80 and a 12-month high of $86.76. The firm has a market capitalization of $4.10 billion, a price-to-earnings ratio of 107.91 and a beta of 0.40. The company has a debt-to-equity ratio of 4.43, a current ratio of 2.20 and a quick ratio of 2.20.

Cogent Communications (NASDAQ:CCOI - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The technology company reported ($1.33) earnings per share for the quarter, beating the consensus estimate of ($1.34) by $0.01. The firm had revenue of $257.20 million during the quarter, compared to the consensus estimate of $258.69 million. Cogent Communications had a negative return on equity of 32.14% and a net margin of 4.26%. The company's revenue was down 6.6% on a year-over-year basis. During the same period last year, the company earned ($1.13) earnings per share. On average, sell-side analysts predict that Cogent Communications will post -4.46 earnings per share for the current year.

Analyst Ratings Changes

Several brokerages recently issued reports on CCOI. TD Cowen lifted their target price on Cogent Communications from $78.00 to $82.00 and gave the company a "buy" rating in a research note on Friday, August 9th. Bank of America cut Cogent Communications from a "neutral" rating to an "underperform" rating and dropped their price objective for the company from $75.00 to $65.00 in a report on Wednesday, August 21st. Citigroup lifted their price target on shares of Cogent Communications from $70.00 to $82.00 and gave the company a "buy" rating in a research note on Monday, August 19th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $74.00 price objective on shares of Cogent Communications in a research note on Tuesday, September 3rd. Finally, The Goldman Sachs Group lifted their price target on Cogent Communications from $62.00 to $71.00 and gave the company a "neutral" rating in a report on Friday, October 4th. Two equities research analysts have rated the stock with a sell rating, two have given a hold rating and four have assigned a buy rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $77.14.

Get Our Latest Stock Analysis on Cogent Communications

Insider Activity at Cogent Communications

In other news, CRO James Bubeck sold 1,920 shares of the business's stock in a transaction dated Wednesday, September 4th. The stock was sold at an average price of $69.77, for a total transaction of $133,958.40. Following the sale, the executive now owns 50,982 shares in the company, valued at approximately $3,557,014.14. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, Director Lewis H. Ferguson sold 1,550 shares of the firm's stock in a transaction on Thursday, August 22nd. The stock was sold at an average price of $72.62, for a total value of $112,561.00. Following the completion of the transaction, the director now owns 17,748 shares in the company, valued at $1,288,859.76. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CRO James Bubeck sold 1,920 shares of Cogent Communications stock in a transaction dated Wednesday, September 4th. The stock was sold at an average price of $69.77, for a total value of $133,958.40. Following the sale, the executive now directly owns 50,982 shares of the company's stock, valued at approximately $3,557,014.14. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 64,870 shares of company stock valued at $4,716,057 in the last ninety days. Corporate insiders own 11.40% of the company's stock.

Cogent Communications Company Profile

(

Get Free Report)

Cogent Communications Holdings, Inc, through its subsidiaries, provides high-speed Internet access, private network, and data center colocation space services in North America, Europe, Oceania, South America, and Africa. The company offers on-net Internet access and private network services to law firms, financial services firms, and advertising and marketing firms, as well as heath care providers, educational institutions and other professional services businesses, other Internet service providers, telephone companies, cable television companies, web hosting companies, media service providers, mobile phone operators, content delivery network companies, and commercial content and application service providers.

Featured Articles

Before you consider Cogent Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cogent Communications wasn't on the list.

While Cogent Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.