Confluence Investment Management LLC trimmed its holdings in Constellation Brands, Inc. (NYSE:STZ - Free Report) by 1.6% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 138,370 shares of the company's stock after selling 2,319 shares during the quarter. Confluence Investment Management LLC owned about 0.08% of Constellation Brands worth $35,656,000 as of its most recent SEC filing.

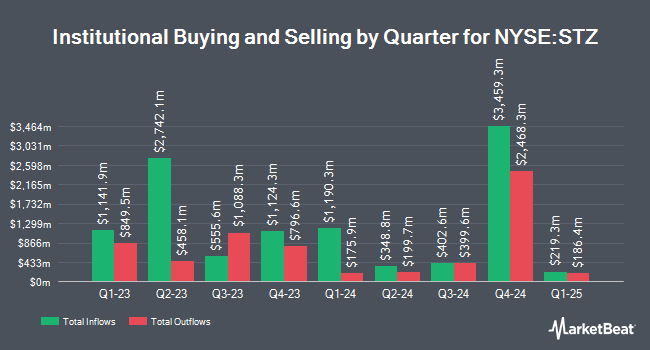

Other institutional investors have also bought and sold shares of the company. New Millennium Group LLC purchased a new position in Constellation Brands during the 2nd quarter worth approximately $25,000. Thurston Springer Miller Herd & Titak Inc. purchased a new stake in Constellation Brands in the 2nd quarter valued at approximately $29,000. Horizon Bancorp Inc. IN purchased a new stake in shares of Constellation Brands in the second quarter valued at $32,000. Opal Wealth Advisors LLC purchased a new position in Constellation Brands in the 2nd quarter valued at about $36,000. Finally, Ashton Thomas Private Wealth LLC purchased a new position in Constellation Brands in the 2nd quarter valued at about $36,000. 77.34% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of research firms have issued reports on STZ. Barclays lowered their price target on Constellation Brands from $309.00 to $300.00 and set an "overweight" rating for the company in a research report on Monday, October 7th. TD Cowen cut shares of Constellation Brands from a "buy" rating to a "hold" rating and cut their price target for the company from $300.00 to $270.00 in a report on Tuesday, October 8th. Morgan Stanley cut their price target on shares of Constellation Brands from $305.00 to $280.00 and set an "overweight" rating on the stock in a report on Monday, August 26th. UBS Group lowered their target price on shares of Constellation Brands from $320.00 to $295.00 and set a "buy" rating for the company in a research note on Monday, September 9th. Finally, JPMorgan Chase & Co. lowered their price target on shares of Constellation Brands from $307.00 to $293.00 and set an "overweight" rating for the company in a research report on Friday, October 4th. Four equities research analysts have rated the stock with a hold rating and thirteen have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Constellation Brands presently has an average rating of "Moderate Buy" and a consensus price target of $290.47.

Check Out Our Latest Research Report on Constellation Brands

Insider Activity at Constellation Brands

In other news, EVP Samuel J. Glaetzer sold 1,510 shares of the firm's stock in a transaction on Monday, October 14th. The stock was sold at an average price of $245.57, for a total value of $370,810.70. Following the transaction, the executive vice president now directly owns 4,970 shares in the company, valued at $1,220,482.90. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this link. In other news, EVP Samuel J. Glaetzer sold 1,510 shares of the business's stock in a transaction dated Monday, October 14th. The stock was sold at an average price of $245.57, for a total value of $370,810.70. Following the transaction, the executive vice president now directly owns 4,970 shares in the company, valued at $1,220,482.90. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Robert Sands sold 119,274 shares of the business's stock in a transaction dated Wednesday, October 16th. The stock was sold at an average price of $242.37, for a total value of $28,908,439.38. Following the completion of the sale, the director now owns 431,729 shares in the company, valued at $104,638,157.73. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 128,210 shares of company stock valued at $31,040,994 in the last 90 days. Corporate insiders own 12.19% of the company's stock.

Constellation Brands Price Performance

Constellation Brands stock traded up $1.13 during midday trading on Friday, hitting $234.41. 1,731,050 shares of the company's stock were exchanged, compared to its average volume of 1,202,091. Constellation Brands, Inc. has a 52-week low of $224.76 and a 52-week high of $274.87. The stock has a 50-day moving average price of $244.87 and a two-hundred day moving average price of $248.86. The company has a debt-to-equity ratio of 1.31, a quick ratio of 0.53 and a current ratio of 1.25. The company has a market cap of $42.56 billion, a P/E ratio of 75.86, a PEG ratio of 1.69 and a beta of 1.75.

Constellation Brands (NYSE:STZ - Get Free Report) last issued its earnings results on Thursday, October 3rd. The company reported $4.32 earnings per share for the quarter, beating the consensus estimate of $4.08 by $0.24. The company had revenue of $2.92 billion during the quarter, compared to analysts' expectations of $2.95 billion. Constellation Brands had a return on equity of 25.34% and a net margin of 5.29%. Constellation Brands's quarterly revenue was up 2.9% compared to the same quarter last year. During the same period in the prior year, the business posted $3.70 EPS. On average, equities research analysts forecast that Constellation Brands, Inc. will post 13.57 earnings per share for the current year.

Constellation Brands Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, November 21st. Investors of record on Tuesday, November 5th will be given a dividend of $1.01 per share. This represents a $4.04 dividend on an annualized basis and a yield of 1.72%. The ex-dividend date is Tuesday, November 5th. Constellation Brands's dividend payout ratio (DPR) is presently 130.74%.

Constellation Brands Profile

(

Free Report)

Constellation Brands, Inc, together with its subsidiaries, produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy. The company provides beer primarily under the Corona Extra, Corona Familiar, Corona Hard Seltzer, Corona Light, Corona Non-Alcoholic, Corona Premier, Corona Refresca, Modelo Especial, Modelo Chelada, Modelo Negra, Modelo Oro, Victoria, Vicky Chamoy, and Pacifico brands.

See Also

Before you consider Constellation Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Constellation Brands wasn't on the list.

While Constellation Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report