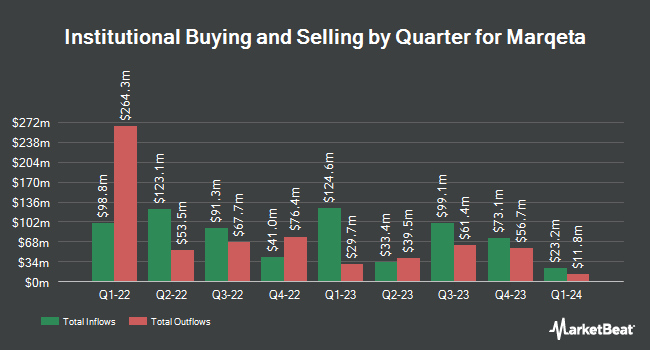

Congress Asset Management Co. lifted its stake in shares of Marqeta, Inc. (NASDAQ:MQ - Free Report) by 7.6% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,135,842 shares of the company's stock after purchasing an additional 80,161 shares during the quarter. Congress Asset Management Co. owned 0.23% of Marqeta worth $4,305,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Nordea Investment Management AB grew its holdings in shares of Marqeta by 107.8% during the 4th quarter. Nordea Investment Management AB now owns 851,278 shares of the company's stock valued at $3,265,000 after purchasing an additional 441,617 shares during the last quarter. Cerity Partners LLC bought a new stake in Marqeta during the 3rd quarter worth approximately $1,466,000. Main Management ETF Advisors LLC bought a new stake in Marqeta during the 3rd quarter worth approximately $786,000. GSA Capital Partners LLP grew its holdings in Marqeta by 671.7% during the 3rd quarter. GSA Capital Partners LLP now owns 234,401 shares of the company's stock worth $1,153,000 after acquiring an additional 204,026 shares during the last quarter. Finally, Holocene Advisors LP grew its holdings in Marqeta by 143.0% during the 3rd quarter. Holocene Advisors LP now owns 522,059 shares of the company's stock worth $2,569,000 after acquiring an additional 307,223 shares during the last quarter. 78.64% of the stock is owned by institutional investors.

Marqeta Price Performance

Shares of Marqeta stock traded down $0.23 during trading on Friday, reaching $3.69. 5,182,255 shares of the company traded hands, compared to its average volume of 4,261,928. Marqeta, Inc. has a 1-year low of $3.37 and a 1-year high of $7.36. The company has a 50 day moving average price of $3.77 and a 200-day moving average price of $4.43. The firm has a market capitalization of $1.85 billion, a PE ratio of 184.50 and a beta of 1.52.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on MQ shares. Mizuho reduced their target price on shares of Marqeta from $7.00 to $5.00 and set an "outperform" rating on the stock in a report on Tuesday, November 5th. Monness Crespi & Hardt lowered shares of Marqeta from a "buy" rating to a "neutral" rating and set a $7.50 target price on the stock. in a report on Tuesday, November 5th. Susquehanna reduced their target price on shares of Marqeta from $9.00 to $7.00 and set a "positive" rating on the stock in a report on Tuesday, November 5th. Deutsche Bank Aktiengesellschaft lowered shares of Marqeta from a "buy" rating to a "hold" rating and reduced their target price for the stock from $9.00 to $4.00 in a report on Tuesday, November 5th. Finally, KeyCorp lowered shares of Marqeta from an "overweight" rating to a "sector weight" rating in a report on Tuesday, November 5th. Eleven equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average target price of $5.65.

Get Our Latest Stock Report on MQ

About Marqeta

(

Free Report)

Marqeta, Inc operates a cloud-based open application programming interface platform that delivers card issuing and transaction processing services. It offers its solutions in various verticals, including financial services, on-demand services, expense management, and e-commerce enablement, as well as buy now, pay later.

See Also

Before you consider Marqeta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marqeta wasn't on the list.

While Marqeta currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.