Connor Clark & Lunn Investment Management Ltd. decreased its holdings in Nuvalent, Inc. (NASDAQ:NUVL - Free Report) by 24.0% in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 33,764 shares of the company's stock after selling 10,650 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.05% of Nuvalent worth $3,454,000 as of its most recent SEC filing.

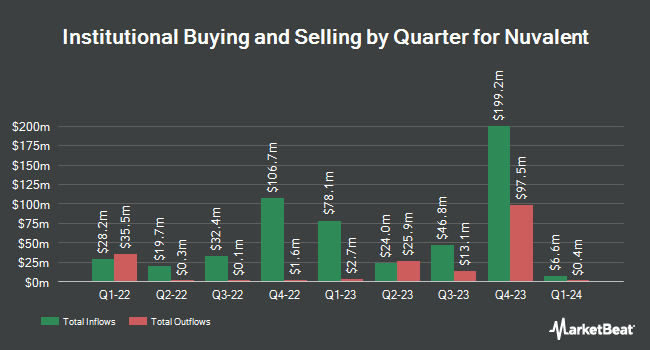

A number of other institutional investors and hedge funds also recently made changes to their positions in NUVL. Edgestream Partners L.P. acquired a new stake in Nuvalent in the 2nd quarter valued at approximately $1,191,000. Vanguard Group Inc. grew its holdings in Nuvalent by 2.2% during the first quarter. Vanguard Group Inc. now owns 3,412,072 shares of the company's stock worth $256,212,000 after purchasing an additional 72,222 shares during the period. First Turn Management LLC raised its stake in Nuvalent by 42.3% in the 3rd quarter. First Turn Management LLC now owns 359,114 shares of the company's stock valued at $36,737,000 after acquiring an additional 106,838 shares during the period. Dimensional Fund Advisors LP boosted its holdings in shares of Nuvalent by 80.5% during the 2nd quarter. Dimensional Fund Advisors LP now owns 348,089 shares of the company's stock worth $26,409,000 after buying an additional 155,276 shares during the period. Finally, Samlyn Capital LLC acquired a new position in shares of Nuvalent in the second quarter valued at approximately $17,397,000. Institutional investors own 97.26% of the company's stock.

Nuvalent Stock Performance

NUVL stock traded up $0.69 on Monday, reaching $95.62. The company's stock had a trading volume of 480,385 shares, compared to its average volume of 439,328. Nuvalent, Inc. has a 12-month low of $61.01 and a 12-month high of $113.51. The firm has a market cap of $6.79 billion, a PE ratio of -27.56 and a beta of 1.33. The business has a fifty day simple moving average of $97.47 and a two-hundred day simple moving average of $84.23.

Nuvalent (NASDAQ:NUVL - Get Free Report) last released its earnings results on Tuesday, November 12th. The company reported ($1.28) EPS for the quarter, missing the consensus estimate of ($0.93) by ($0.35). During the same period last year, the company earned ($0.59) earnings per share. As a group, research analysts anticipate that Nuvalent, Inc. will post -3.8 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several equities analysts have commented on NUVL shares. Barclays started coverage on shares of Nuvalent in a research note on Thursday, August 29th. They issued an "overweight" rating and a $100.00 price objective on the stock. UBS Group initiated coverage on Nuvalent in a research note on Thursday, October 24th. They issued a "neutral" rating and a $100.00 price objective for the company. The Goldman Sachs Group upgraded Nuvalent to a "strong sell" rating in a report on Monday, September 16th. Lifesci Capital upgraded shares of Nuvalent to a "strong-buy" rating in a research note on Monday, July 29th. Finally, BMO Capital Markets lifted their price objective on shares of Nuvalent from $132.00 to $134.00 and gave the company an "outperform" rating in a report on Wednesday, November 13th. One analyst has rated the stock with a sell rating, one has assigned a hold rating, ten have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $112.60.

Check Out Our Latest Stock Analysis on NUVL

Insider Activity at Nuvalent

In other news, insider Darlene Noci sold 5,000 shares of the business's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $84.43, for a total transaction of $422,150.00. Following the completion of the sale, the insider now directly owns 33,300 shares of the company's stock, valued at approximately $2,811,519. The trade was a 13.05 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Alexandra Balcom sold 10,000 shares of Nuvalent stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $84.23, for a total transaction of $842,300.00. Following the sale, the chief financial officer now owns 33,300 shares of the company's stock, valued at $2,804,859. The trade was a 23.09 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 2,106,795 shares of company stock worth $205,834,791. 12.52% of the stock is owned by company insiders.

Nuvalent Profile

(

Free Report)

Nuvalent, Inc, a clinical stage biopharmaceutical company, engages in the development of therapies for patients with cancer. Its lead product candidates are NVL-520, a novel ROS1-selective inhibitor to address the clinical challenges of emergent treatment resistance, central nervous system (CNS)-related adverse events, and brain metastases that may limit the use of ROS1 tyrosine kinase inhibitors (TKIs) for patients with ROS proto-oncogene 1 (ROS1)-positive non-small cell lung cancer (NSCLC) which is under the phase 2 portion of the ARROS-1 Phase 1/2 clinical trial; NVL-655, a brain-penetrant ALK-selective inhibitor, to address the clinical challenges of emergent treatment resistance, CNS-related adverse events, and brain metastases that might limit the use of first-, second-, and third-generation ALK inhibitors that is under the phase 2 portion of the ALKOVE-1 Phase 1/2 clinical trial; and NVL-330, a brain-penetrant human epidermal growth factor receptor 2 (HER2)-selective inhibitor designed to treat tumors driven by HER2ex20, brain metastases, and avoiding treatment-limiting adverse events including due to off-target inhibition of wild-type EGFR, which is expected to initiate phase 1 trial.

Further Reading

Before you consider Nuvalent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nuvalent wasn't on the list.

While Nuvalent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.