Commonwealth of Pennsylvania Public School Empls Retrmt SYS boosted its holdings in shares of Agree Realty Co. (NYSE:ADC - Free Report) by 45.9% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 57,574 shares of the real estate investment trust's stock after purchasing an additional 18,120 shares during the quarter. Commonwealth of Pennsylvania Public School Empls Retrmt SYS owned about 0.06% of Agree Realty worth $4,056,000 at the end of the most recent quarter.

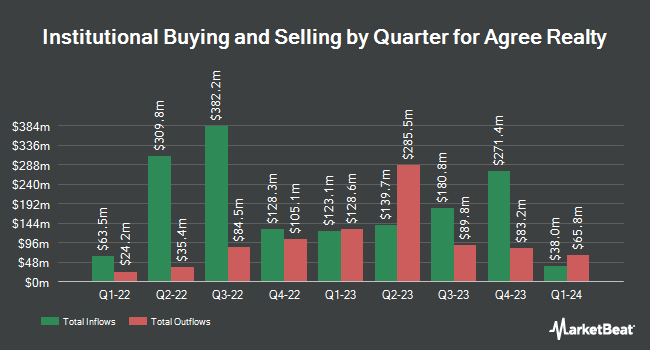

Other large investors also recently added to or reduced their stakes in the company. Versant Capital Management Inc boosted its position in shares of Agree Realty by 230.7% during the fourth quarter. Versant Capital Management Inc now owns 420 shares of the real estate investment trust's stock worth $30,000 after acquiring an additional 293 shares during the last quarter. Financial Life Planners bought a new position in shares of Agree Realty during the 4th quarter valued at about $44,000. MassMutual Private Wealth & Trust FSB grew its position in shares of Agree Realty by 34.4% during the fourth quarter. MassMutual Private Wealth & Trust FSB now owns 898 shares of the real estate investment trust's stock valued at $63,000 after purchasing an additional 230 shares in the last quarter. Wilmington Savings Fund Society FSB bought a new stake in shares of Agree Realty in the third quarter worth about $77,000. Finally, UMB Bank n.a. lifted its position in shares of Agree Realty by 17.3% in the fourth quarter. UMB Bank n.a. now owns 1,139 shares of the real estate investment trust's stock worth $80,000 after buying an additional 168 shares in the last quarter. 97.83% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

ADC has been the topic of several research reports. Evercore ISI assumed coverage on shares of Agree Realty in a research report on Thursday, December 12th. They issued an "outperform" rating and a $82.00 price target on the stock. Stifel Nicolaus decreased their target price on shares of Agree Realty from $81.50 to $81.00 and set a "buy" rating on the stock in a research report on Tuesday, January 7th. JMP Securities downgraded shares of Agree Realty from an "outperform" rating to a "market perform" rating in a report on Tuesday, December 17th. StockNews.com upgraded Agree Realty from a "sell" rating to a "hold" rating in a research report on Sunday, February 16th. Finally, Citizens Jmp cut Agree Realty from a "strong-buy" rating to a "hold" rating in a report on Tuesday, December 17th. Five equities research analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, Agree Realty has a consensus rating of "Moderate Buy" and an average target price of $79.85.

View Our Latest Research Report on ADC

Agree Realty Stock Performance

Shares of NYSE ADC traded up $0.18 during midday trading on Thursday, reaching $76.01. 899,452 shares of the stock were exchanged, compared to its average volume of 924,183. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 0.52. The firm has a 50-day simple moving average of $73.64 and a two-hundred day simple moving average of $73.92. Agree Realty Co. has a twelve month low of $54.78 and a twelve month high of $78.39. The firm has a market cap of $8.16 billion, a price-to-earnings ratio of 42.70, a PEG ratio of 2.88 and a beta of 0.64.

Agree Realty (NYSE:ADC - Get Free Report) last announced its quarterly earnings results on Tuesday, February 11th. The real estate investment trust reported $1.04 earnings per share for the quarter, beating the consensus estimate of $0.43 by $0.61. Agree Realty had a return on equity of 3.70% and a net margin of 30.66%. As a group, analysts anticipate that Agree Realty Co. will post 4.27 EPS for the current fiscal year.

Agree Realty Announces Dividend

The business also recently announced a monthly dividend, which will be paid on Monday, April 14th. Stockholders of record on Monday, March 31st will be paid a dividend of $0.253 per share. The ex-dividend date is Monday, March 31st. This represents a $3.04 dividend on an annualized basis and a dividend yield of 3.99%. Agree Realty's dividend payout ratio is currently 170.22%.

About Agree Realty

(

Free Report)

Agree Realty Corporation is a publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants. As of December 31, 2023, the Company owned and operated a portfolio of 2,135 properties, located in 49 states and containing approximately 44.2 million square feet of gross leasable area.

See Also

Before you consider Agree Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agree Realty wasn't on the list.

While Agree Realty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.