Connor Clark & Lunn Investment Management Ltd. lifted its position in shares of Cimpress plc (NASDAQ:CMPR - Free Report) by 42.8% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 98,322 shares of the business services provider's stock after acquiring an additional 29,484 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.39% of Cimpress worth $8,055,000 at the end of the most recent reporting period.

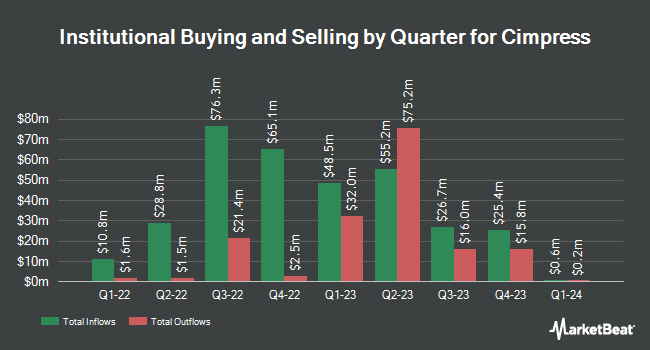

Several other large investors have also recently added to or reduced their stakes in CMPR. Russell Investments Group Ltd. lifted its holdings in shares of Cimpress by 4.6% in the 1st quarter. Russell Investments Group Ltd. now owns 16,039 shares of the business services provider's stock worth $1,422,000 after purchasing an additional 712 shares during the last quarter. ProShare Advisors LLC raised its stake in shares of Cimpress by 8.6% during the first quarter. ProShare Advisors LLC now owns 3,238 shares of the business services provider's stock valued at $287,000 after purchasing an additional 257 shares in the last quarter. State Board of Administration of Florida Retirement System lifted its holdings in Cimpress by 47.5% in the first quarter. State Board of Administration of Florida Retirement System now owns 7,515 shares of the business services provider's stock worth $665,000 after purchasing an additional 2,420 shares during the period. Vanguard Group Inc. lifted its stake in shares of Cimpress by 5.3% in the 1st quarter. Vanguard Group Inc. now owns 1,812,047 shares of the business services provider's stock worth $160,384,000 after acquiring an additional 91,543 shares during the period. Finally, Lazard Asset Management LLC raised its holdings in Cimpress by 9,821.4% during the first quarter. Lazard Asset Management LLC now owns 156,361 shares of the business services provider's stock worth $13,838,000 after purchasing an additional 154,785 shares in the last quarter. 77.64% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of analysts recently commented on the stock. Barrington Research boosted their target price on shares of Cimpress from $113.00 to $119.00 and gave the stock an "outperform" rating in a report on Tuesday, August 27th. Truist Financial reduced their price objective on shares of Cimpress from $120.00 to $110.00 and set a "buy" rating for the company in a research note on Friday, November 1st. Finally, StockNews.com lowered Cimpress from a "strong-buy" rating to a "buy" rating in a report on Friday, November 8th.

View Our Latest Stock Report on CMPR

Cimpress Stock Performance

Shares of Cimpress stock traded up $0.08 during trading on Friday, hitting $81.33. 96,114 shares of the stock traded hands, compared to its average volume of 166,486. The company has a fifty day moving average price of $79.63 and a two-hundred day moving average price of $84.94. Cimpress plc has a twelve month low of $58.05 and a twelve month high of $104.92. The stock has a market cap of $2.05 billion, a P/E ratio of 13.97, a PEG ratio of 0.70 and a beta of 2.05.

Cimpress (NASDAQ:CMPR - Get Free Report) last posted its earnings results on Wednesday, October 30th. The business services provider reported ($0.50) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.30 by ($0.80). The business had revenue of $804.97 million during the quarter, compared to analyst estimates of $800.51 million. Cimpress had a net margin of 4.69% and a negative return on equity of 27.15%. During the same quarter last year, the firm earned $0.17 earnings per share. On average, equities research analysts expect that Cimpress plc will post 4.27 EPS for the current fiscal year.

Insider Buying and Selling

In related news, CEO Robert S. Keane sold 396 shares of the firm's stock in a transaction that occurred on Thursday, September 5th. The stock was sold at an average price of $97.55, for a total value of $38,629.80. Following the transaction, the chief executive officer now directly owns 986,785 shares of the company's stock, valued at approximately $96,260,876.75. This trade represents a 0.04 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Sean Edward Quinn sold 24,093 shares of the business's stock in a transaction that occurred on Thursday, August 29th. The stock was sold at an average price of $98.48, for a total value of $2,372,678.64. The disclosure for this sale can be found here. Over the last three months, insiders sold 69,799 shares of company stock worth $6,901,076. Corporate insiders own 17.80% of the company's stock.

Cimpress Company Profile

(

Free Report)

Cimpress plc provides various mass customization of printing and related products in North America, Europe, and internationally. The company operates through five segments: Vista, PrintBrothers, The Print Group, National Pen, and All Other Businesses. It offers printed and digital marketing products; internet-based canvas-print wall décor, business signage, and other printed products; business cards; and marketing materials, such as flyers and postcards, digital and marketing services, writing instruments, decorated apparel, promotional products and gifts, packaging, design services, textiles, and magazines and catalogs.

Featured Articles

Before you consider Cimpress, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cimpress wasn't on the list.

While Cimpress currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.