Connor Clark & Lunn Investment Management Ltd. reduced its holdings in shares of Wix.com Ltd. (NASDAQ:WIX - Free Report) by 32.3% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 301,508 shares of the information services provider's stock after selling 144,032 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.55% of Wix.com worth $50,403,000 at the end of the most recent reporting period.

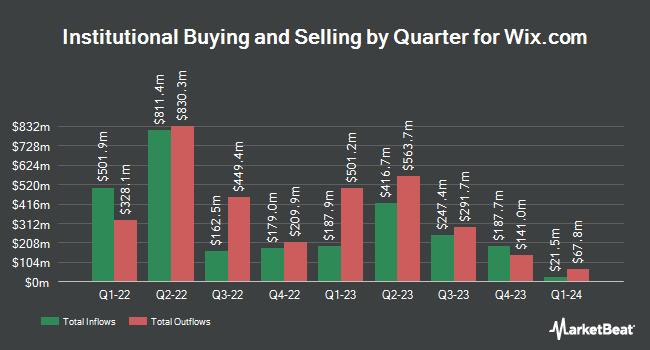

A number of other large investors have also recently added to or reduced their stakes in the company. Blue Trust Inc. lifted its holdings in shares of Wix.com by 98.0% during the third quarter. Blue Trust Inc. now owns 198 shares of the information services provider's stock worth $31,000 after purchasing an additional 98 shares during the period. Industrial Alliance Investment Management Inc. lifted its holdings in Wix.com by 246.5% during the first quarter. Industrial Alliance Investment Management Inc. now owns 686 shares of the information services provider's stock worth $94,000 after acquiring an additional 488 shares during the period. CWM LLC raised its holdings in shares of Wix.com by 19.0% in the 3rd quarter. CWM LLC now owns 632 shares of the information services provider's stock worth $106,000 after purchasing an additional 101 shares during the period. Toronto Dominion Bank lifted its holdings in Wix.com by 19.0% during the second quarter. Toronto Dominion Bank now owns 778 shares of the information services provider's stock valued at $124,000 after purchasing an additional 124 shares during the last quarter. Finally, Metis Global Partners LLC bought a new position in shares of Wix.com in the third quarter worth $200,000. Institutional investors and hedge funds own 81.52% of the company's stock.

Analyst Ratings Changes

Several research firms have commented on WIX. Benchmark boosted their target price on Wix.com from $210.00 to $225.00 and gave the stock a "buy" rating in a report on Thursday, August 8th. JMP Securities reissued a "market outperform" rating and issued a $180.00 price objective on shares of Wix.com in a research report on Thursday, July 25th. StockNews.com downgraded shares of Wix.com from a "buy" rating to a "hold" rating in a report on Friday, November 15th. JPMorgan Chase & Co. raised their target price on shares of Wix.com from $195.00 to $205.00 and gave the stock a "neutral" rating in a report on Wednesday. Finally, Needham & Company LLC restated a "buy" rating and issued a $200.00 price objective on shares of Wix.com in a report on Wednesday. Four equities research analysts have rated the stock with a hold rating, fourteen have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, Wix.com currently has a consensus rating of "Moderate Buy" and a consensus price target of $194.13.

Get Our Latest Analysis on Wix.com

Wix.com Trading Up 14.3 %

NASDAQ WIX traded up $26.32 during trading hours on Wednesday, reaching $210.27. 2,670,824 shares of the company traded hands, compared to its average volume of 552,857. Wix.com Ltd. has a 12 month low of $95.65 and a 12 month high of $213.26. The stock has a market capitalization of $11.53 billion, a PE ratio of 164.29, a PEG ratio of 3.84 and a beta of 1.47. The company has a 50 day moving average of $167.07 and a two-hundred day moving average of $161.41.

About Wix.com

(

Free Report)

Wix.com Ltd., together with its subsidiaries, operates as a cloud-based web development platform for registered users and creators worldwide. The company offers Wix Editor, a drag-and-drop visual development and website editing environment platform; and Wix ADI that enables users to have the freedom of customization that the classic editor offers.

Featured Stories

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.