Equities researchers at UBS Group began coverage on shares of Columbia Banking System (NASDAQ:COLB - Get Free Report) in a research report issued on Tuesday, MarketBeat Ratings reports. The firm set a "neutral" rating and a $32.00 price target on the financial services provider's stock. UBS Group's target price would suggest a potential upside of 11.77% from the company's current price.

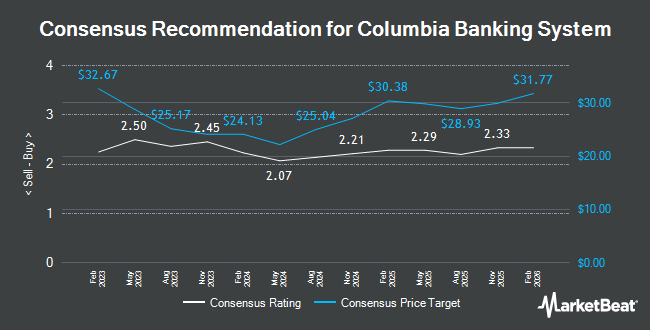

A number of other equities analysts have also recently issued reports on the company. Barclays lifted their target price on Columbia Banking System from $29.00 to $33.00 and gave the stock an "equal weight" rating in a report on Thursday, December 5th. Truist Financial boosted their price objective on Columbia Banking System from $28.00 to $30.00 and gave the stock a "hold" rating in a report on Monday, October 28th. JPMorgan Chase & Co. decreased their target price on shares of Columbia Banking System from $29.00 to $28.00 and set a "neutral" rating for the company in a report on Wednesday, October 9th. Wells Fargo & Company lifted their target price on shares of Columbia Banking System from $30.00 to $33.00 and gave the stock an "equal weight" rating in a research report on Tuesday, December 3rd. Finally, Keefe, Bruyette & Woods raised their price objective on shares of Columbia Banking System from $30.00 to $34.00 and gave the stock a "market perform" rating in a research note on Wednesday, December 4th. Eleven analysts have rated the stock with a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $29.00.

Get Our Latest Report on Columbia Banking System

Columbia Banking System Stock Performance

NASDAQ COLB traded down $1.11 on Tuesday, reaching $28.63. The company's stock had a trading volume of 1,686,113 shares, compared to its average volume of 2,180,055. Columbia Banking System has a twelve month low of $17.08 and a twelve month high of $32.85. The firm's 50 day moving average is $29.35 and its two-hundred day moving average is $25.06. The stock has a market cap of $6.00 billion, a PE ratio of 12.41 and a beta of 0.64.

Columbia Banking System (NASDAQ:COLB - Get Free Report) last released its earnings results on Thursday, October 24th. The financial services provider reported $0.69 EPS for the quarter, beating the consensus estimate of $0.62 by $0.07. The business had revenue of $765.06 million during the quarter, compared to analyst estimates of $478.80 million. Columbia Banking System had a net margin of 16.15% and a return on equity of 10.13%. During the same period in the prior year, the business earned $0.79 earnings per share. Equities research analysts anticipate that Columbia Banking System will post 2.63 EPS for the current fiscal year.

Hedge Funds Weigh In On Columbia Banking System

A number of hedge funds have recently added to or reduced their stakes in the company. Blue Trust Inc. grew its position in Columbia Banking System by 8,253.4% in the second quarter. Blue Trust Inc. now owns 6,098 shares of the financial services provider's stock worth $118,000 after acquiring an additional 6,025 shares in the last quarter. Easterly Investment Partners LLC increased its position in Columbia Banking System by 72.3% during the second quarter. Easterly Investment Partners LLC now owns 246,973 shares of the financial services provider's stock worth $4,912,000 after buying an additional 103,625 shares during the last quarter. Bank of New York Mellon Corp lifted its position in shares of Columbia Banking System by 0.5% in the second quarter. Bank of New York Mellon Corp now owns 4,718,494 shares of the financial services provider's stock worth $93,851,000 after buying an additional 23,963 shares during the last quarter. Verdence Capital Advisors LLC boosted its stake in shares of Columbia Banking System by 15.1% during the 2nd quarter. Verdence Capital Advisors LLC now owns 18,499 shares of the financial services provider's stock worth $368,000 after acquiring an additional 2,430 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC increased its holdings in shares of Columbia Banking System by 111.5% during the 2nd quarter. Allspring Global Investments Holdings LLC now owns 2,618 shares of the financial services provider's stock valued at $52,000 after acquiring an additional 1,380 shares during the last quarter. Institutional investors and hedge funds own 92.53% of the company's stock.

About Columbia Banking System

(

Get Free Report)

Columbia Banking System, Inc operates as the holding company of Umpqua Bank that provides banking, private banking, mortgage, and other financial services in the United States. The company offers deposit products, including business, non-interest bearing checking, interest-bearing checking and savings, money market, and certificate of deposit accounts; and insured cash sweep and other investment sweep solutions.

See Also

Before you consider Columbia Banking System, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Columbia Banking System wasn't on the list.

While Columbia Banking System currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.