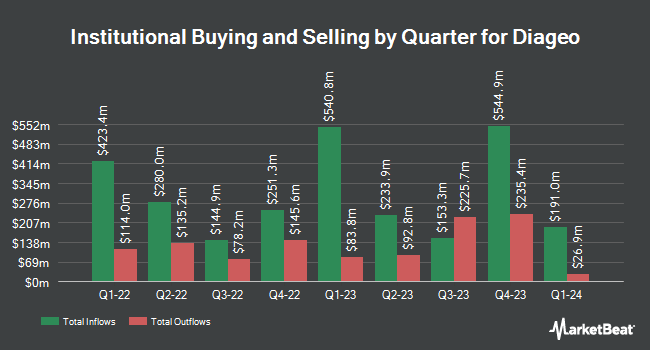

Confluence Investment Management LLC increased its holdings in Diageo plc (NYSE:DEO - Free Report) by 30.5% during the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 1,215,786 shares of the company's stock after buying an additional 284,046 shares during the period. Diageo accounts for approximately 2.3% of Confluence Investment Management LLC's portfolio, making the stock its 3rd largest holding. Confluence Investment Management LLC owned approximately 0.22% of Diageo worth $170,623,000 at the end of the most recent quarter.

Several other large investors also recently added to or reduced their stakes in the business. Hara Capital LLC bought a new stake in shares of Diageo during the 3rd quarter valued at about $222,000. Keudell Morrison Wealth Management purchased a new stake in Diageo in the third quarter valued at approximately $372,000. Malaga Cove Capital LLC lifted its position in Diageo by 3.4% during the third quarter. Malaga Cove Capital LLC now owns 3,001 shares of the company's stock valued at $421,000 after purchasing an additional 100 shares during the last quarter. American Capital Advisory LLC purchased a new position in Diageo in the 3rd quarter worth approximately $343,000. Finally, Concurrent Investment Advisors LLC increased its holdings in shares of Diageo by 5.3% in the 3rd quarter. Concurrent Investment Advisors LLC now owns 15,199 shares of the company's stock worth $2,133,000 after buying an additional 762 shares during the last quarter. Institutional investors own 8.97% of the company's stock.

Analyst Ratings Changes

DEO has been the subject of a number of research analyst reports. Bank of America raised shares of Diageo from a "neutral" rating to a "buy" rating in a report on Thursday, September 12th. Royal Bank of Canada upgraded Diageo from an "underperform" rating to a "sector perform" rating in a report on Monday, August 12th. Finally, The Goldman Sachs Group cut Diageo from a "neutral" rating to a "sell" rating in a report on Friday, July 12th. Three analysts have rated the stock with a sell rating, three have assigned a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold".

Check Out Our Latest Report on Diageo

Diageo Price Performance

DEO traded down $1.36 on Friday, hitting $120.39. 767,907 shares of the company were exchanged, compared to its average volume of 754,716. The company has a debt-to-equity ratio of 1.62, a current ratio of 1.53 and a quick ratio of 0.55. The firm has a fifty day simple moving average of $132.52 and a two-hundred day simple moving average of $132.49. Diageo plc has a 12 month low of $118.35 and a 12 month high of $161.64.

Diageo Company Profile

(

Free Report)

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

Read More

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.