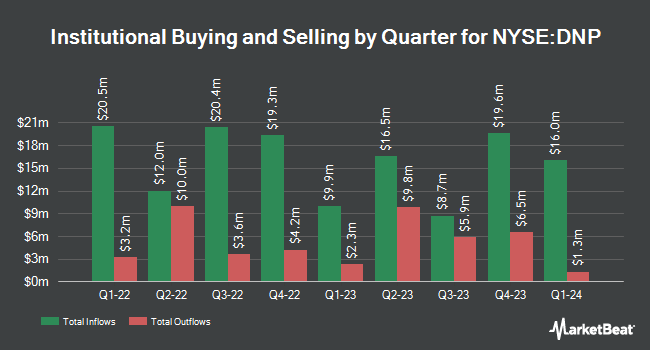

Commonwealth Equity Services LLC boosted its position in DNP Select Income Fund Inc. (NYSE:DNP - Free Report) by 5.5% during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 1,159,114 shares of the investment management company's stock after buying an additional 60,825 shares during the quarter. Commonwealth Equity Services LLC owned approximately 0.31% of DNP Select Income Fund worth $10,223,000 as of its most recent filing with the SEC.

Other hedge funds and other institutional investors have also bought and sold shares of the company. Safe Harbor Fiduciary LLC acquired a new stake in DNP Select Income Fund in the 3rd quarter valued at approximately $28,000. Crews Bank & Trust acquired a new stake in DNP Select Income Fund in the 4th quarter valued at approximately $29,000. UMB Bank n.a. acquired a new stake in DNP Select Income Fund in the 4th quarter valued at approximately $34,000. Tandem Financial LLC acquired a new stake in DNP Select Income Fund in the 4th quarter valued at approximately $34,000. Finally, Golden State Wealth Management LLC acquired a new stake in DNP Select Income Fund in the 4th quarter valued at approximately $35,000. Institutional investors and hedge funds own 8.51% of the company's stock.

Insiders Place Their Bets

In other DNP Select Income Fund news, Director Geraldine M. Mcnamara sold 11,391 shares of the business's stock in a transaction that occurred on Wednesday, February 19th. The stock was sold at an average price of $9.41, for a total transaction of $107,189.31. Following the transaction, the director now owns 5,344 shares of the company's stock, valued at $50,287.04. The trade was a 68.07 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Insiders own 0.06% of the company's stock.

DNP Select Income Fund Stock Down 0.1 %

DNP Select Income Fund stock traded down $0.01 during midday trading on Friday, reaching $9.62. The stock had a trading volume of 425,866 shares, compared to its average volume of 673,651. The firm's fifty day simple moving average is $9.42 and its 200-day simple moving average is $9.45. DNP Select Income Fund Inc. has a 1-year low of $8.02 and a 1-year high of $10.04.

DNP Select Income Fund Announces Dividend

The business also recently declared a monthly dividend, which will be paid on Thursday, July 10th. Shareholders of record on Monday, June 30th will be given a dividend of $0.065 per share. This represents a $0.78 annualized dividend and a dividend yield of 8.11%. The ex-dividend date of this dividend is Monday, June 30th.

DNP Select Income Fund Company Profile

(

Free Report)

DNP Select Income Fund Inc is a closed ended balanced mutual fund launched by Virtus Investment Partners, Inc The fund is managed by Duff & Phelps Investment Management Co It invests in the public equity and fixed income markets of the United States. For the fixed income portion, the fund invests in bonds.

Read More

Before you consider DNP Select Income Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DNP Select Income Fund wasn't on the list.

While DNP Select Income Fund currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.