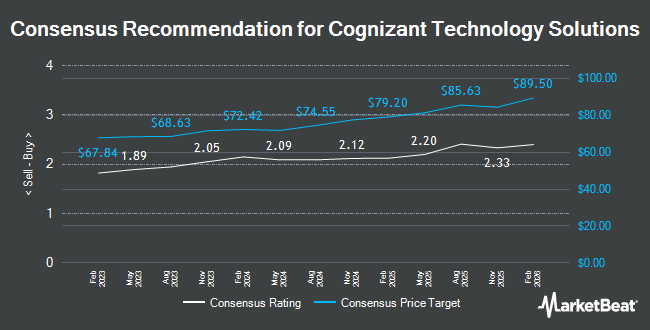

Cognizant Technology Solutions (NASDAQ:CTSH - Get Free Report) had its price target lowered by analysts at Morgan Stanley from $85.00 to $80.00 in a note issued to investors on Wednesday,Benzinga reports. The firm presently has an "equal weight" rating on the information technology service provider's stock. Morgan Stanley's price objective points to a potential downside of 3.00% from the stock's current price.

CTSH has been the topic of several other reports. Needham & Company LLC reissued a "hold" rating on shares of Cognizant Technology Solutions in a report on Thursday, February 6th. Royal Bank of Canada upped their price target on shares of Cognizant Technology Solutions from $82.00 to $93.00 and gave the stock a "sector perform" rating in a report on Thursday, February 6th. UBS Group lifted their price objective on shares of Cognizant Technology Solutions from $83.00 to $86.00 and gave the company a "neutral" rating in a research note on Monday, February 3rd. BMO Capital Markets upped their target price on Cognizant Technology Solutions from $88.00 to $94.00 and gave the stock a "market perform" rating in a research note on Thursday, February 6th. Finally, StockNews.com upgraded Cognizant Technology Solutions from a "hold" rating to a "buy" rating in a research note on Thursday, February 6th. Sixteen equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $83.39.

View Our Latest Stock Report on CTSH

Cognizant Technology Solutions Stock Performance

Shares of NASDAQ CTSH opened at $82.47 on Wednesday. Cognizant Technology Solutions has a one year low of $63.79 and a one year high of $90.82. The company has a debt-to-equity ratio of 0.06, a current ratio of 2.09 and a quick ratio of 2.09. The firm has a market cap of $40.79 billion, a price-to-earnings ratio of 18.29, a P/E/G ratio of 2.11 and a beta of 1.12. The stock's fifty day moving average price is $82.23 and its two-hundred day moving average price is $79.38.

Cognizant Technology Solutions (NASDAQ:CTSH - Get Free Report) last issued its quarterly earnings data on Wednesday, February 5th. The information technology service provider reported $1.21 earnings per share for the quarter, topping the consensus estimate of $1.12 by $0.09. Cognizant Technology Solutions had a net margin of 11.35% and a return on equity of 16.78%. On average, equities analysts forecast that Cognizant Technology Solutions will post 4.98 EPS for the current year.

Institutional Investors Weigh In On Cognizant Technology Solutions

Institutional investors have recently modified their holdings of the company. Duncker Streett & Co. Inc. acquired a new position in Cognizant Technology Solutions in the fourth quarter valued at $28,000. Ashton Thomas Securities LLC acquired a new position in shares of Cognizant Technology Solutions in the 3rd quarter valued at about $30,000. Trust Co. of Vermont boosted its position in shares of Cognizant Technology Solutions by 188.4% during the 4th quarter. Trust Co. of Vermont now owns 447 shares of the information technology service provider's stock valued at $34,000 after purchasing an additional 292 shares in the last quarter. Park Square Financial Group LLC acquired a new stake in Cognizant Technology Solutions during the fourth quarter worth approximately $36,000. Finally, SBI Securities Co. Ltd. bought a new stake in Cognizant Technology Solutions in the fourth quarter worth approximately $36,000. 92.44% of the stock is owned by institutional investors.

Cognizant Technology Solutions Company Profile

(

Get Free Report)

Cognizant Technology Solutions Corporation, a professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally. It operates through four segments: Financial Services, Health Sciences, Products and Resources, and Communications, Media and Technology.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cognizant Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cognizant Technology Solutions wasn't on the list.

While Cognizant Technology Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.