Commerce Bank lowered its stake in Cisco Systems, Inc. (NASDAQ:CSCO - Free Report) by 3.8% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 790,611 shares of the network equipment provider's stock after selling 31,364 shares during the period. Commerce Bank's holdings in Cisco Systems were worth $42,076,000 at the end of the most recent quarter.

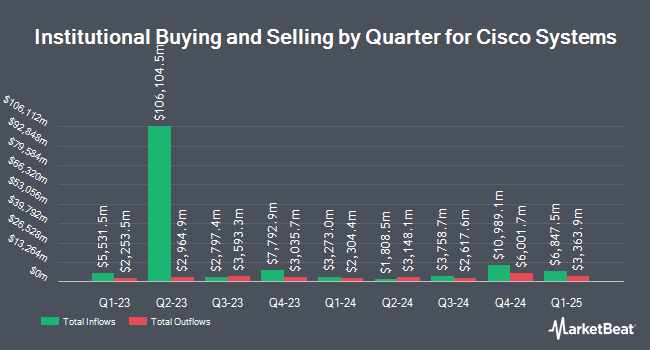

A number of other hedge funds and other institutional investors also recently made changes to their positions in CSCO. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp boosted its holdings in Cisco Systems by 59.3% in the 2nd quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 775,559 shares of the network equipment provider's stock valued at $36,847,000 after purchasing an additional 288,775 shares during the period. Citizens Financial Group Inc. RI boosted its stake in Cisco Systems by 24.4% in the second quarter. Citizens Financial Group Inc. RI now owns 264,647 shares of the network equipment provider's stock valued at $12,573,000 after acquiring an additional 51,924 shares during the last quarter. Commerzbank Aktiengesellschaft FI increased its holdings in Cisco Systems by 10.9% during the 3rd quarter. Commerzbank Aktiengesellschaft FI now owns 1,658,417 shares of the network equipment provider's stock worth $88,261,000 after acquiring an additional 162,544 shares during the period. Quintet Private Bank Europe S.A. increased its holdings in shares of Cisco Systems by 17.0% in the 3rd quarter. Quintet Private Bank Europe S.A. now owns 635,667 shares of the network equipment provider's stock worth $33,830,000 after buying an additional 92,179 shares during the last quarter. Finally, IRON Financial LLC purchased a new stake in Cisco Systems during the 3rd quarter valued at $856,000. 73.33% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of equities analysts recently issued reports on CSCO shares. Bank of America raised their price objective on shares of Cisco Systems from $60.00 to $72.00 and gave the stock a "buy" rating in a report on Thursday, November 14th. Piper Sandler increased their price target on shares of Cisco Systems from $52.00 to $57.00 and gave the stock a "neutral" rating in a report on Thursday, November 14th. StockNews.com raised Cisco Systems from a "hold" rating to a "buy" rating in a research note on Thursday, November 14th. Hsbc Global Res raised Cisco Systems to a "strong-buy" rating in a report on Friday, August 16th. Finally, Morgan Stanley raised their price target on Cisco Systems from $58.00 to $62.00 and gave the company an "overweight" rating in a research report on Thursday, November 14th. Ten analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $59.94.

Read Our Latest Analysis on CSCO

Cisco Systems Trading Up 0.3 %

Shares of NASDAQ CSCO traded up $0.15 during trading hours on Wednesday, reaching $57.16. The stock had a trading volume of 6,663,363 shares, compared to its average volume of 19,100,730. The firm has a market cap of $228.11 billion, a price-to-earnings ratio of 24.47, a P/E/G ratio of 4.67 and a beta of 0.83. Cisco Systems, Inc. has a 52-week low of $44.50 and a 52-week high of $59.38. The company has a current ratio of 0.88, a quick ratio of 0.80 and a debt-to-equity ratio of 0.43. The business's fifty day moving average price is $54.52 and its two-hundred day moving average price is $49.95.

Cisco Systems (NASDAQ:CSCO - Get Free Report) last announced its quarterly earnings results on Wednesday, November 13th. The network equipment provider reported $0.91 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.87 by $0.04. The business had revenue of $13.84 billion during the quarter, compared to the consensus estimate of $13.78 billion. Cisco Systems had a net margin of 17.73% and a return on equity of 25.70%. The business's revenue was down 5.6% compared to the same quarter last year. During the same quarter last year, the firm earned $0.98 EPS. Analysts expect that Cisco Systems, Inc. will post 2.89 EPS for the current fiscal year.

Cisco Systems Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 22nd. Shareholders of record on Friday, January 3rd will be given a dividend of $0.40 per share. The ex-dividend date is Friday, January 3rd. This represents a $1.60 annualized dividend and a yield of 2.80%. Cisco Systems's payout ratio is currently 68.67%.

Insider Activity

In related news, EVP Thimaya K. Subaiya sold 1,328 shares of Cisco Systems stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $48.92, for a total value of $64,965.76. Following the sale, the executive vice president now directly owns 132,910 shares in the company, valued at $6,501,957.20. This trade represents a 0.99 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, SVP Maria Victoria Wong sold 3,379 shares of the business's stock in a transaction that occurred on Wednesday, August 28th. The stock was sold at an average price of $50.36, for a total transaction of $170,166.44. Following the completion of the sale, the senior vice president now owns 47,182 shares in the company, valued at $2,376,085.52. The trade was a 6.68 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 321,628 shares of company stock worth $18,449,561 over the last ninety days. 0.01% of the stock is currently owned by insiders.

Cisco Systems Profile

(

Free Report)

Cisco Systems, Inc designs, manufactures, and sells Internet Protocol based networking and other products related to the communications and information technology industry in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China. The company also offers switching portfolio encompasses campus switching as well as data center switching; enterprise routing portfolio interconnects public and private wireline and mobile networks, delivering highly secure, and reliable connectivity to campus, data center and branch networks; wireless products include wireless access points and controllers; and compute portfolio including the cisco unified computing system, hyperflex, and software management capabilities, which combine computing, networking, and storage infrastructure management and virtualization.

Read More

Before you consider Cisco Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cisco Systems wasn't on the list.

While Cisco Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report