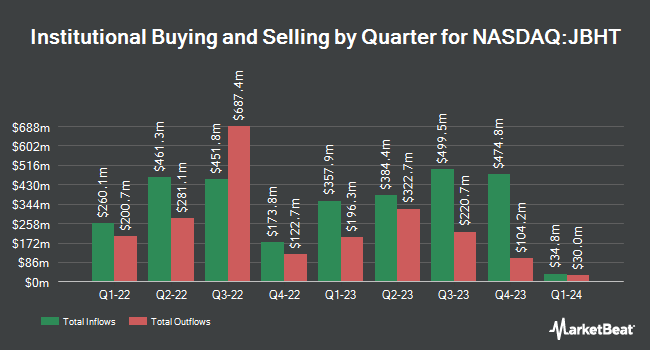

Comgest Global Investors S.A.S. increased its holdings in J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT - Free Report) by 3.3% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 216,448 shares of the transportation company's stock after purchasing an additional 6,817 shares during the period. J.B. Hunt Transport Services makes up 0.5% of Comgest Global Investors S.A.S.'s portfolio, making the stock its 28th biggest position. Comgest Global Investors S.A.S. owned about 0.21% of J.B. Hunt Transport Services worth $37,300,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Empirical Finance LLC boosted its position in J.B. Hunt Transport Services by 2.0% in the third quarter. Empirical Finance LLC now owns 2,855 shares of the transportation company's stock valued at $492,000 after buying an additional 56 shares in the last quarter. Farther Finance Advisors LLC boosted its position in J.B. Hunt Transport Services by 18.3% in the third quarter. Farther Finance Advisors LLC now owns 388 shares of the transportation company's stock valued at $67,000 after buying an additional 60 shares in the last quarter. Huntington National Bank boosted its position in J.B. Hunt Transport Services by 21.8% in the third quarter. Huntington National Bank now owns 341 shares of the transportation company's stock valued at $59,000 after buying an additional 61 shares in the last quarter. Greenleaf Trust boosted its position in J.B. Hunt Transport Services by 4.0% in the third quarter. Greenleaf Trust now owns 1,599 shares of the transportation company's stock valued at $276,000 after buying an additional 62 shares in the last quarter. Finally, Studio Investment Management LLC boosted its position in J.B. Hunt Transport Services by 6.6% in the second quarter. Studio Investment Management LLC now owns 1,013 shares of the transportation company's stock valued at $162,000 after buying an additional 63 shares in the last quarter. 74.95% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In other news, EVP Spencer Frazier sold 2,200 shares of the firm's stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $194.21, for a total transaction of $427,262.00. Following the completion of the transaction, the executive vice president now directly owns 4,050 shares in the company, valued at $786,550.50. This trade represents a 35.20 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Darren P. Field sold 3,000 shares of the stock in a transaction that occurred on Friday, August 23rd. The shares were sold at an average price of $175.03, for a total transaction of $525,090.00. Following the sale, the executive vice president now directly owns 14,150 shares of the company's stock, valued at $2,476,674.50. This represents a 17.49 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 8,314 shares of company stock worth $1,534,052. 2.10% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

Several equities research analysts have weighed in on the stock. BMO Capital Markets restated an "outperform" rating and issued a $195.00 price objective on shares of J.B. Hunt Transport Services in a research report on Wednesday, October 16th. Stifel Nicolaus raised their price objective on shares of J.B. Hunt Transport Services from $151.00 to $167.00 and gave the company a "hold" rating in a research report on Wednesday, October 16th. Susquehanna upped their target price on shares of J.B. Hunt Transport Services from $160.00 to $165.00 and gave the company a "neutral" rating in a research report on Wednesday, October 16th. Evercore ISI raised their price target on J.B. Hunt Transport Services from $183.00 to $185.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 16th. Finally, Barclays boosted their price objective on J.B. Hunt Transport Services from $175.00 to $195.00 and gave the company an "equal weight" rating in a research report on Wednesday. Seven analysts have rated the stock with a hold rating and twelve have given a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $190.11.

Get Our Latest Analysis on J.B. Hunt Transport Services

J.B. Hunt Transport Services Stock Down 1.2 %

NASDAQ JBHT traded down $2.16 during trading hours on Friday, hitting $182.35. 751,079 shares of the company traded hands, compared to its average volume of 870,431. The business's 50-day moving average is $175.60 and its 200-day moving average is $168.23. J.B. Hunt Transport Services, Inc. has a twelve month low of $153.12 and a twelve month high of $219.51. The company has a debt-to-equity ratio of 0.26, a quick ratio of 0.94 and a current ratio of 0.94. The stock has a market capitalization of $18.39 billion, a price-to-earnings ratio of 33.15, a P/E/G ratio of 3.23 and a beta of 1.14.

J.B. Hunt Transport Services (NASDAQ:JBHT - Get Free Report) last issued its quarterly earnings data on Tuesday, October 15th. The transportation company reported $1.49 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.42 by $0.07. J.B. Hunt Transport Services had a net margin of 4.65% and a return on equity of 13.92%. The firm had revenue of $3.07 billion during the quarter, compared to the consensus estimate of $3.04 billion. During the same period last year, the business posted $1.80 earnings per share. Sell-side analysts anticipate that J.B. Hunt Transport Services, Inc. will post 5.7 earnings per share for the current year.

J.B. Hunt Transport Services Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, November 22nd. Stockholders of record on Friday, November 8th will be given a $0.43 dividend. This represents a $1.72 annualized dividend and a dividend yield of 0.94%. The ex-dividend date of this dividend is Friday, November 8th. J.B. Hunt Transport Services's payout ratio is presently 31.27%.

J.B. Hunt Transport Services Company Profile

(

Free Report)

J.B. Hunt Transport Services, Inc provides surface transportation, delivery, and logistic services in the United States. It operates through five segments: Intermodal (JBI), Dedicated Contract Services (DCS), Integrated Capacity Solutions (ICS), Final Mile Services (FMS), and Truckload (JBT). The JBI segment offers intermodal freight solutions.

Featured Articles

Before you consider J.B. Hunt Transport Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and J.B. Hunt Transport Services wasn't on the list.

While J.B. Hunt Transport Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.