Connor Clark & Lunn Investment Management Ltd. trimmed its position in shares of American Superconductor Co. (NASDAQ:AMSC - Free Report) by 18.5% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 426,261 shares of the technology company's stock after selling 96,652 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 1.08% of American Superconductor worth $10,060,000 as of its most recent SEC filing.

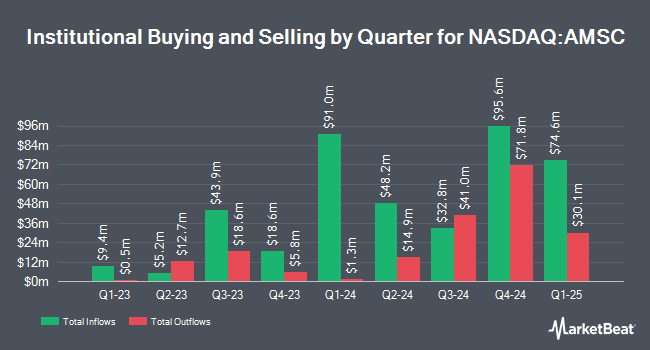

A number of other institutional investors also recently modified their holdings of AMSC. Vanguard Group Inc. lifted its holdings in American Superconductor by 30.5% in the 1st quarter. Vanguard Group Inc. now owns 1,698,934 shares of the technology company's stock worth $22,953,000 after buying an additional 396,814 shares during the period. Acadian Asset Management LLC lifted its position in American Superconductor by 92.5% during the first quarter. Acadian Asset Management LLC now owns 48,218 shares of the technology company's stock valued at $649,000 after buying an additional 23,174 shares during the period. Healthcare of Ontario Pension Plan Trust Fund boosted its stake in American Superconductor by 36.3% during the 1st quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 38,318 shares of the technology company's stock valued at $518,000 after purchasing an additional 10,197 shares during the last quarter. Quadrature Capital Ltd purchased a new position in shares of American Superconductor in the first quarter worth $203,000. Finally, Hood River Capital Management LLC bought a new stake in American Superconductor in the 1st quarter worth about $21,870,000. 52.28% of the stock is currently owned by hedge funds and other institutional investors.

American Superconductor Stock Performance

Shares of AMSC traded up $0.26 during mid-day trading on Friday, reaching $34.22. The stock had a trading volume of 1,142,998 shares, compared to its average volume of 1,052,425. The firm has a market cap of $1.35 billion, a price-to-earnings ratio of -681.07 and a beta of 2.14. American Superconductor Co. has a 12 month low of $8.56 and a 12 month high of $38.02. The business has a fifty day moving average of $25.66 and a 200 day moving average of $22.94.

Analyst Ratings Changes

A number of analysts have recently issued reports on AMSC shares. Craig Hallum reaffirmed a "buy" rating and set a $33.00 price target on shares of American Superconductor in a report on Tuesday, September 10th. Roth Mkm reissued a "buy" rating and set a $29.00 price target on shares of American Superconductor in a report on Monday, September 30th.

Check Out Our Latest Stock Analysis on AMSC

American Superconductor Company Profile

(

Free Report)

American Superconductor Corporation, together with its subsidiaries, provides megawatt-scale power resiliency solutions worldwide. The company operates through Grid and Wind segments. The Grid segment offers products and services that enable electric utilities, industrial facilities, and renewable energy project developers to connect, transmit, and distribute power under the Gridtec Solutions brand.

Featured Articles

Before you consider American Superconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Superconductor wasn't on the list.

While American Superconductor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.