Connor Clark & Lunn Investment Management Ltd. purchased a new position in shares of Worthington Enterprises, Inc. (NYSE:WOR - Free Report) in the 3rd quarter, according to the company in its most recent filing with the SEC. The fund purchased 42,562 shares of the industrial products company's stock, valued at approximately $1,764,000. Connor Clark & Lunn Investment Management Ltd. owned 0.08% of Worthington Enterprises at the end of the most recent reporting period.

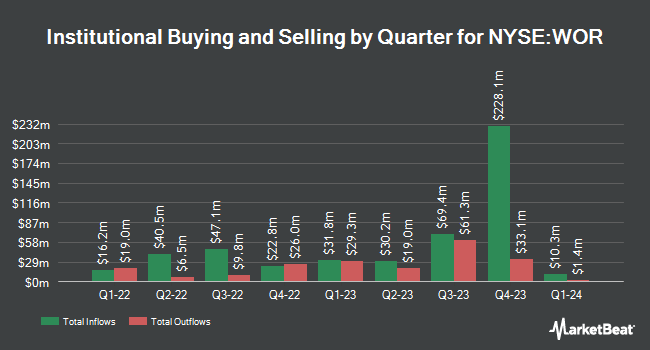

Other hedge funds and other institutional investors also recently made changes to their positions in the company. American Century Companies Inc. grew its stake in shares of Worthington Enterprises by 43.7% in the second quarter. American Century Companies Inc. now owns 568,678 shares of the industrial products company's stock valued at $26,916,000 after acquiring an additional 172,850 shares in the last quarter. Private Wealth Strategies L.L.C. bought a new stake in shares of Worthington Enterprises in the second quarter valued at approximately $3,913,000. Edgestream Partners L.P. acquired a new stake in Worthington Enterprises during the second quarter worth approximately $3,060,000. Panagora Asset Management Inc. bought a new position in Worthington Enterprises during the 2nd quarter worth $2,044,000. Finally, Denali Advisors LLC raised its holdings in Worthington Enterprises by 38.0% in the 2nd quarter. Denali Advisors LLC now owns 111,800 shares of the industrial products company's stock valued at $5,291,000 after acquiring an additional 30,779 shares in the last quarter. 51.59% of the stock is owned by institutional investors.

Worthington Enterprises Price Performance

NYSE:WOR traded down $0.92 during mid-day trading on Tuesday, reaching $40.17. The stock had a trading volume of 158,830 shares, compared to its average volume of 277,646. The company has a debt-to-equity ratio of 0.33, a quick ratio of 2.34 and a current ratio of 3.47. The firm has a 50 day moving average price of $41.08 and a two-hundred day moving average price of $46.33. The stock has a market capitalization of $2.02 billion, a P/E ratio of 54.07 and a beta of 1.26. Worthington Enterprises, Inc. has a one year low of $38.24 and a one year high of $69.96.

Worthington Enterprises (NYSE:WOR - Get Free Report) last issued its quarterly earnings data on Tuesday, September 24th. The industrial products company reported $0.50 earnings per share for the quarter, missing analysts' consensus estimates of $0.71 by ($0.21). The company had revenue of $257.31 million for the quarter, compared to the consensus estimate of $296.05 million. Worthington Enterprises had a net margin of 1.96% and a return on equity of 12.23%. The firm's revenue for the quarter was down 17.5% on a year-over-year basis. During the same quarter last year, the company earned $2.06 EPS.

Worthington Enterprises Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Friday, December 13th will be paid a $0.17 dividend. This represents a $0.68 annualized dividend and a dividend yield of 1.69%. The ex-dividend date is Friday, December 13th. Worthington Enterprises's payout ratio is 89.47%.

Analyst Upgrades and Downgrades

WOR has been the subject of several research analyst reports. StockNews.com upgraded shares of Worthington Enterprises from a "sell" rating to a "hold" rating in a report on Wednesday, September 25th. Canaccord Genuity Group decreased their price target on shares of Worthington Enterprises from $52.00 to $46.00 and set a "hold" rating for the company in a research report on Thursday, September 26th. Finally, Canaccord Genuity Group reiterated a "hold" rating and set a $46.00 price target on shares of Worthington Enterprises in a report on Friday, October 4th. One analyst has rated the stock with a sell rating and three have assigned a hold rating to the company's stock. According to MarketBeat, Worthington Enterprises has a consensus rating of "Hold" and a consensus target price of $45.00.

Read Our Latest Stock Analysis on Worthington Enterprises

Insider Transactions at Worthington Enterprises

In other news, CFO Joseph B. Hayek bought 2,500 shares of the firm's stock in a transaction that occurred on Friday, October 11th. The stock was bought at an average price of $40.21 per share, with a total value of $100,525.00. Following the completion of the transaction, the chief financial officer now directly owns 168,875 shares of the company's stock, valued at approximately $6,790,463.75. The trade was a 1.50 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Company insiders own 37.50% of the company's stock.

Worthington Enterprises Profile

(

Free Report)

Worthington Enterprises, Inc operates as an industrial manufacturing company. It operates through three segments: Building Products, Consumer Products, and Sustainable Energy Solutions. The Building Products segment sells refrigerant and LPG cylinders, well water and expansion tanks, fire suppression tanks, chemical tanks, and foam and adhesive tanks for gas producers, and distributors.

Further Reading

Before you consider Worthington Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Worthington Enterprises wasn't on the list.

While Worthington Enterprises currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.