Bank of New York Mellon Corp trimmed its holdings in CommScope Holding Company, Inc. (NASDAQ:COMM - Free Report) by 33.5% in the fourth quarter, according to the company in its most recent filing with the SEC. The fund owned 684,127 shares of the communications equipment provider's stock after selling 344,183 shares during the quarter. Bank of New York Mellon Corp owned 0.32% of CommScope worth $3,564,000 at the end of the most recent quarter.

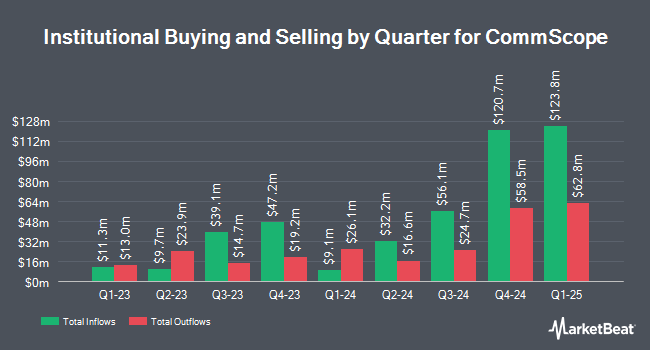

A number of other hedge funds have also recently made changes to their positions in COMM. Thompson Davis & CO. Inc. bought a new stake in shares of CommScope in the 3rd quarter worth approximately $215,000. Intech Investment Management LLC bought a new stake in CommScope during the 3rd quarter valued at $302,000. Landscape Capital Management L.L.C. bought a new stake in CommScope during the 3rd quarter valued at $152,000. Alpha DNA Investment Management LLC bought a new stake in CommScope during the 3rd quarter valued at $409,000. Finally, Dynamic Technology Lab Private Ltd bought a new stake in CommScope during the 3rd quarter valued at $332,000. 88.04% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of equities research analysts recently commented on the stock. StockNews.com upgraded shares of CommScope from a "hold" rating to a "buy" rating in a report on Friday, February 28th. JPMorgan Chase & Co. upgraded shares of CommScope from an "underweight" rating to a "neutral" rating and set a $5.00 price target for the company in a report on Tuesday, January 14th. Raymond James lowered shares of CommScope from a "market perform" rating to an "underperform" rating in a report on Monday, January 6th. Morgan Stanley lowered shares of CommScope from an "equal weight" rating to an "underweight" rating and set a $5.00 price target for the company. in a report on Tuesday, December 17th. Finally, Deutsche Bank Aktiengesellschaft reissued a "hold" rating and set a $7.00 price objective on shares of CommScope in a research report on Thursday, February 27th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $4.75.

Get Our Latest Stock Analysis on CommScope

CommScope Price Performance

CommScope stock traded up $0.11 during mid-day trading on Friday, reaching $5.60. 8,728,922 shares of the company traded hands, compared to its average volume of 4,466,118. The firm's 50 day moving average price is $5.29 and its 200 day moving average price is $5.45. The firm has a market capitalization of $1.21 billion, a price-to-earnings ratio of -1.27, a P/E/G ratio of 0.41 and a beta of 1.89. CommScope Holding Company, Inc. has a 52-week low of $0.86 and a 52-week high of $7.19.

CommScope Company Profile

(

Free Report)

CommScope Holding Company, Inc provides infrastructure solutions for communications, data center, and entertainment networks worldwide. The company operates through Connectivity and Cable Solutions (CCS); Outdoor Wireless Networks (OWN); Networking, Intelligent Cellular and Security Solutions (NICS), and Access Network Solutions (ANS) segments.

Featured Articles

Before you consider CommScope, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CommScope wasn't on the list.

While CommScope currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.