Concentric Capital Strategies LP acquired a new position in Medtronic plc (NYSE:MDT - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 67,725 shares of the medical technology company's stock, valued at approximately $6,097,000.

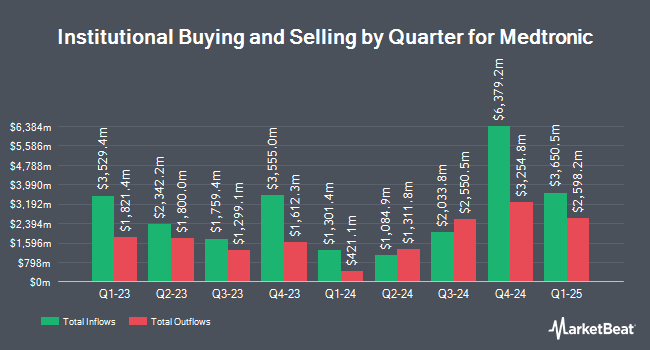

Several other institutional investors have also recently made changes to their positions in the business. Pzena Investment Management LLC raised its position in shares of Medtronic by 3.3% during the third quarter. Pzena Investment Management LLC now owns 8,582,993 shares of the medical technology company's stock valued at $772,727,000 after buying an additional 275,870 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its holdings in Medtronic by 436.7% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 7,343,385 shares of the medical technology company's stock valued at $661,125,000 after acquiring an additional 5,975,110 shares during the last quarter. Dimensional Fund Advisors LP boosted its holdings in shares of Medtronic by 7.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 7,120,554 shares of the medical technology company's stock valued at $560,494,000 after purchasing an additional 515,751 shares during the last quarter. Raymond James & Associates grew its position in shares of Medtronic by 2.3% during the third quarter. Raymond James & Associates now owns 6,391,865 shares of the medical technology company's stock valued at $575,460,000 after purchasing an additional 145,504 shares in the last quarter. Finally, Fisher Asset Management LLC increased its holdings in shares of Medtronic by 11.5% in the third quarter. Fisher Asset Management LLC now owns 5,893,720 shares of the medical technology company's stock worth $530,612,000 after purchasing an additional 609,391 shares during the last quarter. Hedge funds and other institutional investors own 82.06% of the company's stock.

Medtronic Price Performance

Shares of NYSE:MDT remained flat at $86.54 on Monday. The stock had a trading volume of 7,058,600 shares, compared to its average volume of 6,276,077. The stock's 50 day simple moving average is $88.69 and its 200 day simple moving average is $85.00. The company has a debt-to-equity ratio of 0.51, a current ratio of 1.84 and a quick ratio of 1.39. The company has a market capitalization of $110.97 billion, a PE ratio of 26.46, a price-to-earnings-growth ratio of 2.45 and a beta of 0.84. Medtronic plc has a fifty-two week low of $75.96 and a fifty-two week high of $92.68.

Medtronic (NYSE:MDT - Get Free Report) last announced its quarterly earnings data on Tuesday, November 19th. The medical technology company reported $1.26 earnings per share for the quarter, beating analysts' consensus estimates of $1.25 by $0.01. The company had revenue of $8.40 billion during the quarter, compared to analyst estimates of $8.27 billion. Medtronic had a net margin of 13.00% and a return on equity of 13.79%. The firm's revenue for the quarter was up 5.2% on a year-over-year basis. During the same quarter last year, the business posted $1.25 EPS. Equities analysts forecast that Medtronic plc will post 5.46 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of brokerages recently commented on MDT. Daiwa America raised Medtronic to a "strong-buy" rating in a research note on Friday, August 23rd. Oppenheimer raised their target price on shares of Medtronic from $92.00 to $94.00 and gave the company a "market perform" rating in a report on Wednesday, August 21st. Stifel Nicolaus upped their price target on shares of Medtronic from $85.00 to $87.00 and gave the company a "hold" rating in a research note on Wednesday, August 21st. Barclays lifted their price objective on shares of Medtronic from $105.00 to $109.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 26th. Finally, Evercore ISI upped their target price on shares of Medtronic from $100.00 to $104.00 and gave the company an "outperform" rating in a research report on Tuesday, October 1st. One investment analyst has rated the stock with a sell rating, nine have assigned a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, Medtronic currently has an average rating of "Hold" and a consensus price target of $95.27.

Read Our Latest Report on MDT

Medtronic Company Profile

(

Free Report)

Medtronic plc develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. Its Cardiovascular Portfolio segment offers implantable cardiac pacemakers, cardioverter defibrillators, and cardiac resynchronization therapy devices; cardiac ablation products; insertable cardiac monitor systems; TYRX products; and remote monitoring and patient-centered software.

Featured Stories

Before you consider Medtronic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medtronic wasn't on the list.

While Medtronic currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.