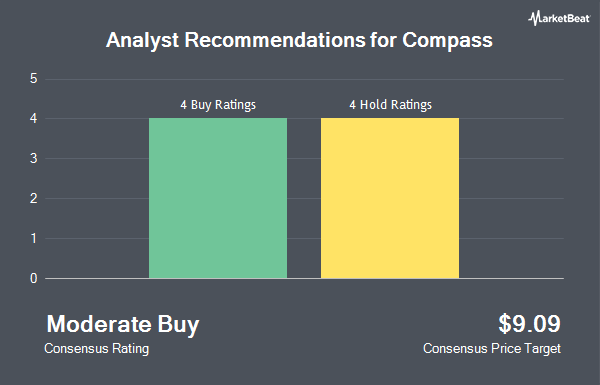

Shares of Compass, Inc. (NYSE:COMP - Get Free Report) have been assigned a consensus recommendation of "Moderate Buy" from the seven brokerages that are currently covering the firm, Marketbeat.com reports. Three analysts have rated the stock with a hold rating and four have given a buy rating to the company. The average 12 month target price among brokers that have covered the stock in the last year is $7.01.

COMP has been the topic of a number of research reports. The Goldman Sachs Group boosted their price objective on shares of Compass from $7.00 to $8.00 and gave the stock a "buy" rating in a research report on Tuesday, December 3rd. Oppenheimer raised their target price on shares of Compass from $8.50 to $9.50 and gave the stock an "outperform" rating in a research note on Tuesday, December 3rd. UBS Group upped their price objective on Compass from $4.40 to $6.50 and gave the company a "neutral" rating in a report on Tuesday, October 22nd. Barclays increased their price target on Compass from $6.00 to $7.00 and gave the stock an "equal weight" rating in a research report on Wednesday, December 11th. Finally, Needham & Company LLC reissued a "buy" rating and issued a $10.00 target price on shares of Compass in a report on Thursday, January 16th.

Check Out Our Latest Analysis on COMP

Compass Price Performance

COMP traded up $0.27 during trading on Thursday, reaching $7.54. The company had a trading volume of 5,985,502 shares, compared to its average volume of 5,472,586. The business's fifty day moving average price is $6.51 and its 200 day moving average price is $5.86. Compass has a 12 month low of $2.89 and a 12 month high of $7.69. The company has a market cap of $3.85 billion, a P/E ratio of -18.84 and a beta of 2.92.

Insiders Place Their Bets

In related news, CEO Robert L. Reffkin sold 49,316 shares of the stock in a transaction dated Thursday, January 2nd. The stock was sold at an average price of $5.91, for a total transaction of $291,457.56. Following the completion of the sale, the chief executive officer now directly owns 2,950,684 shares in the company, valued at $17,438,542.44. This represents a 1.64 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, major shareholder Excalibur (Cayman) Ltd Svf sold 10,000,000 shares of the firm's stock in a transaction that occurred on Tuesday, December 17th. The stock was sold at an average price of $6.33, for a total transaction of $63,300,000.00. Following the completion of the transaction, the insider now owns 58,070,273 shares in the company, valued at $367,584,828.09. This represents a 14.69 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 12,536,716 shares of company stock worth $79,523,984 in the last ninety days. 6.25% of the stock is currently owned by insiders.

About Compass

(

Get Free ReportCompass, Inc provides real estate brokerage services in the United States. It operates a cloud-based platform that provides an integrated suite of software for customer relationship management, marketing, client service, operations, and other functionality in the real estate industry. The company offers mobile apps that allow agents to manage their business anytime and anywhere, as well as designs consumer-grade user interfaces, automated and simplified workflows for agent-client interactions, and insight-rich dashboards and reports.

Featured Stories

Before you consider Compass, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compass wasn't on the list.

While Compass currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.