Commerce Bank raised its holdings in Stryker Co. (NYSE:SYK - Free Report) by 2.5% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 180,523 shares of the medical technology company's stock after acquiring an additional 4,362 shares during the quarter. Commerce Bank's holdings in Stryker were worth $65,216,000 at the end of the most recent quarter.

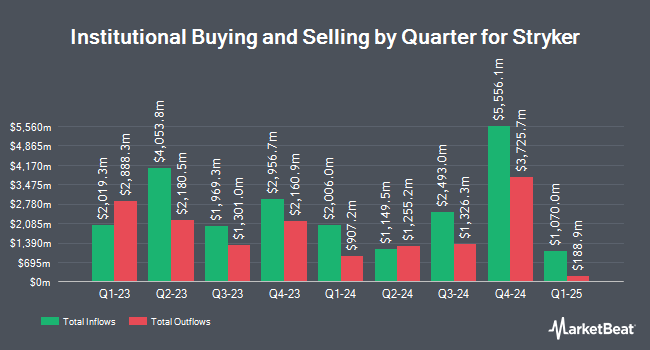

Several other large investors also recently added to or reduced their stakes in the business. Centennial Bank AR boosted its holdings in Stryker by 106.7% in the second quarter. Centennial Bank AR now owns 93 shares of the medical technology company's stock worth $32,000 after purchasing an additional 48 shares in the last quarter. HBW Advisory Services LLC bought a new stake in shares of Stryker during the 3rd quarter worth about $42,000. Hara Capital LLC acquired a new position in shares of Stryker during the 3rd quarter valued at about $42,000. Grove Bank & Trust raised its stake in shares of Stryker by 84.8% in the 3rd quarter. Grove Bank & Trust now owns 122 shares of the medical technology company's stock valued at $44,000 after acquiring an additional 56 shares in the last quarter. Finally, DT Investment Partners LLC boosted its position in Stryker by 114.3% during the third quarter. DT Investment Partners LLC now owns 135 shares of the medical technology company's stock worth $49,000 after purchasing an additional 72 shares during the period. 77.09% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of analysts have recently weighed in on the stock. Wolfe Research started coverage on shares of Stryker in a research note on Tuesday, September 10th. They issued an "outperform" rating and a $405.00 price objective for the company. BTIG Research boosted their target price on shares of Stryker from $383.00 to $394.00 and gave the stock a "buy" rating in a research report on Wednesday, October 30th. Barclays raised their price target on Stryker from $402.00 to $418.00 and gave the company an "overweight" rating in a research report on Thursday, October 31st. Royal Bank of Canada boosted their price objective on Stryker from $386.00 to $400.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 30th. Finally, Citigroup raised their target price on Stryker from $406.00 to $411.00 and gave the company a "buy" rating in a report on Thursday, October 31st. Four investment analysts have rated the stock with a hold rating and seventeen have issued a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $393.65.

Get Our Latest Report on SYK

Stryker Stock Down 0.2 %

Shares of SYK opened at $388.66 on Wednesday. The company has a market capitalization of $148.16 billion, a P/E ratio of 41.66, a PEG ratio of 2.94 and a beta of 0.91. Stryker Co. has a one year low of $285.79 and a one year high of $398.20. The business's 50 day simple moving average is $365.08 and its 200-day simple moving average is $348.40. The company has a debt-to-equity ratio of 0.66, a current ratio of 1.91 and a quick ratio of 1.22.

Stryker (NYSE:SYK - Get Free Report) last announced its earnings results on Tuesday, October 29th. The medical technology company reported $2.87 EPS for the quarter, topping the consensus estimate of $2.77 by $0.10. Stryker had a return on equity of 23.07% and a net margin of 16.34%. The company had revenue of $5.49 billion for the quarter, compared to analysts' expectations of $5.37 billion. During the same quarter in the prior year, the business earned $2.46 earnings per share. The business's revenue for the quarter was up 11.9% on a year-over-year basis. As a group, sell-side analysts predict that Stryker Co. will post 12.06 EPS for the current fiscal year.

Insider Buying and Selling at Stryker

In other news, insider Viju Menon sold 600 shares of the firm's stock in a transaction dated Tuesday, August 27th. The shares were sold at an average price of $355.00, for a total value of $213,000.00. Following the transaction, the insider now owns 9,069 shares of the company's stock, valued at approximately $3,219,495. This trade represents a 6.21 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Kevin Lobo sold 57,313 shares of Stryker stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $368.70, for a total transaction of $21,131,303.10. Following the sale, the chief executive officer now directly owns 100,027 shares of the company's stock, valued at $36,879,954.90. This represents a 36.43 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 67,381 shares of company stock worth $24,825,275. 5.50% of the stock is currently owned by corporate insiders.

Stryker Company Profile

(

Free Report)

Stryker Corporation operates as a medical technology company. The company operates through two segments, MedSurg and Neurotechnology, and Orthopaedics and Spine. The Orthopaedics and Spine segment provides implants for use in total joint replacements, such as hip, knee and shoulder, and trauma and extremities surgeries.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Stryker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stryker wasn't on the list.

While Stryker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.