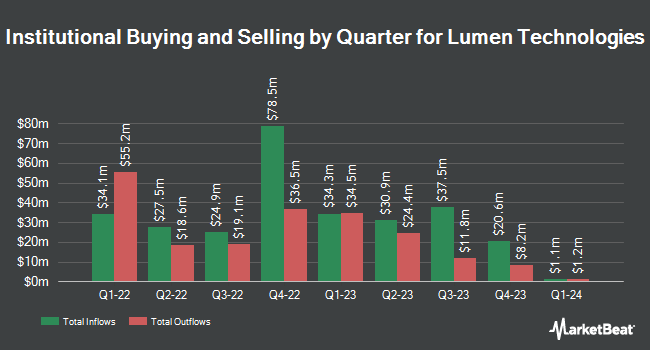

Connor Clark & Lunn Investment Management Ltd. raised its stake in Lumen Technologies, Inc. (NYSE:LUMN - Free Report) by 9.9% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 3,265,415 shares of the technology company's stock after purchasing an additional 294,679 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned 0.32% of Lumen Technologies worth $23,184,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Concord Wealth Partners lifted its position in Lumen Technologies by 98.8% in the third quarter. Concord Wealth Partners now owns 4,008 shares of the technology company's stock valued at $28,000 after purchasing an additional 1,992 shares during the last quarter. Allspring Global Investments Holdings LLC bought a new position in shares of Lumen Technologies during the third quarter valued at approximately $46,000. GAMMA Investing LLC raised its holdings in shares of Lumen Technologies by 1,901.8% during the third quarter. GAMMA Investing LLC now owns 6,846 shares of the technology company's stock valued at $49,000 after acquiring an additional 6,504 shares in the last quarter. ORG Wealth Partners LLC bought a new position in shares of Lumen Technologies during the third quarter valued at approximately $59,000. Finally, Stableford Capital II LLC bought a new position in shares of Lumen Technologies during the third quarter valued at approximately $71,000. Institutional investors own 66.19% of the company's stock.

Lumen Technologies Stock Performance

Shares of Lumen Technologies stock traded up $0.33 during trading on Thursday, hitting $7.88. 9,433,397 shares of the company's stock traded hands, compared to its average volume of 19,817,113. The company has a debt-to-equity ratio of 53.05, a current ratio of 1.20 and a quick ratio of 1.20. Lumen Technologies, Inc. has a 1 year low of $0.97 and a 1 year high of $10.33. The stock has a market capitalization of $8.00 billion, a P/E ratio of -3.63 and a beta of 1.21. The business has a 50-day simple moving average of $7.11 and a 200-day simple moving average of $4.19.

Lumen Technologies (NYSE:LUMN - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The technology company reported ($0.13) EPS for the quarter, missing the consensus estimate of ($0.09) by ($0.04). Lumen Technologies had a negative net margin of 16.06% and a negative return on equity of 49.74%. The business had revenue of $3.22 billion for the quarter, compared to analysts' expectations of $3.21 billion. During the same period last year, the business earned ($0.09) earnings per share. The company's quarterly revenue was down 11.5% on a year-over-year basis. As a group, analysts forecast that Lumen Technologies, Inc. will post -0.38 EPS for the current year.

Insider Buying and Selling at Lumen Technologies

In other news, Director James Fowler bought 10,000 shares of the stock in a transaction on Tuesday, September 3rd. The shares were bought at an average price of $4.70 per share, with a total value of $47,000.00. Following the completion of the acquisition, the director now owns 384,056 shares in the company, valued at $1,805,063.20. The trade was a 2.67 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 1.68% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of equities analysts recently commented on LUMN shares. JPMorgan Chase & Co. upgraded Lumen Technologies from an "underweight" rating to a "neutral" rating in a report on Wednesday, August 7th. The Goldman Sachs Group upped their price target on Lumen Technologies from $4.50 to $5.00 and gave the stock a "neutral" rating in a research note on Wednesday, November 6th. Moffett Nathanson upped their price target on Lumen Technologies from $1.00 to $3.00 and gave the stock a "sell" rating in a research note on Wednesday, August 7th. UBS Group upped their price target on Lumen Technologies from $1.50 to $5.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 7th. Finally, Wells Fargo & Company cut Lumen Technologies from an "equal weight" rating to an "underweight" rating and upped their price target for the stock from $1.75 to $4.00 in a research note on Friday, August 16th. Three analysts have rated the stock with a sell rating and five have issued a hold rating to the company. According to MarketBeat, Lumen Technologies presently has an average rating of "Hold" and a consensus price target of $4.02.

View Our Latest Stock Report on LUMN

About Lumen Technologies

(

Free Report)

Lumen Technologies, Inc, a facilities-based technology and communications company, provides various integrated products and services to business and residential customers in the United States and internationally. The company operates in two segments, Business and Mass Markets. It offers dark fiber, edge cloud services, internet protocol, managed security, software-defined wide area networks, secure access service edge, unified communications and collaboration, and optical wavelengths services; ethernet and VPN data networks services; and legacy services to manage cash flow, including time division multiplexing voice, private line, and other legacy services, as well as sells communication equipment, and IT solutions.

Further Reading

Before you consider Lumen Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumen Technologies wasn't on the list.

While Lumen Technologies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.