Connor Clark & Lunn Investment Management Ltd. trimmed its position in PDD Holdings Inc. (NASDAQ:PDD - Free Report) by 61.3% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 252,743 shares of the company's stock after selling 401,153 shares during the quarter. Connor Clark & Lunn Investment Management Ltd.'s holdings in PDD were worth $24,514,000 as of its most recent filing with the Securities and Exchange Commission.

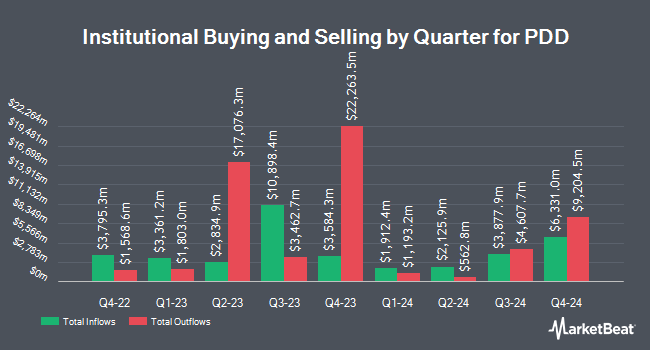

Other institutional investors and hedge funds have also modified their holdings of the company. Gordian Capital Singapore Pte Ltd increased its position in PDD by 1,218.9% during the third quarter. Gordian Capital Singapore Pte Ltd now owns 6,990 shares of the company's stock worth $942,000 after acquiring an additional 6,460 shares during the period. Lord Abbett & CO. LLC increased its position in PDD by 63.9% during the third quarter. Lord Abbett & CO. LLC now owns 38,235 shares of the company's stock worth $5,155,000 after acquiring an additional 14,905 shares during the period. Maple Rock Capital Partners Inc. bought a new position in PDD during the third quarter worth $74,221,000. Headwater Capital Co Ltd bought a new position in PDD during the fourth quarter worth $9,699,000. Finally, Baillie Gifford & Co. increased its position in PDD by 5.4% during the fourth quarter. Baillie Gifford & Co. now owns 38,059,343 shares of the company's stock worth $3,691,376,000 after acquiring an additional 1,942,891 shares during the period. 39.83% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of equities analysts recently issued reports on the stock. JPMorgan Chase & Co. lowered shares of PDD from an "overweight" rating to a "neutral" rating and dropped their target price for the stock from $170.00 to $105.00 in a research report on Friday, November 22nd. Benchmark lowered their price target on shares of PDD from $185.00 to $160.00 and set a "buy" rating on the stock in a report on Friday, November 22nd. Dbs Bank lowered shares of PDD from a "strong-buy" rating to a "hold" rating in a report on Friday, November 22nd. Finally, Jefferies Financial Group lowered their price target on shares of PDD from $181.00 to $171.00 and set a "buy" rating on the stock in a report on Thursday, November 21st. Three investment analysts have rated the stock with a hold rating, eight have assigned a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, PDD currently has a consensus rating of "Moderate Buy" and a consensus target price of $173.40.

View Our Latest Analysis on PDD

PDD Stock Down 0.1 %

PDD opened at $117.86 on Thursday. The firm's 50-day simple moving average is $111.92 and its 200-day simple moving average is $111.76. The firm has a market cap of $162.16 billion, a price-to-earnings ratio of 11.51, a PEG ratio of 0.32 and a beta of 0.69. The company has a debt-to-equity ratio of 0.02, a quick ratio of 2.15 and a current ratio of 2.15. PDD Holdings Inc. has a twelve month low of $88.01 and a twelve month high of $164.69.

PDD Profile

(

Free Report)

PDD Holdings Inc, a multinational commerce group, owns and operates a portfolio of businesses. It operates Pinduoduo, an e-commerce platform that offers products in various categories, including agricultural produce, apparel, shoes, bags, mother and childcare products, food and beverage, electronic appliances, furniture and household goods, cosmetics and other personal care, sports and fitness items and auto accessories; and Temu, an online marketplace.

See Also

Want to see what other hedge funds are holding PDD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for PDD Holdings Inc. (NASDAQ:PDD - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PDD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDD wasn't on the list.

While PDD currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.