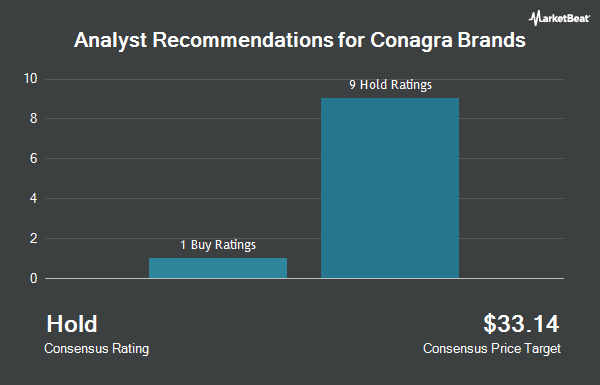

Shares of Conagra Brands, Inc. (NYSE:CAG - Get Free Report) have been assigned an average rating of "Hold" from the eleven research firms that are covering the stock, MarketBeat.com reports. Nine equities research analysts have rated the stock with a hold rating, one has assigned a buy rating and one has given a strong buy rating to the company. The average twelve-month price objective among brokers that have issued ratings on the stock in the last year is $27.90.

A number of analysts have issued reports on the company. Morgan Stanley initiated coverage on Conagra Brands in a research report on Monday, March 24th. They issued an "equal weight" rating and a $27.00 target price on the stock. Barclays boosted their price objective on Conagra Brands from $27.00 to $29.00 and gave the company an "overweight" rating in a report on Monday, April 7th. JPMorgan Chase & Co. dropped their target price on Conagra Brands from $29.00 to $26.00 and set a "neutral" rating for the company in a research report on Thursday, March 6th. Wells Fargo & Company reduced their price target on shares of Conagra Brands from $28.00 to $27.00 and set an "equal weight" rating on the stock in a research report on Tuesday, February 18th. Finally, The Goldman Sachs Group lowered shares of Conagra Brands from a "buy" rating to a "neutral" rating and lowered their price objective for the company from $33.00 to $26.00 in a research note on Monday, February 24th.

Check Out Our Latest Analysis on Conagra Brands

Hedge Funds Weigh In On Conagra Brands

Several hedge funds have recently added to or reduced their stakes in CAG. Vanguard Group Inc. grew its position in shares of Conagra Brands by 2.0% in the 4th quarter. Vanguard Group Inc. now owns 58,798,952 shares of the company's stock valued at $1,631,671,000 after buying an additional 1,132,839 shares during the last quarter. Nordea Investment Management AB increased its position in shares of Conagra Brands by 5.3% during the fourth quarter. Nordea Investment Management AB now owns 12,285,579 shares of the company's stock worth $341,048,000 after purchasing an additional 618,096 shares in the last quarter. Geode Capital Management LLC lifted its holdings in shares of Conagra Brands by 2.0% in the 4th quarter. Geode Capital Management LLC now owns 11,745,629 shares of the company's stock valued at $325,096,000 after purchasing an additional 231,477 shares during the last quarter. Invesco Ltd. boosted its position in shares of Conagra Brands by 18.5% in the 4th quarter. Invesco Ltd. now owns 11,161,355 shares of the company's stock valued at $309,728,000 after purchasing an additional 1,745,319 shares during the period. Finally, Two Sigma Advisers LP increased its position in Conagra Brands by 33.9% during the fourth quarter. Two Sigma Advisers LP now owns 8,135,000 shares of the company's stock worth $225,746,000 after buying an additional 2,058,000 shares during the period. 83.75% of the stock is currently owned by hedge funds and other institutional investors.

Conagra Brands Trading Up 1.7 %

Shares of NYSE CAG traded up $0.41 during midday trading on Tuesday, reaching $25.31. 4,787,593 shares of the stock were exchanged, compared to its average volume of 5,129,135. Conagra Brands has a twelve month low of $23.06 and a twelve month high of $33.24. The stock has a market capitalization of $12.08 billion, a P/E ratio of 24.82, a PEG ratio of 1.76 and a beta of 0.27. The company has a 50 day simple moving average of $25.77 and a 200 day simple moving average of $26.89. The company has a debt-to-equity ratio of 0.71, a quick ratio of 0.22 and a current ratio of 0.70.

Conagra Brands (NYSE:CAG - Get Free Report) last posted its earnings results on Thursday, April 3rd. The company reported $0.51 EPS for the quarter, missing analysts' consensus estimates of $0.52 by ($0.01). Conagra Brands had a net margin of 4.13% and a return on equity of 13.76%. The business had revenue of $2.84 billion during the quarter, compared to analysts' expectations of $2.92 billion. During the same quarter in the prior year, the firm earned $0.69 EPS. Conagra Brands's revenue for the quarter was down 6.3% compared to the same quarter last year. As a group, equities analysts expect that Conagra Brands will post 2.35 earnings per share for the current year.

Conagra Brands Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, May 29th. Stockholders of record on Monday, April 28th will be issued a $0.35 dividend. The ex-dividend date is Monday, April 28th. This represents a $1.40 dividend on an annualized basis and a dividend yield of 5.53%. Conagra Brands's payout ratio is currently 205.88%.

About Conagra Brands

(

Get Free ReportConagra Brands, Inc, together with its subsidiaries, operates as a consumer packaged goods food company primarily in the United States. The company operates through Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice segments. The Grocery & Snacks segment primarily offers shelf stable food products through various retail channels.

Recommended Stories

Before you consider Conagra Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Conagra Brands wasn't on the list.

While Conagra Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.