Connor Clark & Lunn Investment Management Ltd. acquired a new stake in shares of EZCORP, Inc. (NASDAQ:EZPW - Free Report) during the third quarter, according to its most recent disclosure with the SEC. The fund acquired 81,879 shares of the credit services provider's stock, valued at approximately $918,000. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.15% of EZCORP as of its most recent SEC filing.

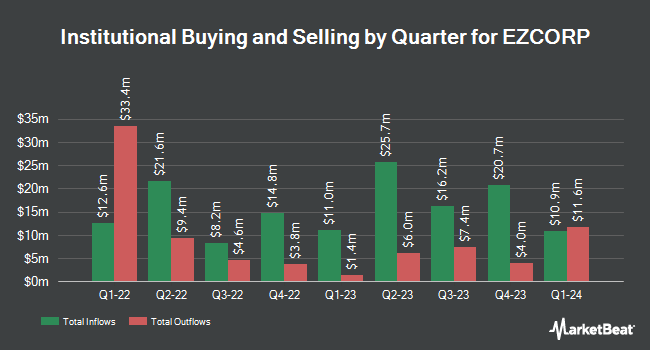

A number of other hedge funds also recently made changes to their positions in EZPW. Quest Partners LLC grew its position in shares of EZCORP by 32.6% during the third quarter. Quest Partners LLC now owns 107,565 shares of the credit services provider's stock worth $1,206,000 after purchasing an additional 26,419 shares in the last quarter. Empowered Funds LLC lifted its holdings in shares of EZCORP by 5.3% in the third quarter. Empowered Funds LLC now owns 324,807 shares of the credit services provider's stock worth $3,641,000 after buying an additional 16,482 shares in the last quarter. Royce & Associates LP grew its stake in EZCORP by 19.2% during the third quarter. Royce & Associates LP now owns 370,697 shares of the credit services provider's stock valued at $4,156,000 after acquiring an additional 59,795 shares in the last quarter. Oppenheimer Asset Management Inc. bought a new stake in EZCORP in the 3rd quarter valued at $181,000. Finally, Aigen Investment Management LP lifted its stake in EZCORP by 16.5% in the 3rd quarter. Aigen Investment Management LP now owns 17,712 shares of the credit services provider's stock worth $199,000 after purchasing an additional 2,508 shares in the last quarter. 99.83% of the stock is currently owned by institutional investors.

EZCORP Trading Up 0.9 %

NASDAQ EZPW traded up $0.11 on Thursday, hitting $12.65. 511,584 shares of the stock were exchanged, compared to its average volume of 519,516. The company has a debt-to-equity ratio of 0.28, a quick ratio of 1.99 and a current ratio of 2.71. EZCORP, Inc. has a 52-week low of $7.72 and a 52-week high of $12.85. The firm has a market capitalization of $688.98 million, a P/E ratio of 11.40 and a beta of 1.03. The stock has a fifty day moving average price of $11.56 and a two-hundred day moving average price of $10.99.

Insiders Place Their Bets

In related news, insider Sunil Sajnani sold 34,493 shares of EZCORP stock in a transaction dated Friday, November 22nd. The shares were sold at an average price of $12.42, for a total transaction of $428,403.06. Following the completion of the sale, the insider now owns 66,242 shares in the company, valued at $822,725.64. This trade represents a 34.24 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 2.13% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

Several equities research analysts have recently issued reports on the company. Canaccord Genuity Group reaffirmed a "buy" rating and issued a $19.00 target price on shares of EZCORP in a report on Friday, October 4th. Stephens initiated coverage on shares of EZCORP in a report on Wednesday, November 13th. They issued an "equal weight" rating and a $13.00 target price for the company.

Get Our Latest Report on EZCORP

About EZCORP

(

Free Report)

EZCORP, Inc provides pawn services in the United States and Latin America. The company operates through three segments: U.S. Pawn, Latin America Pawn, and Other Investments. The company offers pawn loans collateralized by tangible personal property, jewelry, consumer electronics, tools, sporting goods, and musical instruments.

Read More

Before you consider EZCORP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EZCORP wasn't on the list.

While EZCORP currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.