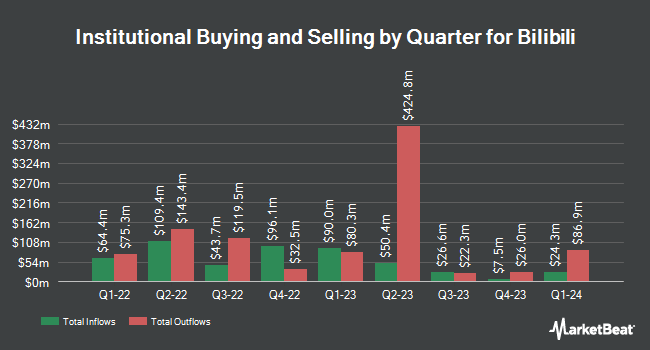

Connor Clark & Lunn Investment Management Ltd. grew its holdings in shares of Bilibili Inc. (NASDAQ:BILI - Free Report) by 31.6% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,294,180 shares of the company's stock after acquiring an additional 311,073 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.31% of Bilibili worth $30,258,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds and other institutional investors have also recently modified their holdings of BILI. Jennison Associates LLC lifted its stake in shares of Bilibili by 208.4% during the 3rd quarter. Jennison Associates LLC now owns 1,807,524 shares of the company's stock valued at $42,260,000 after buying an additional 1,221,433 shares in the last quarter. Vaughan Nelson Investment Management L.P. purchased a new position in shares of Bilibili in the third quarter valued at about $1,189,000. Natixis Advisors LLC purchased a new position in shares of Bilibili in the third quarter valued at about $272,000. KBC Group NV grew its position in shares of Bilibili by 90.9% during the third quarter. KBC Group NV now owns 10,683 shares of the company's stock worth $250,000 after purchasing an additional 5,086 shares in the last quarter. Finally, Venturi Wealth Management LLC bought a new stake in Bilibili during the 3rd quarter valued at approximately $63,000. 16.08% of the stock is currently owned by hedge funds and other institutional investors.

Bilibili Trading Up 3.6 %

Shares of BILI opened at $19.19 on Thursday. The company's fifty day simple moving average is $20.78 and its 200-day simple moving average is $17.10. The company has a market cap of $7.95 billion, a P/E ratio of -20.89 and a beta of 0.86. Bilibili Inc. has a twelve month low of $8.80 and a twelve month high of $31.77.

Bilibili (NASDAQ:BILI - Get Free Report) last posted its quarterly earnings data on Thursday, November 14th. The company reported $0.57 earnings per share for the quarter, topping analysts' consensus estimates of $0.10 by $0.47. Bilibili had a negative net margin of 10.73% and a negative return on equity of 15.17%. The company had revenue of $7.31 billion for the quarter, compared to analyst estimates of $7.14 billion. During the same period in the prior year, the company posted ($0.39) EPS. The firm's revenue for the quarter was up 25.8% on a year-over-year basis. Analysts predict that Bilibili Inc. will post -0.32 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several equities research analysts have recently issued reports on BILI shares. Sanford C. Bernstein lifted their price objective on shares of Bilibili from $12.00 to $13.00 and gave the company a "market perform" rating in a research report on Friday, August 23rd. Nomura raised shares of Bilibili from a "neutral" rating to a "buy" rating and set a $18.00 price objective for the company in a report on Thursday, August 22nd. Barclays raised their price objective on Bilibili from $19.00 to $24.00 and gave the company an "overweight" rating in a research report on Monday. Bank of America increased their price target on Bilibili from $19.00 to $22.50 and gave the company a "buy" rating in a research note on Friday, October 25th. Finally, Daiwa America raised Bilibili from a "hold" rating to a "strong-buy" rating in a report on Friday, November 8th. Three investment analysts have rated the stock with a hold rating, nine have assigned a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, Bilibili presently has an average rating of "Moderate Buy" and a consensus price target of $19.69.

View Our Latest Research Report on BILI

Bilibili Company Profile

(

Free Report)

Bilibili Inc provides online entertainment services for the young generations in the People's Republic of China. It offers a range of digital content, including professional user generated videos, mobile games, and value-added services, such as live broadcasting, occupationally generated videos, audio drama on Maoer, and comics on Bilibili Comic.

See Also

Want to see what other hedge funds are holding BILI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Bilibili Inc. (NASDAQ:BILI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bilibili, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bilibili wasn't on the list.

While Bilibili currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.