Connor Clark & Lunn Investment Management Ltd. raised its holdings in shares of Community Health Systems, Inc. (NYSE:CYH - Free Report) by 522.5% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 264,198 shares of the company's stock after buying an additional 221,759 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.19% of Community Health Systems worth $1,604,000 at the end of the most recent reporting period.

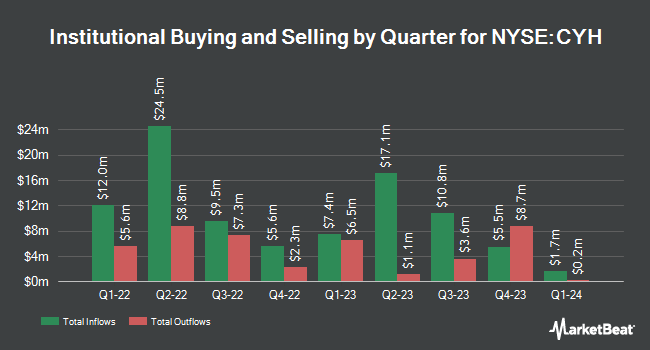

Several other hedge funds and other institutional investors have also recently bought and sold shares of CYH. Vanguard Group Inc. boosted its holdings in Community Health Systems by 0.4% in the first quarter. Vanguard Group Inc. now owns 8,124,617 shares of the company's stock worth $28,436,000 after acquiring an additional 28,669 shares in the last quarter. Quadrature Capital Ltd raised its stake in shares of Community Health Systems by 236.2% in the first quarter. Quadrature Capital Ltd now owns 105,777 shares of the company's stock worth $370,000 after purchasing an additional 74,319 shares during the last quarter. Price T Rowe Associates Inc. MD lifted its position in Community Health Systems by 7.7% during the first quarter. Price T Rowe Associates Inc. MD now owns 96,027 shares of the company's stock valued at $337,000 after purchasing an additional 6,852 shares during the period. SG Americas Securities LLC boosted its stake in shares of Community Health Systems by 384.7% in the 2nd quarter. SG Americas Securities LLC now owns 212,852 shares of the company's stock worth $715,000 after buying an additional 168,941 shares during the last quarter. Finally, Assenagon Asset Management S.A. bought a new position in Community Health Systems in the second quarter valued at about $5,121,000. Institutional investors own 84.99% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have issued reports on CYH. Royal Bank of Canada reiterated an "outperform" rating and issued a $6.00 price target on shares of Community Health Systems in a research note on Monday, August 12th. StockNews.com lowered shares of Community Health Systems from a "hold" rating to a "sell" rating in a report on Monday. UBS Group boosted their price objective on Community Health Systems from $4.70 to $5.10 and gave the company a "neutral" rating in a report on Wednesday, August 14th. Barclays upped their price target on shares of Community Health Systems from $3.00 to $5.00 and gave the stock an "equal weight" rating in a report on Thursday, October 24th. Finally, Truist Financial reduced their target price on shares of Community Health Systems from $5.50 to $5.00 and set a "hold" rating on the stock in a research report on Friday, October 25th. Three investment analysts have rated the stock with a sell rating, three have issued a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $4.77.

Get Our Latest Analysis on Community Health Systems

Community Health Systems Price Performance

CYH traded down $0.14 during trading hours on Tuesday, reaching $3.56. The company's stock had a trading volume of 1,635,056 shares, compared to its average volume of 1,813,976. Community Health Systems, Inc. has a fifty-two week low of $2.31 and a fifty-two week high of $6.29. The business's 50-day moving average is $4.98 and its 200-day moving average is $4.51. The stock has a market cap of $494.66 million, a PE ratio of -1.18 and a beta of 1.60.

Community Health Systems (NYSE:CYH - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The company reported ($0.30) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.16) by ($0.14). The business had revenue of $3.09 billion during the quarter, compared to the consensus estimate of $3.08 billion. The firm's revenue for the quarter was up .1% compared to the same quarter last year. During the same quarter last year, the firm posted ($0.33) earnings per share. Analysts expect that Community Health Systems, Inc. will post -0.52 EPS for the current year.

About Community Health Systems

(

Free Report)

Community Health Systems, Inc owns, leases, and operates general acute care hospitals in the United States. It offers general acute care, emergency room, general and specialty surgery, critical care, internal medicine, obstetrics, diagnostic, psychiatric, and rehabilitation services, as well as skilled nursing and home care services.

Read More

Before you consider Community Health Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Community Health Systems wasn't on the list.

While Community Health Systems currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.