Stifel Financial Corp increased its stake in Coinbase Global, Inc. (NASDAQ:COIN - Free Report) by 45.4% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 43,512 shares of the cryptocurrency exchange's stock after buying an additional 13,591 shares during the quarter. Stifel Financial Corp's holdings in Coinbase Global were worth $7,753,000 as of its most recent filing with the SEC.

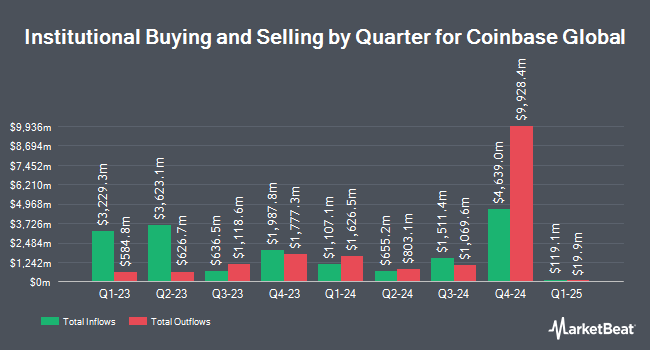

Several other hedge funds have also modified their holdings of COIN. RPg Family Wealth Advisory LLC purchased a new stake in Coinbase Global during the 3rd quarter worth approximately $25,000. Crewe Advisors LLC raised its holdings in Coinbase Global by 547.4% in the second quarter. Crewe Advisors LLC now owns 123 shares of the cryptocurrency exchange's stock valued at $27,000 after acquiring an additional 104 shares in the last quarter. ORG Wealth Partners LLC bought a new position in Coinbase Global during the 3rd quarter valued at $32,000. Spirit of America Management Corp NY acquired a new position in Coinbase Global during the 2nd quarter worth $33,000. Finally, Continuum Advisory LLC increased its position in shares of Coinbase Global by 3,000.0% in the 2nd quarter. Continuum Advisory LLC now owns 155 shares of the cryptocurrency exchange's stock worth $34,000 after purchasing an additional 150 shares during the last quarter. 68.84% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

COIN has been the topic of several research analyst reports. Mizuho increased their price target on shares of Coinbase Global from $160.00 to $178.00 and gave the stock an "underperform" rating in a research report on Thursday, October 31st. The Goldman Sachs Group lifted their target price on Coinbase Global from $183.00 to $397.00 and gave the stock a "neutral" rating in a research report on Monday, December 2nd. Canaccord Genuity Group reissued a "buy" rating and set a $280.00 price target on shares of Coinbase Global in a research report on Thursday, October 31st. Bank of America lifted their price objective on shares of Coinbase Global from $196.00 to $214.00 and gave the stock a "neutral" rating in a report on Thursday, October 31st. Finally, Monness Crespi & Hardt began coverage on shares of Coinbase Global in a report on Monday, October 28th. They set a "buy" rating and a $245.00 target price on the stock. One analyst has rated the stock with a sell rating, nine have assigned a hold rating and ten have given a buy rating to the stock. According to MarketBeat, the company has an average rating of "Hold" and an average target price of $276.22.

Get Our Latest Report on COIN

Coinbase Global Stock Performance

Shares of NASDAQ:COIN traded down $2.38 on Friday, hitting $310.58. The company's stock had a trading volume of 5,806,783 shares, compared to its average volume of 11,259,770. The company has a market capitalization of $77.75 billion, a price-to-earnings ratio of 53.00 and a beta of 3.57. The company has a debt-to-equity ratio of 0.48, a quick ratio of 1.03 and a current ratio of 1.03. Coinbase Global, Inc. has a 12 month low of $114.51 and a 12 month high of $349.75. The stock's 50-day moving average is $256.88 and its two-hundred day moving average is $225.14.

Coinbase Global (NASDAQ:COIN - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The cryptocurrency exchange reported $0.28 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.41 by ($0.13). Coinbase Global had a net margin of 29.76% and a return on equity of 14.81%. The company had revenue of $1.21 billion during the quarter, compared to the consensus estimate of $1.26 billion. During the same quarter last year, the business earned ($0.01) earnings per share. The company's revenue was up 78.8% on a year-over-year basis. On average, equities research analysts forecast that Coinbase Global, Inc. will post 4.44 EPS for the current year.

Insiders Place Their Bets

In related news, CEO Brian Armstrong sold 58,269 shares of Coinbase Global stock in a transaction on Monday, November 18th. The stock was sold at an average price of $328.00, for a total transaction of $19,112,232.00. Following the completion of the sale, the chief executive officer now owns 526 shares of the company's stock, valued at approximately $172,528. This trade represents a 99.11 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Paul Grewal sold 10,000 shares of the stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of $170.10, for a total transaction of $1,701,000.00. Following the transaction, the insider now owns 74,956 shares in the company, valued at approximately $12,750,015.60. This trade represents a 11.77 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 270,720 shares of company stock worth $79,787,248. Company insiders own 23.43% of the company's stock.

Coinbase Global Company Profile

(

Free Report)

Coinbase Global, Inc provides financial infrastructure and technology for the crypto economy in the United States and internationally. The company offers the primary financial account in the crypto economy for consumers; and a marketplace with a pool of liquidity for transacting in crypto assets for institutions.

Read More

Before you consider Coinbase Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coinbase Global wasn't on the list.

While Coinbase Global currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.