Thomas Story & Son LLC lifted its stake in shares of Cognex Co. (NASDAQ:CGNX - Free Report) by 16.1% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 143,927 shares of the scientific and technical instruments company's stock after purchasing an additional 19,915 shares during the period. Cognex makes up about 2.4% of Thomas Story & Son LLC's holdings, making the stock its 18th biggest position. Thomas Story & Son LLC owned 0.08% of Cognex worth $5,829,000 as of its most recent SEC filing.

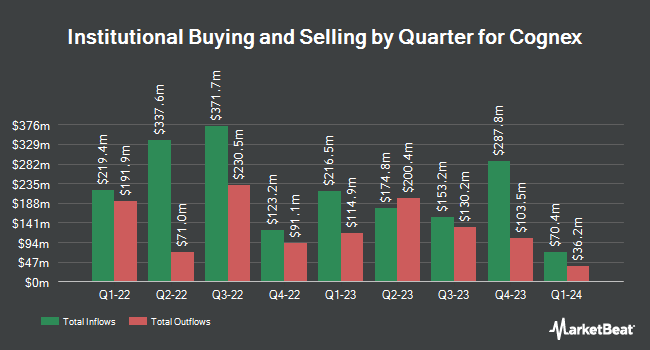

Other institutional investors and hedge funds also recently modified their holdings of the company. Commonwealth Equity Services LLC grew its stake in Cognex by 3.6% in the first quarter. Commonwealth Equity Services LLC now owns 13,871 shares of the scientific and technical instruments company's stock valued at $588,000 after purchasing an additional 487 shares in the last quarter. BNP Paribas Financial Markets lifted its position in shares of Cognex by 153.6% in the 1st quarter. BNP Paribas Financial Markets now owns 134,516 shares of the scientific and technical instruments company's stock worth $5,706,000 after acquiring an additional 81,467 shares during the period. BI Asset Management Fondsmaeglerselskab A S lifted its position in shares of Cognex by 303.1% during the 1st quarter. BI Asset Management Fondsmaeglerselskab A S now owns 770 shares of the scientific and technical instruments company's stock worth $33,000 after buying an additional 579 shares during the period. Texas Permanent School Fund Corp lifted its position in shares of Cognex by 1.3% during the 1st quarter. Texas Permanent School Fund Corp now owns 150,657 shares of the scientific and technical instruments company's stock worth $6,391,000 after buying an additional 1,950 shares during the period. Finally, Sei Investments Co. increased its holdings in Cognex by 4.9% during the 1st quarter. Sei Investments Co. now owns 209,304 shares of the scientific and technical instruments company's stock valued at $8,879,000 after purchasing an additional 9,748 shares in the last quarter. 88.12% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

CGNX has been the topic of several recent analyst reports. The Goldman Sachs Group reduced their target price on Cognex from $45.00 to $39.00 and set a "sell" rating on the stock in a report on Friday, August 2nd. Vertical Research started coverage on Cognex in a research note on Tuesday, July 23rd. They set a "buy" rating and a $58.00 target price for the company. Needham & Company LLC decreased their price objective on Cognex from $50.00 to $47.00 and set a "buy" rating for the company in a report on Friday, November 1st. DA Davidson decreased their price target on Cognex from $41.00 to $39.00 and set a "neutral" rating for the company in a report on Monday, August 5th. Finally, Truist Financial cut shares of Cognex from a "buy" rating to a "hold" rating and dropped their target price for the stock from $46.00 to $43.00 in a research report on Tuesday. One investment analyst has rated the stock with a sell rating, five have given a hold rating and six have given a buy rating to the company's stock. According to MarketBeat, Cognex has a consensus rating of "Hold" and a consensus price target of $47.91.

Read Our Latest Stock Analysis on Cognex

Insiders Place Their Bets

In other news, CFO Dennis Fehr acquired 6,570 shares of the firm's stock in a transaction on Wednesday, September 4th. The shares were purchased at an average price of $38.04 per share, for a total transaction of $249,922.80. Following the completion of the transaction, the chief financial officer now owns 6,570 shares of the company's stock, valued at $249,922.80. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 1.10% of the stock is currently owned by insiders.

Cognex Price Performance

Cognex stock traded down $0.14 during mid-day trading on Friday, hitting $42.91. The company's stock had a trading volume of 1,311,656 shares, compared to its average volume of 1,304,488. The stock has a market cap of $7.36 billion, a price-to-earnings ratio of 82.52 and a beta of 1.40. The business has a 50 day moving average price of $39.62 and a 200-day moving average price of $43.04. Cognex Co. has a 12 month low of $34.79 and a 12 month high of $53.13.

Cognex Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Thursday, November 14th will be paid a $0.08 dividend. The ex-dividend date of this dividend is Thursday, November 14th. This is an increase from Cognex's previous quarterly dividend of $0.08. This represents a $0.32 annualized dividend and a yield of 0.75%. Cognex's payout ratio is currently 61.54%.

Cognex Company Profile

(

Free Report)

Cognex Corporation provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide. Its machine vision products are used to automate the manufacturing and tracking of discrete items, including mobile phones, electric vehicle batteries, and e-commerce packages by locating, identifying, inspecting, and measuring them during the manufacturing or distribution process.

Further Reading

Before you consider Cognex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cognex wasn't on the list.

While Cognex currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.