Coldstream Capital Management Inc. lifted its holdings in shares of Tetra Tech, Inc. (NASDAQ:TTEK - Free Report) by 417.1% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 24,165 shares of the industrial products company's stock after buying an additional 19,492 shares during the quarter. Coldstream Capital Management Inc.'s holdings in Tetra Tech were worth $1,140,000 at the end of the most recent quarter.

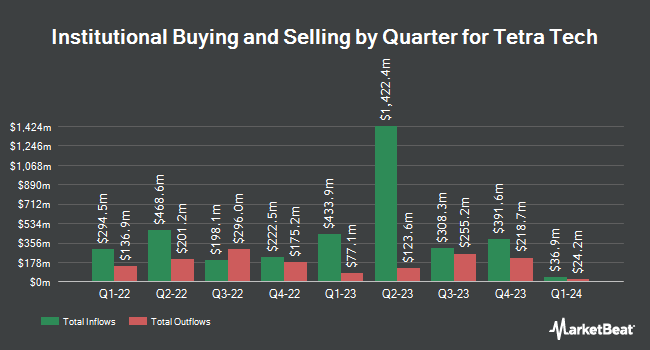

Several other institutional investors and hedge funds also recently bought and sold shares of TTEK. Allworth Financial LP lifted its position in shares of Tetra Tech by 629.3% during the third quarter. Allworth Financial LP now owns 547 shares of the industrial products company's stock worth $26,000 after acquiring an additional 472 shares in the last quarter. LGT Financial Advisors LLC boosted its stake in Tetra Tech by 400.0% in the 3rd quarter. LGT Financial Advisors LLC now owns 555 shares of the industrial products company's stock worth $26,000 after purchasing an additional 444 shares during the period. Banque Cantonale Vaudoise purchased a new position in Tetra Tech during the 2nd quarter valued at about $28,000. Venturi Wealth Management LLC increased its position in shares of Tetra Tech by 3,261.1% during the third quarter. Venturi Wealth Management LLC now owns 605 shares of the industrial products company's stock valued at $29,000 after buying an additional 587 shares during the period. Finally, Canton Hathaway LLC lifted its holdings in shares of Tetra Tech by 400.0% in the third quarter. Canton Hathaway LLC now owns 645 shares of the industrial products company's stock worth $30,000 after buying an additional 516 shares in the last quarter. 93.89% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several equities analysts recently commented on the stock. KeyCorp reduced their price objective on shares of Tetra Tech from $56.00 to $49.00 and set an "overweight" rating for the company in a research note on Friday, November 15th. Royal Bank of Canada restated an "outperform" rating and set a $52.00 price target on shares of Tetra Tech in a research report on Friday, November 15th. StockNews.com downgraded Tetra Tech from a "buy" rating to a "hold" rating in a research report on Friday, November 15th. Finally, Robert W. Baird boosted their target price on Tetra Tech from $46.00 to $47.00 and gave the stock a "neutral" rating in a research report on Thursday, November 14th. Two equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $49.32.

Read Our Latest Stock Analysis on TTEK

Tetra Tech Price Performance

Shares of NASDAQ TTEK traded down $0.49 during mid-day trading on Thursday, reaching $41.75. 1,432,983 shares of the company were exchanged, compared to its average volume of 1,523,600. Tetra Tech, Inc. has a 52 week low of $31.61 and a 52 week high of $51.20. The company's 50 day moving average price is $45.73 and its 200 day moving average price is $44.52. The stock has a market capitalization of $11.18 billion, a PE ratio of 33.94 and a beta of 0.88. The company has a quick ratio of 1.25, a current ratio of 1.25 and a debt-to-equity ratio of 0.44.

Tetra Tech Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Wednesday, November 27th will be issued a $0.058 dividend. This represents a $0.23 dividend on an annualized basis and a dividend yield of 0.56%. The ex-dividend date of this dividend is Wednesday, November 27th. Tetra Tech's payout ratio is currently 18.70%.

Tetra Tech Profile

(

Free Report)

Tetra Tech, Inc provides consulting and engineering services in the United States and internationally. The company operates through two segments, Government Services Group (GSG) and Commercial/International Services Group (CIG). The GSG segment offers early data collection and monitoring, data analysis and information management, science and engineering applied research, engineering design, project management, and operations and maintenance services; and climate change and energy management consulting, as well as greenhouse gas inventory assessment, certification, reduction, and management services.

Featured Articles

Before you consider Tetra Tech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tetra Tech wasn't on the list.

While Tetra Tech currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.