Connor Clark & Lunn Investment Management Ltd. purchased a new stake in Air Lease Co. (NYSE:AL - Free Report) in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 19,259 shares of the transportation company's stock, valued at approximately $872,000.

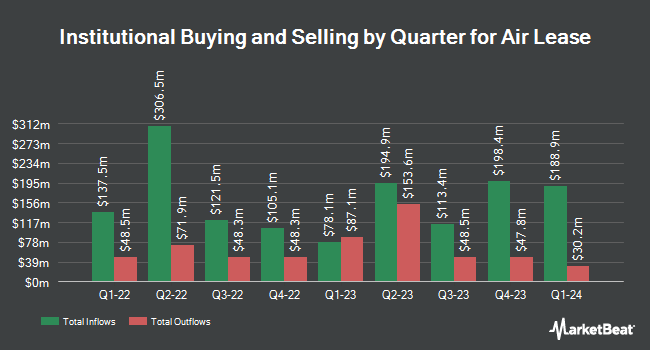

Other institutional investors have also added to or reduced their stakes in the company. Factorial Partners LLC raised its position in Air Lease by 10.7% during the 3rd quarter. Factorial Partners LLC now owns 79,700 shares of the transportation company's stock worth $3,610,000 after buying an additional 7,700 shares during the last quarter. BCGM Wealth Management LLC purchased a new stake in shares of Air Lease during the third quarter worth approximately $1,899,000. Natixis Advisors LLC raised its stake in Air Lease by 8.6% in the 3rd quarter. Natixis Advisors LLC now owns 204,577 shares of the transportation company's stock valued at $9,266,000 after purchasing an additional 16,184 shares during the last quarter. Royce & Associates LP boosted its stake in Air Lease by 2.5% during the 3rd quarter. Royce & Associates LP now owns 2,875,522 shares of the transportation company's stock worth $130,232,000 after purchasing an additional 70,299 shares during the last quarter. Finally, KBC Group NV raised its position in shares of Air Lease by 20.0% in the third quarter. KBC Group NV now owns 3,345 shares of the transportation company's stock valued at $151,000 after buying an additional 557 shares during the last quarter. Institutional investors and hedge funds own 94.59% of the company's stock.

Wall Street Analyst Weigh In

Several analysts recently issued reports on AL shares. The Goldman Sachs Group restated a "buy" rating and issued a $65.00 price objective on shares of Air Lease in a report on Thursday, November 21st. JPMorgan Chase & Co. upped their price target on Air Lease from $52.00 to $56.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 12th. Finally, Barclays dropped their price objective on Air Lease from $55.00 to $54.00 and set an "overweight" rating for the company in a research note on Friday, August 2nd. One research analyst has rated the stock with a hold rating and five have given a buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $57.60.

Check Out Our Latest Report on AL

Air Lease Stock Down 1.0 %

Shares of Air Lease stock traded down $0.51 on Thursday, reaching $50.71. 271,509 shares of the company were exchanged, compared to its average volume of 952,990. The stock's 50 day moving average price is $45.91 and its 200-day moving average price is $46.16. The company has a debt-to-equity ratio of 2.63, a current ratio of 0.43 and a quick ratio of 0.43. Air Lease Co. has a 1-year low of $37.75 and a 1-year high of $52.31. The company has a market cap of $5.65 billion, a P/E ratio of 11.55, a price-to-earnings-growth ratio of 1.61 and a beta of 1.59.

Air Lease Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 9th. Shareholders of record on Thursday, December 12th will be given a $0.22 dividend. The ex-dividend date is Thursday, December 12th. This is an increase from Air Lease's previous quarterly dividend of $0.21. This represents a $0.88 dividend on an annualized basis and a dividend yield of 1.74%. Air Lease's dividend payout ratio is currently 19.13%.

Air Lease Company Profile

(

Free Report)

Air Lease Corporation, an aircraft leasing company, engages in the purchase and leasing of commercial jet aircraft to airlines worldwide. It sells aircraft from its fleet to third parties, including other leasing companies, financial services companies, airlines, and other investors. The company provides fleet management services to investors and owners of aircraft portfolios.

Featured Stories

Before you consider Air Lease, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Lease wasn't on the list.

While Air Lease currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.