Connor Clark & Lunn Investment Management Ltd. lifted its holdings in shares of Futu Holdings Limited (NASDAQ:FUTU - Free Report) by 127.1% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 52,530 shares of the company's stock after buying an additional 29,401 shares during the period. Connor Clark & Lunn Investment Management Ltd.'s holdings in Futu were worth $5,024,000 at the end of the most recent reporting period.

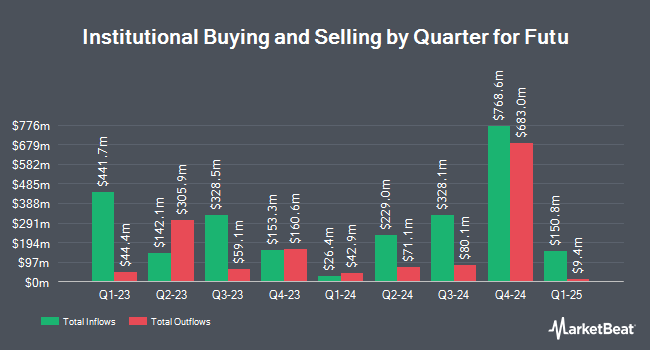

A number of other institutional investors also recently made changes to their positions in the stock. Russell Investments Group Ltd. boosted its holdings in Futu by 3.7% in the 1st quarter. Russell Investments Group Ltd. now owns 13,422 shares of the company's stock valued at $727,000 after purchasing an additional 484 shares during the period. O Shaughnessy Asset Management LLC raised its holdings in Futu by 3.2% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 11,123 shares of the company's stock valued at $602,000 after acquiring an additional 343 shares in the last quarter. UniSuper Management Pty Ltd increased its stake in shares of Futu by 100.0% in the 1st quarter. UniSuper Management Pty Ltd now owns 800 shares of the company's stock valued at $43,000 after purchasing an additional 400 shares during the last quarter. CANADA LIFE ASSURANCE Co grew its position in Futu by 34.7% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 42,306 shares of the company's stock worth $2,293,000 after acquiring an additional 10,900 shares during the last quarter. Finally, Natixis acquired a new position in Futu during the 1st quarter worth about $202,000.

Futu Stock Down 0.6 %

Futu stock traded down $0.47 during mid-day trading on Friday, hitting $84.22. 2,393,581 shares of the company were exchanged, compared to its average volume of 3,359,372. The business has a fifty day moving average of $92.90 and a 200 day moving average of $75.66. The company has a market capitalization of $11.60 billion, a PE ratio of 20.64, a price-to-earnings-growth ratio of 0.26 and a beta of 0.75. Futu Holdings Limited has a 1-year low of $43.61 and a 1-year high of $130.50.

Wall Street Analyst Weigh In

Several analysts recently issued reports on FUTU shares. Citigroup cut Futu from a "buy" rating to a "neutral" rating and raised their target price for the stock from $79.00 to $95.00 in a research note on Tuesday, November 19th. Morgan Stanley raised shares of Futu from an "equal weight" rating to an "overweight" rating and increased their target price for the company from $70.00 to $115.00 in a research report on Monday, November 18th. Finally, Bank of America boosted their target price on shares of Futu from $80.20 to $90.00 and gave the stock a "buy" rating in a research note on Friday, September 27th. One equities research analyst has rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, Futu currently has a consensus rating of "Moderate Buy" and a consensus price target of $85.07.

Get Our Latest Stock Analysis on Futu

Futu Profile

(

Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

Read More

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.