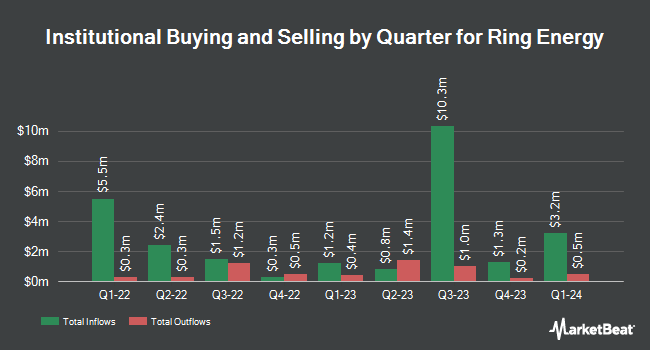

Connor Clark & Lunn Investment Management Ltd. boosted its position in shares of Ring Energy, Inc. (NYSEAMERICAN:REI - Free Report) by 196.4% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 414,893 shares of the company's stock after purchasing an additional 274,933 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned about 0.21% of Ring Energy worth $564,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other large investors also recently added to or reduced their stakes in REI. CreativeOne Wealth LLC acquired a new position in shares of Ring Energy in the 3rd quarter valued at $26,000. Mraz Amerine & Associates Inc. bought a new position in Ring Energy during the fourth quarter worth about $27,000. Virtu Financial LLC acquired a new position in Ring Energy in the third quarter valued at about $39,000. R Squared Ltd bought a new stake in shares of Ring Energy in the fourth quarter worth about $41,000. Finally, Sequoia Financial Advisors LLC raised its position in shares of Ring Energy by 103.9% during the fourth quarter. Sequoia Financial Advisors LLC now owns 32,499 shares of the company's stock worth $44,000 after purchasing an additional 16,558 shares during the period. 77.14% of the stock is currently owned by institutional investors and hedge funds.

Ring Energy Stock Up 6.1 %

Shares of NYSEAMERICAN REI traded up $0.07 during midday trading on Wednesday, hitting $1.22. 1,191,081 shares of the company's stock were exchanged, compared to its average volume of 1,757,254. The company has a quick ratio of 0.49, a current ratio of 0.54 and a debt-to-equity ratio of 0.46. The business has a 50 day moving average of $1.32. Ring Energy, Inc. has a 12 month low of $1.05 and a 12 month high of $2.20. The company has a market capitalization of $241.80 million, a price-to-earnings ratio of 2.14 and a beta of 1.55.

Insider Transactions at Ring Energy

In other Ring Energy news, CEO Paul D. Mckinney bought 200,000 shares of the firm's stock in a transaction on Monday, March 10th. The shares were purchased at an average price of $1.08 per share, for a total transaction of $216,000.00. Following the transaction, the chief executive officer now directly owns 2,966,054 shares in the company, valued at approximately $3,203,338.32. This trade represents a 7.23 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, major shareholder Warburg Pincus (E&P) Xii Llc sold 6,575,000 shares of the firm's stock in a transaction on Monday, February 24th. The stock was sold at an average price of $1.23, for a total value of $8,087,250.00. Following the transaction, the insider now owns 28,945,643 shares in the company, valued at approximately $35,603,140.89. This trade represents a 18.51 % decrease in their position. The disclosure for this sale can be found here. 2.60% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

REI has been the topic of several research analyst reports. Industrial Alliance Securities set a $2.50 target price on shares of Ring Energy in a report on Friday, March 7th. Alliance Global Partners reaffirmed a "buy" rating on shares of Ring Energy in a research note on Friday, March 7th.

Read Our Latest Stock Analysis on REI

About Ring Energy

(

Free Report)

Ring Energy, Inc, an independent oil and natural gas company, engages in the acquisition, exploration, development, and production of oil and natural gas properties. The company has interests in 56,711 net developed acres and 2,668 net undeveloped acres in Andrews, Gaines, Crane, Ector, Winkler, and Ward counties, Texas; and 8,751 net developed acres and 12,405 net undeveloped acres in Yoakum County, Texas and Lea County, New Mexico.

Recommended Stories

Before you consider Ring Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ring Energy wasn't on the list.

While Ring Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.