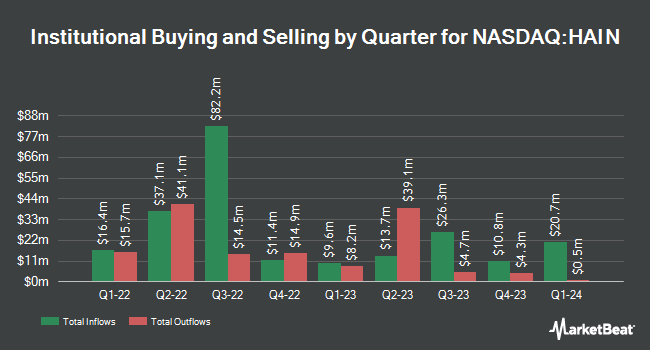

Connor Clark & Lunn Investment Management Ltd. grew its stake in The Hain Celestial Group, Inc. (NASDAQ:HAIN - Free Report) by 257.0% during the third quarter, according to its most recent 13F filing with the SEC. The firm owned 496,842 shares of the company's stock after acquiring an additional 357,669 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.55% of The Hain Celestial Group worth $4,288,000 as of its most recent filing with the SEC.

Several other large investors have also recently made changes to their positions in HAIN. Sei Investments Co. increased its holdings in The Hain Celestial Group by 17.9% during the 1st quarter. Sei Investments Co. now owns 54,087 shares of the company's stock worth $425,000 after purchasing an additional 8,203 shares during the period. State Board of Administration of Florida Retirement System lifted its stake in The Hain Celestial Group by 24.3% in the first quarter. State Board of Administration of Florida Retirement System now owns 31,747 shares of the company's stock worth $250,000 after acquiring an additional 6,210 shares during the last quarter. Vanguard Group Inc. lifted its stake in The Hain Celestial Group by 0.8% in the first quarter. Vanguard Group Inc. now owns 10,942,729 shares of the company's stock worth $86,010,000 after acquiring an additional 84,689 shares during the last quarter. CANADA LIFE ASSURANCE Co grew its holdings in The Hain Celestial Group by 3.8% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 103,773 shares of the company's stock worth $814,000 after acquiring an additional 3,767 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD increased its position in shares of The Hain Celestial Group by 12.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 60,167 shares of the company's stock valued at $473,000 after purchasing an additional 6,493 shares during the last quarter. 97.01% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, insider Chad D. Marquardt acquired 5,300 shares of the firm's stock in a transaction that occurred on Wednesday, September 4th. The shares were purchased at an average price of $8.32 per share, with a total value of $44,096.00. Following the completion of the acquisition, the insider now owns 15,300 shares in the company, valued at approximately $127,296. This represents a 53.00 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.83% of the stock is currently owned by corporate insiders.

The Hain Celestial Group Stock Performance

Shares of HAIN stock traded up $0.19 during midday trading on Friday, hitting $8.24. The company had a trading volume of 941,059 shares, compared to its average volume of 1,442,081. The stock has a market cap of $743.17 million, a price-to-earnings ratio of -8.77 and a beta of 0.74. The company has a debt-to-equity ratio of 0.76, a current ratio of 2.01 and a quick ratio of 1.05. The company's 50 day simple moving average is $8.22 and its 200 day simple moving average is $7.63. The Hain Celestial Group, Inc. has a 52-week low of $5.68 and a 52-week high of $11.68.

The Hain Celestial Group (NASDAQ:HAIN - Get Free Report) last issued its earnings results on Thursday, November 7th. The company reported ($0.04) earnings per share for the quarter, missing the consensus estimate of ($0.02) by ($0.02). The Hain Celestial Group had a negative net margin of 4.94% and a positive return on equity of 3.13%. The firm had revenue of $394.60 million during the quarter, compared to analysts' expectations of $394.24 million. During the same period in the previous year, the firm earned ($0.04) EPS. The firm's revenue was down 7.2% on a year-over-year basis. Research analysts anticipate that The Hain Celestial Group, Inc. will post 0.46 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of equities analysts recently commented on HAIN shares. DA Davidson lowered their target price on shares of The Hain Celestial Group from $9.00 to $8.00 and set a "neutral" rating for the company in a research note on Tuesday, November 12th. Piper Sandler reaffirmed a "neutral" rating and issued a $8.00 price target on shares of The Hain Celestial Group in a report on Thursday, September 19th. Stifel Nicolaus increased their price objective on The Hain Celestial Group from $8.00 to $9.00 and gave the company a "hold" rating in a report on Wednesday, August 28th. Finally, Barclays cut their target price on shares of The Hain Celestial Group from $9.00 to $8.00 and set an "equal weight" rating on the stock in a report on Monday, November 11th. Six investment analysts have rated the stock with a hold rating and one has assigned a buy rating to the company's stock. Based on data from MarketBeat, The Hain Celestial Group has an average rating of "Hold" and an average price target of $9.43.

Get Our Latest Research Report on HAIN

The Hain Celestial Group Profile

(

Free Report)

The Hain Celestial Group, Inc manufactures, markets, and sells organic and natural products in United States, United Kingdom, Europe, and internationally. It operates through two segments: North America and International. The company offers infant formula; infant, toddler, and kids' food; plant-based beverages and frozen desserts, such as soy, rice, oat, and spelt; and condiments.

Read More

Before you consider The Hain Celestial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hain Celestial Group wasn't on the list.

While The Hain Celestial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.