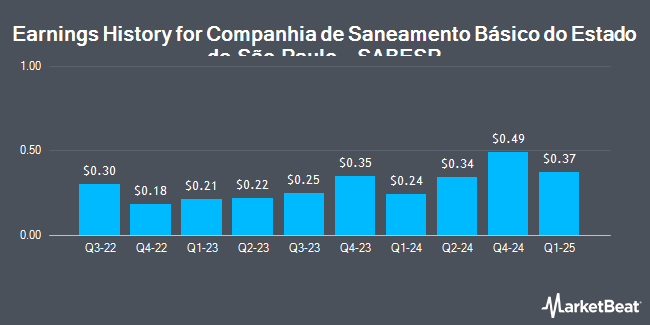

Companhia de Saneamento Básico do Estado de São Paulo - SABESP (NYSE:SBS - Get Free Report) issued its quarterly earnings results on Monday. The utilities provider reported $0.49 earnings per share for the quarter, beating analysts' consensus estimates of $0.06 by $0.43, Zacks reports. Companhia de Saneamento Básico do Estado de São Paulo - SABESP had a net margin of 25.62% and a return on equity of 27.73%. The business had revenue of $981.20 million during the quarter, compared to analyst estimates of $6.89 billion.

Companhia de Saneamento Básico do Estado de São Paulo - SABESP Trading Down 0.6 %

Shares of NYSE:SBS traded down $0.11 during trading on Friday, hitting $17.94. 1,133,612 shares of the company's stock were exchanged, compared to its average volume of 1,034,808. The firm has a 50-day moving average price of $16.80 and a two-hundred day moving average price of $16.12. Companhia de Saneamento Básico do Estado de São Paulo - SABESP has a 1-year low of $13.10 and a 1-year high of $18.36. The firm has a market cap of $12.26 billion, a P/E ratio of 7.06 and a beta of 1.15. The company has a current ratio of 1.14, a quick ratio of 1.13 and a debt-to-equity ratio of 0.56.

Analyst Upgrades and Downgrades

Separately, StockNews.com downgraded Companhia de Saneamento Básico do Estado de São Paulo - SABESP from a "buy" rating to a "hold" rating in a research report on Tuesday, March 18th.

Get Our Latest Stock Analysis on SBS

About Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(

Get Free Report)

Companhia de Saneamento Basico do Estado de Sao Paulo SABESP engages in the provision of water and sewage service. It also offers advisory services on the rational use of water, planning and commercial, and financial and operational management. The company was founded on September 6, 1973 and is headquartered in São Paulo, Brazil.

See Also

Before you consider Companhia de Saneamento Básico do Estado de São Paulo - SABESP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Companhia de Saneamento Básico do Estado de São Paulo - SABESP wasn't on the list.

While Companhia de Saneamento Básico do Estado de São Paulo - SABESP currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.