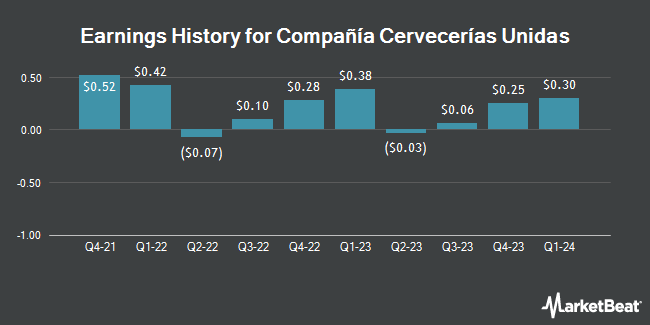

Compañía Cervecerías Unidas (NYSE:CCU - Get Free Report) is expected to be issuing its quarterly earnings data before the market opens on Tuesday, February 25th. Analysts expect the company to announce earnings of $0.22 per share and revenue of $752.77 billion for the quarter. Investors that wish to register for the company's conference call can do so using this link.

Compañía Cervecerías Unidas Price Performance

NYSE:CCU traded down $0.07 on Friday, hitting $12.95. The company had a trading volume of 66,200 shares, compared to its average volume of 132,832. Compañía Cervecerías Unidas has a 52 week low of $10.00 and a 52 week high of $13.74. The company has a current ratio of 2.06, a quick ratio of 1.44 and a debt-to-equity ratio of 0.80. The stock has a market capitalization of $2.39 billion, a price-to-earnings ratio of 17.27, a PEG ratio of 2.64 and a beta of 0.90. The firm has a 50 day moving average of $11.95 and a two-hundred day moving average of $11.42.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently weighed in on CCU shares. The Goldman Sachs Group reduced their price objective on Compañía Cervecerías Unidas from $10.50 to $9.40 and set a "sell" rating on the stock in a research report on Tuesday, November 12th. Scotiabank upgraded Compañía Cervecerías Unidas from a "hold" rating to a "strong-buy" rating in a report on Thursday, November 7th. Three equities research analysts have rated the stock with a sell rating, one has assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $11.03.

Read Our Latest Report on Compañía Cervecerías Unidas

Compañía Cervecerías Unidas Company Profile

(

Get Free Report)

Compañía Cervecerías Unidas SA operates as a beverage company in Chile, Argentina, Bolivia, Colombia, Paraguay, and Uruguay. The company operates through three segments: Chile, International Business, and Wine. It produces and sells alcoholic and non-alcoholic beer under proprietary and licensed brands, as well as distributes Pernod Ricard products in non-supermarket retail stores.

See Also

Before you consider Compañía Cervecerías Unidas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compañía Cervecerías Unidas wasn't on the list.

While Compañía Cervecerías Unidas currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.