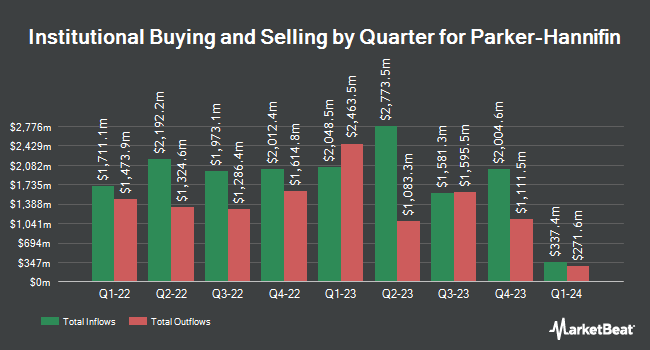

Connective Portfolio Management LLC purchased a new position in shares of Parker-Hannifin Co. (NYSE:PH - Free Report) during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm purchased 900 shares of the industrial products company's stock, valued at approximately $572,000.

A number of other hedge funds have also recently modified their holdings of PH. West Branch Capital LLC bought a new stake in Parker-Hannifin during the 3rd quarter worth approximately $25,000. Bangor Savings Bank increased its stake in Parker-Hannifin by 238.5% in the 3rd quarter. Bangor Savings Bank now owns 44 shares of the industrial products company's stock worth $28,000 after buying an additional 31 shares in the last quarter. Prestige Wealth Management Group LLC increased its stake in Parker-Hannifin by 83.3% in the 3rd quarter. Prestige Wealth Management Group LLC now owns 55 shares of the industrial products company's stock worth $35,000 after buying an additional 25 shares in the last quarter. Bank of New Hampshire bought a new stake in Parker-Hannifin during the fourth quarter valued at about $35,000. Finally, Northwest Investment Counselors LLC purchased a new stake in shares of Parker-Hannifin during the third quarter worth about $39,000. Institutional investors own 82.44% of the company's stock.

Analysts Set New Price Targets

PH has been the topic of a number of research analyst reports. Mizuho boosted their price target on Parker-Hannifin from $665.00 to $715.00 and gave the stock an "outperform" rating in a report on Thursday, October 17th. UBS Group started coverage on shares of Parker-Hannifin in a research report on Wednesday, November 13th. They set a "buy" rating and a $842.00 target price for the company. Wells Fargo & Company reduced their price target on shares of Parker-Hannifin from $770.00 to $710.00 and set an "overweight" rating on the stock in a report on Tuesday, January 7th. Argus increased their price objective on shares of Parker-Hannifin from $650.00 to $710.00 and gave the company a "buy" rating in a report on Tuesday, November 5th. Finally, Jefferies Financial Group lifted their target price on Parker-Hannifin from $765.00 to $810.00 and gave the stock a "buy" rating in a report on Friday, December 6th. Two investment analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $722.94.

Check Out Our Latest Analysis on PH

Insider Transactions at Parker-Hannifin

In other Parker-Hannifin news, VP Thomas C. Gentile sold 2,430 shares of the business's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $701.16, for a total value of $1,703,818.80. Following the completion of the sale, the vice president now directly owns 5,465 shares of the company's stock, valued at $3,831,839.40. The trade was a 30.78 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, COO Andrew D. Ross sold 4,864 shares of Parker-Hannifin stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $706.04, for a total transaction of $3,434,178.56. Following the sale, the chief operating officer now directly owns 13,120 shares of the company's stock, valued at $9,263,244.80. This represents a 27.05 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 18,077 shares of company stock worth $12,303,829. 0.39% of the stock is currently owned by company insiders.

Parker-Hannifin Stock Performance

NYSE PH opened at $656.08 on Thursday. The company has a market cap of $84.45 billion, a P/E ratio of 29.63, a P/E/G ratio of 2.54 and a beta of 1.45. The business's 50 day moving average price is $673.15 and its 200-day moving average price is $616.80. Parker-Hannifin Co. has a fifty-two week low of $453.18 and a fifty-two week high of $712.42. The company has a debt-to-equity ratio of 0.52, a quick ratio of 0.57 and a current ratio of 0.96.

Parker-Hannifin (NYSE:PH - Get Free Report) last announced its earnings results on Thursday, October 31st. The industrial products company reported $6.20 earnings per share for the quarter, beating the consensus estimate of $6.14 by $0.06. Parker-Hannifin had a net margin of 14.47% and a return on equity of 27.95%. The business had revenue of $4.90 billion for the quarter, compared to the consensus estimate of $4.90 billion. During the same quarter in the prior year, the firm posted $5.96 earnings per share. The business's revenue for the quarter was up 1.2% on a year-over-year basis. Sell-side analysts predict that Parker-Hannifin Co. will post 26.75 earnings per share for the current year.

Parker-Hannifin Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, December 6th. Shareholders of record on Friday, November 8th were given a dividend of $1.63 per share. The ex-dividend date of this dividend was Friday, November 8th. This represents a $6.52 annualized dividend and a dividend yield of 0.99%. Parker-Hannifin's dividend payout ratio (DPR) is presently 29.45%.

About Parker-Hannifin

(

Free Report)

Parker-Hannifin Corporation manufactures and sells motion and control technologies and systems for various mobile, industrial, and aerospace markets worldwide. The company operates through two segments: Diversified Industrial and Aerospace Systems. The Diversified Industrial segment offers sealing, shielding, thermal products and systems, adhesives, coatings, and noise vibration and harshness solutions; filters, systems, and diagnostics solutions to ensure purity and remove contaminants from fuel, air, oil, water, and other liquids and gases; connectors used in fluid and gas handling; and hydraulic, pneumatic, and electromechanical components and systems for builders and users of mobile and industrial machinery and equipment.

Featured Stories

Want to see what other hedge funds are holding PH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Parker-Hannifin Co. (NYSE:PH - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Parker-Hannifin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parker-Hannifin wasn't on the list.

While Parker-Hannifin currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.