Commonwealth Equity Services LLC raised its position in shares of Invesco Municipal Income Opportunities Trust (NYSE:OIA - Free Report) by 33.1% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 265,083 shares of the investment management company's stock after acquiring an additional 65,856 shares during the period. Commonwealth Equity Services LLC owned approximately 0.56% of Invesco Municipal Income Opportunities Trust worth $1,564,000 at the end of the most recent reporting period.

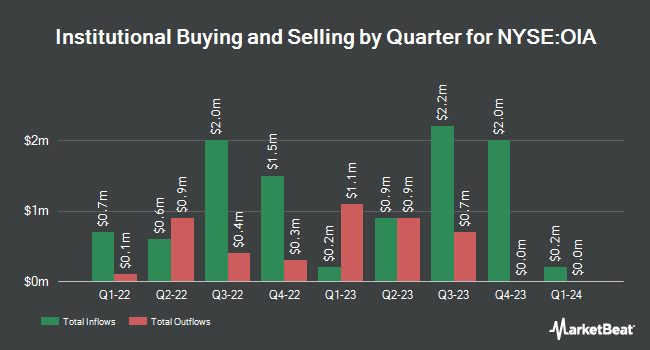

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Raymond James Financial Inc. acquired a new stake in Invesco Municipal Income Opportunities Trust during the 4th quarter worth approximately $973,000. Wolverine Asset Management LLC purchased a new stake in Invesco Municipal Income Opportunities Trust during the fourth quarter worth approximately $396,000. Van ECK Associates Corp grew its stake in Invesco Municipal Income Opportunities Trust by 10.0% during the fourth quarter. Van ECK Associates Corp now owns 217,955 shares of the investment management company's stock worth $1,286,000 after buying an additional 19,889 shares during the period. Janney Montgomery Scott LLC acquired a new stake in shares of Invesco Municipal Income Opportunities Trust in the fourth quarter worth $111,000. Finally, Avantax Advisory Services Inc. raised its stake in shares of Invesco Municipal Income Opportunities Trust by 27.2% in the 4th quarter. Avantax Advisory Services Inc. now owns 72,817 shares of the investment management company's stock valued at $430,000 after acquiring an additional 15,587 shares during the period. 12.57% of the stock is currently owned by institutional investors and hedge funds.

Invesco Municipal Income Opportunities Trust Stock Up 1.1 %

Invesco Municipal Income Opportunities Trust stock traded up $0.06 during trading on Tuesday, reaching $6.08. 92,327 shares of the company's stock were exchanged, compared to its average volume of 102,911. Invesco Municipal Income Opportunities Trust has a 52-week low of $5.78 and a 52-week high of $6.99. The company's 50-day moving average is $6.10 and its two-hundred day moving average is $6.34.

Invesco Municipal Income Opportunities Trust Dividend Announcement

The business also recently announced a monthly dividend, which will be paid on Wednesday, April 30th. Stockholders of record on Wednesday, April 16th will be given a $0.0291 dividend. This represents a $0.35 annualized dividend and a dividend yield of 5.74%. The ex-dividend date is Wednesday, April 16th.

About Invesco Municipal Income Opportunities Trust

(

Free Report)

Invesco Municipal Income Opportunities Trust is a closed-ended fixed income mutual fund launched by Invesco Ltd. The fund is co-managed by Invesco Advisers, Inc, INVESCO Asset Management Deutschland GmbH, INVESCO Asset Management Limited, INVESCO Asset Management (Japan) Limited, Invesco Hong Kong Limited, INVESCO Senior Secured Management, Inc, and Invesco Canada Ltd.

Featured Stories

Before you consider Invesco Municipal Income Opportunities Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invesco Municipal Income Opportunities Trust wasn't on the list.

While Invesco Municipal Income Opportunities Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.