Connor Clark & Lunn Investment Management Ltd. reduced its holdings in Shutterstock, Inc. (NYSE:SSTK - Free Report) by 17.4% in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 85,237 shares of the business services provider's stock after selling 17,909 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned about 0.24% of Shutterstock worth $3,015,000 at the end of the most recent quarter.

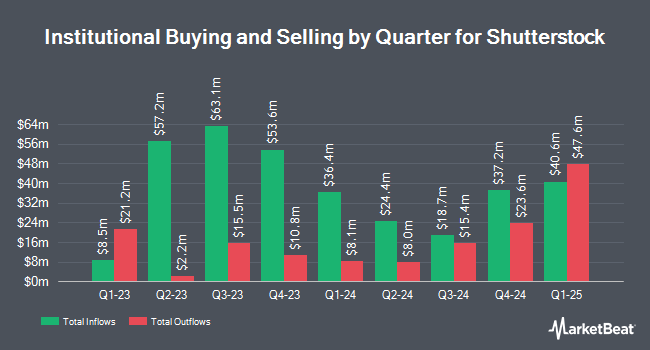

Several other institutional investors have also recently added to or reduced their stakes in the business. Vanguard Group Inc. boosted its position in shares of Shutterstock by 1.7% during the 1st quarter. Vanguard Group Inc. now owns 2,926,166 shares of the business services provider's stock worth $134,048,000 after purchasing an additional 47,929 shares in the last quarter. TD Asset Management Inc boosted its holdings in Shutterstock by 13.7% in the second quarter. TD Asset Management Inc now owns 1,793,925 shares of the business services provider's stock worth $69,425,000 after acquiring an additional 215,539 shares in the last quarter. Epoch Investment Partners Inc. grew its stake in Shutterstock by 22.8% in the second quarter. Epoch Investment Partners Inc. now owns 1,085,539 shares of the business services provider's stock valued at $42,010,000 after acquiring an additional 201,391 shares during the period. Dimensional Fund Advisors LP increased its holdings in shares of Shutterstock by 4.1% during the second quarter. Dimensional Fund Advisors LP now owns 869,469 shares of the business services provider's stock valued at $33,648,000 after acquiring an additional 34,243 shares in the last quarter. Finally, Invenomic Capital Management LP raised its position in shares of Shutterstock by 30.9% during the first quarter. Invenomic Capital Management LP now owns 594,475 shares of the business services provider's stock worth $27,233,000 after purchasing an additional 140,339 shares during the period. 82.79% of the stock is owned by institutional investors and hedge funds.

Shutterstock Stock Up 3.6 %

SSTK traded up $1.12 during mid-day trading on Monday, reaching $32.10. 458,814 shares of the stock were exchanged, compared to its average volume of 510,359. Shutterstock, Inc. has a 1 year low of $28.85 and a 1 year high of $54.40. The company has a debt-to-equity ratio of 0.23, a quick ratio of 0.42 and a current ratio of 0.42. The stock has a market capitalization of $1.12 billion, a PE ratio of 31.81 and a beta of 1.10. The company has a 50 day moving average price of $32.22 and a two-hundred day moving average price of $36.03.

Shutterstock (NYSE:SSTK - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The business services provider reported $1.31 earnings per share for the quarter, topping the consensus estimate of $1.06 by $0.25. The business had revenue of $250.59 million for the quarter, compared to analysts' expectations of $240.90 million. Shutterstock had a net margin of 4.03% and a return on equity of 20.39%. The firm's revenue for the quarter was up 7.4% compared to the same quarter last year. During the same period in the previous year, the company earned $0.99 earnings per share. As a group, research analysts anticipate that Shutterstock, Inc. will post 3.07 EPS for the current year.

Shutterstock Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 29th will be given a dividend of $0.30 per share. This represents a $1.20 dividend on an annualized basis and a dividend yield of 3.74%. The ex-dividend date is Friday, November 29th. Shutterstock's payout ratio is 117.65%.

Analysts Set New Price Targets

Several analysts recently issued reports on SSTK shares. Truist Financial reduced their price target on shares of Shutterstock from $65.00 to $56.00 and set a "buy" rating for the company in a research report on Wednesday, October 30th. Morgan Stanley reduced their price objective on shares of Shutterstock from $58.00 to $50.00 and set an "equal weight" rating for the company in a report on Monday, October 21st. StockNews.com cut shares of Shutterstock from a "buy" rating to a "hold" rating in a research report on Wednesday, October 30th. Finally, Needham & Company LLC reissued a "buy" rating and set a $55.00 price objective on shares of Shutterstock in a report on Tuesday, October 29th.

Check Out Our Latest Stock Analysis on Shutterstock

About Shutterstock

(

Free Report)

Shutterstock, Inc provides platform to connect brands and businesses to high quality content in North America, Europe, and internationally. The company offers image services consisting of photographs, vectors, and illustrations, which is used in visual communications, such as websites, digital and print marketing materials, corporate communications, books, publications, and others; footage services, including video clips, filmed by industry experts and cinema grade video effects in HD and 4K formats that are integrated into websites, social media, marketing campaigns, and cinematic productions; and music services comprising music tracks and sound effects, which are used to complement images and footage.

See Also

Before you consider Shutterstock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shutterstock wasn't on the list.

While Shutterstock currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.