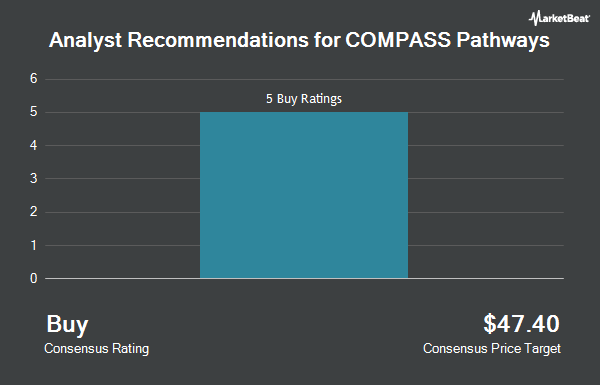

COMPASS Pathways plc (NASDAQ:CMPS - Get Free Report) has been assigned an average recommendation of "Buy" from the six analysts that are currently covering the company, Marketbeat reports. Six equities research analysts have rated the stock with a buy rating. The average twelve-month price objective among brokers that have issued a report on the stock in the last year is $33.60.

Several research analysts have commented on CMPS shares. Maxim Group decreased their price objective on shares of COMPASS Pathways from $22.00 to $12.00 and set a "buy" rating for the company in a report on Friday, November 1st. HC Wainwright decreased their price objective on shares of COMPASS Pathways from $120.00 to $60.00 and set a "buy" rating for the company in a report on Friday, November 1st. Finally, Royal Bank of Canada restated an "outperform" rating and issued a $18.00 price objective on shares of COMPASS Pathways in a report on Wednesday.

Read Our Latest Stock Report on COMPASS Pathways

Institutional Trading of COMPASS Pathways

Several institutional investors have recently bought and sold shares of the company. Franklin Resources Inc. grew its position in COMPASS Pathways by 4.4% during the 3rd quarter. Franklin Resources Inc. now owns 295,785 shares of the company's stock valued at $1,810,000 after purchasing an additional 12,599 shares during the last quarter. Green Alpha Advisors LLC purchased a new stake in COMPASS Pathways during the 3rd quarter valued at about $99,000. Y Intercept Hong Kong Ltd purchased a new stake in COMPASS Pathways during the 3rd quarter valued at about $131,000. Geode Capital Management LLC grew its position in COMPASS Pathways by 160.3% during the 3rd quarter. Geode Capital Management LLC now owns 42,169 shares of the company's stock valued at $266,000 after purchasing an additional 25,970 shares during the last quarter. Finally, Hennion & Walsh Asset Management Inc. grew its position in COMPASS Pathways by 18.1% during the 4th quarter. Hennion & Walsh Asset Management Inc. now owns 174,921 shares of the company's stock valued at $661,000 after purchasing an additional 26,787 shares during the last quarter. 46.19% of the stock is owned by hedge funds and other institutional investors.

COMPASS Pathways Trading Up 2.3 %

NASDAQ:CMPS traded up $0.08 during midday trading on Tuesday, reaching $3.49. 927,935 shares of the stock traded hands, compared to its average volume of 1,512,709. The company has a fifty day moving average of $4.32 and a 200 day moving average of $5.87. COMPASS Pathways has a 12 month low of $3.16 and a 12 month high of $12.75. The company has a debt-to-equity ratio of 0.15, a quick ratio of 8.91 and a current ratio of 8.91. The stock has a market capitalization of $238.79 million, a P/E ratio of -1.59 and a beta of 2.27.

COMPASS Pathways (NASDAQ:CMPS - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The company reported ($0.56) EPS for the quarter, beating analysts' consensus estimates of ($0.60) by $0.04. During the same quarter in the prior year, the business earned ($0.67) EPS. On average, research analysts predict that COMPASS Pathways will post -2.33 EPS for the current year.

About COMPASS Pathways

(

Get Free ReportCOMPASS Pathways plc operates as a mental health care company in the United Kingdom and the United States. It develops COMP360, a psilocybin therapy that is in Phase III clinical trials for the treatment of treatment-resistant depression; and is in Phase II clinical trials for the treatment of post-traumatic stress disorder and anorexia nervosa.

Recommended Stories

Before you consider COMPASS Pathways, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and COMPASS Pathways wasn't on the list.

While COMPASS Pathways currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.