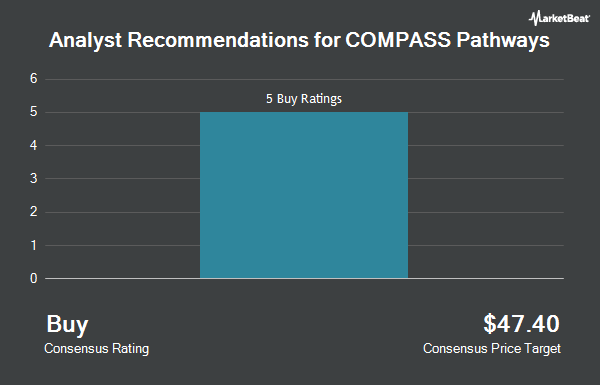

COMPASS Pathways plc (NASDAQ:CMPS - Get Free Report) has earned an average recommendation of "Buy" from the six ratings firms that are covering the firm, Marketbeat reports. Six research analysts have rated the stock with a buy recommendation. The average 12 month price objective among brokers that have updated their coverage on the stock in the last year is $33.60.

Several equities analysts have recently commented on CMPS shares. Cantor Fitzgerald reissued an "overweight" rating on shares of COMPASS Pathways in a report on Monday, September 9th. HC Wainwright decreased their price target on shares of COMPASS Pathways from $120.00 to $60.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. Maxim Group cut their price objective on COMPASS Pathways from $22.00 to $12.00 and set a "buy" rating for the company in a research report on Friday, November 1st. Finally, Royal Bank of Canada decreased their target price on COMPASS Pathways from $23.00 to $18.00 and set an "outperform" rating on the stock in a research report on Friday, November 1st.

Read Our Latest Stock Analysis on CMPS

Insider Activity at COMPASS Pathways

In related news, major shareholder Life Sciences N.V. Atai sold 2,660,000 shares of the stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $6.05, for a total transaction of $16,093,000.00. Following the sale, the insider now owns 6,905,774 shares in the company, valued at approximately $41,779,932.70. This represents a 27.81 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. 4.25% of the stock is owned by insiders.

Hedge Funds Weigh In On COMPASS Pathways

A number of large investors have recently made changes to their positions in CMPS. Blue Trust Inc. bought a new stake in COMPASS Pathways in the second quarter worth about $81,000. Green Alpha Advisors LLC bought a new stake in shares of COMPASS Pathways during the 3rd quarter worth approximately $99,000. Y Intercept Hong Kong Ltd bought a new stake in shares of COMPASS Pathways during the 3rd quarter worth approximately $131,000. Fore Capital LLC purchased a new position in COMPASS Pathways during the 2nd quarter valued at $181,000. Finally, Geode Capital Management LLC grew its position in COMPASS Pathways by 160.3% in the 3rd quarter. Geode Capital Management LLC now owns 42,169 shares of the company's stock valued at $266,000 after acquiring an additional 25,970 shares during the last quarter. 46.19% of the stock is owned by hedge funds and other institutional investors.

COMPASS Pathways Stock Performance

Shares of NASDAQ:CMPS traded up $0.05 during midday trading on Friday, reaching $3.97. 1,169,654 shares of the company's stock traded hands, compared to its average volume of 638,571. The company has a debt-to-equity ratio of 0.15, a quick ratio of 8.91 and a current ratio of 8.91. COMPASS Pathways has a one year low of $3.86 and a one year high of $12.75. The company has a market cap of $271.63 million, a price-to-earnings ratio of -1.80 and a beta of 2.24. The stock has a 50 day moving average of $5.07 and a 200 day moving average of $6.24.

COMPASS Pathways (NASDAQ:CMPS - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The company reported ($0.56) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.60) by $0.04. During the same period in the previous year, the company earned ($0.67) earnings per share. As a group, equities research analysts anticipate that COMPASS Pathways will post -2.33 EPS for the current fiscal year.

About COMPASS Pathways

(

Get Free ReportCOMPASS Pathways plc operates as a mental health care company in the United Kingdom and the United States. It develops COMP360, a psilocybin therapy that is in Phase III clinical trials for the treatment of treatment-resistant depression; and is in Phase II clinical trials for the treatment of post-traumatic stress disorder and anorexia nervosa.

Featured Articles

Before you consider COMPASS Pathways, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and COMPASS Pathways wasn't on the list.

While COMPASS Pathways currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.