Connor Clark & Lunn Investment Management Ltd. lifted its stake in shares of ChromaDex Co. (NASDAQ:CDXC - Free Report) by 189.0% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 506,186 shares of the company's stock after acquiring an additional 331,014 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.66% of ChromaDex worth $2,685,000 at the end of the most recent reporting period.

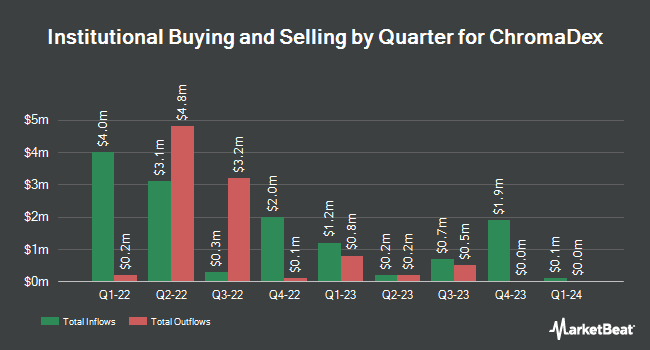

A number of other hedge funds and other institutional investors have also recently modified their holdings of the business. USA Financial Formulas bought a new stake in ChromaDex during the 4th quarter valued at $25,000. Truist Financial Corp purchased a new position in ChromaDex in the fourth quarter valued at about $54,000. FMR LLC bought a new position in ChromaDex in the third quarter worth about $55,000. MetLife Investment Management LLC lifted its position in shares of ChromaDex by 39.3% during the third quarter. MetLife Investment Management LLC now owns 18,114 shares of the company's stock valued at $66,000 after buying an additional 5,115 shares during the last quarter. Finally, Franklin Resources Inc. purchased a new stake in ChromaDex during the third quarter valued at approximately $68,000. 15.41% of the stock is currently owned by institutional investors.

ChromaDex Stock Performance

The firm has a market cap of $611.50 million, a P/E ratio of 787.29 and a beta of 2.21. The firm has a 50-day moving average price of $6.16 and a two-hundred day moving average price of $5.44. ChromaDex Co. has a 12-month low of $2.31 and a 12-month high of $9.18.

Analyst Upgrades and Downgrades

CDXC has been the subject of several analyst reports. StockNews.com lowered ChromaDex from a "strong-buy" rating to a "buy" rating in a report on Thursday, March 6th. LADENBURG THALM/SH SH raised their price target on ChromaDex from $6.80 to $8.10 and gave the stock a "buy" rating in a report on Wednesday, March 5th. Finally, HC Wainwright restated a "buy" rating and set a $11.00 price objective on shares of ChromaDex in a report on Monday.

Check Out Our Latest Stock Analysis on CDXC

About ChromaDex

(

Free Report)

ChromaDex Corporation operates as a bioscience company focusing on developing healthy aging products. The company operates through three segments: Consumer products; Ingredients; and Analytical Reference Standards and Services. It researches nicotinamide adenine dinucleotide (NAD+); provides finished dietary supplement products that contain its proprietary ingredients directly to consumers and distributors; and develops and commercializes proprietary-based ingredient technologies and supplies these ingredients as raw materials to the manufacturers of consumer products.

Further Reading

Before you consider ChromaDex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ChromaDex wasn't on the list.

While ChromaDex currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.