FMR LLC increased its stake in shares of Compass Diversified (NYSE:CODI - Free Report) by 115.0% during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor owned 283,777 shares of the financial services provider's stock after acquiring an additional 151,783 shares during the period. FMR LLC owned approximately 0.38% of Compass Diversified worth $6,280,000 at the end of the most recent reporting period.

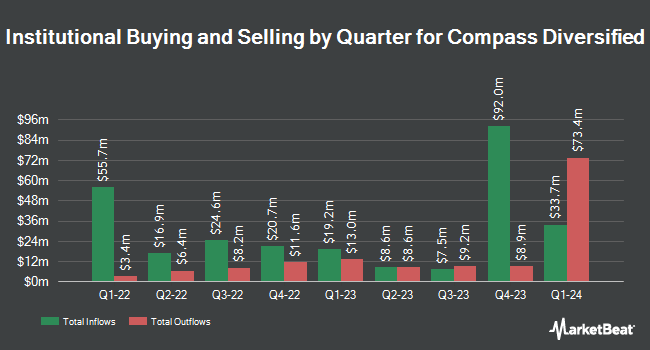

A number of other institutional investors and hedge funds have also recently bought and sold shares of the stock. HHM Wealth Advisors LLC purchased a new stake in shares of Compass Diversified during the second quarter worth about $33,000. Farther Finance Advisors LLC increased its holdings in Compass Diversified by 273.6% during the 3rd quarter. Farther Finance Advisors LLC now owns 2,219 shares of the financial services provider's stock worth $49,000 after purchasing an additional 1,625 shares during the last quarter. Ridgewood Investments LLC acquired a new position in shares of Compass Diversified in the 2nd quarter valued at approximately $55,000. Nisa Investment Advisors LLC boosted its stake in shares of Compass Diversified by 190.3% during the 3rd quarter. Nisa Investment Advisors LLC now owns 3,051 shares of the financial services provider's stock valued at $68,000 after buying an additional 2,000 shares during the last quarter. Finally, Ashton Thomas Private Wealth LLC acquired a new stake in shares of Compass Diversified during the second quarter worth approximately $137,000. Hedge funds and other institutional investors own 72.73% of the company's stock.

Insider Transactions at Compass Diversified

In other Compass Diversified news, major shareholder Cgi Magyar Holdings Llc sold 135,274 shares of the firm's stock in a transaction on Monday, November 11th. The stock was sold at an average price of $23.05, for a total value of $3,118,065.70. Following the sale, the insider now directly owns 7,456,197 shares in the company, valued at approximately $171,865,340.85. This trade represents a 1.78 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, insider Patrick A. Maciariello purchased 5,000 shares of Compass Diversified stock in a transaction dated Friday, September 20th. The shares were purchased at an average cost of $21.87 per share, with a total value of $109,350.00. Following the acquisition, the insider now owns 228,518 shares of the company's stock, valued at approximately $4,997,688.66. This trade represents a 2.24 % increase in their position. The disclosure for this purchase can be found here. Insiders own 1.76% of the company's stock.

Wall Street Analyst Weigh In

Separately, TD Cowen initiated coverage on shares of Compass Diversified in a report on Wednesday, November 27th. They issued a "buy" rating and a $34.00 price target on the stock.

Read Our Latest Research Report on Compass Diversified

Compass Diversified Stock Down 0.5 %

Compass Diversified stock traded down $0.13 during midday trading on Friday, hitting $23.62. The stock had a trading volume of 127,578 shares, compared to its average volume of 205,385. The business has a fifty day moving average price of $22.31 and a 200 day moving average price of $22.05. Compass Diversified has a 12 month low of $19.76 and a 12 month high of $25.07. The stock has a market cap of $1.79 billion, a P/E ratio of 49.48, a P/E/G ratio of 1.54 and a beta of 1.66. The company has a current ratio of 4.22, a quick ratio of 1.62 and a debt-to-equity ratio of 1.51.

Compass Diversified (NYSE:CODI - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The financial services provider reported $0.64 earnings per share for the quarter, beating analysts' consensus estimates of $0.54 by $0.10. Compass Diversified had a return on equity of 12.25% and a net margin of 6.24%. The business had revenue of $582.62 million during the quarter, compared to the consensus estimate of $571.68 million. During the same period in the previous year, the business earned $0.34 EPS. The business's quarterly revenue was up 11.8% on a year-over-year basis. Research analysts predict that Compass Diversified will post 1.96 EPS for the current year.

Compass Diversified Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, October 24th. Shareholders of record on Thursday, October 17th were issued a dividend of $0.25 per share. The ex-dividend date was Thursday, October 17th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 4.23%. Compass Diversified's dividend payout ratio (DPR) is 208.33%.

About Compass Diversified

(

Free Report)

Compass Diversified is a private equity firm specializing in add on acquisitions, buyouts, industry consolidation, recapitalization, late stage and middle market investments. It seeks to invest in niche industrial or branded consumer companies, manufacturing, distribution, consumer products, business services sector, healthcare, safety & security, electronic components, food and foodservice.

Recommended Stories

Before you consider Compass Diversified, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compass Diversified wasn't on the list.

While Compass Diversified currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.