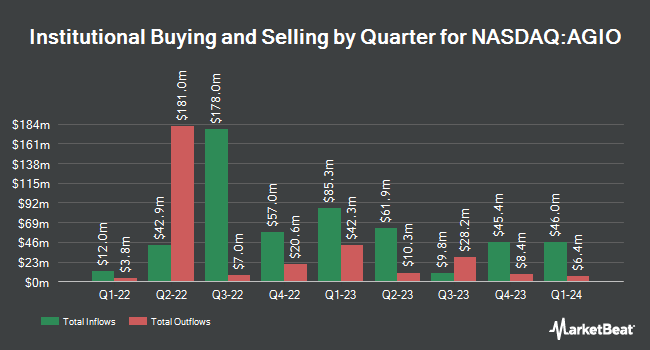

Connor Clark & Lunn Investment Management Ltd. cut its holdings in shares of Agios Pharmaceuticals, Inc. (NASDAQ:AGIO - Free Report) by 40.3% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 22,273 shares of the biopharmaceutical company's stock after selling 15,008 shares during the period. Connor Clark & Lunn Investment Management Ltd.'s holdings in Agios Pharmaceuticals were worth $990,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also recently made changes to their positions in AGIO. Quest Partners LLC grew its stake in Agios Pharmaceuticals by 139.6% during the 3rd quarter. Quest Partners LLC now owns 2,202 shares of the biopharmaceutical company's stock worth $98,000 after buying an additional 1,283 shares during the last quarter. Atria Investments Inc boosted its holdings in Agios Pharmaceuticals by 47.4% in the third quarter. Atria Investments Inc now owns 10,628 shares of the biopharmaceutical company's stock worth $472,000 after acquiring an additional 3,418 shares in the last quarter. Harbor Capital Advisors Inc. grew its stake in shares of Agios Pharmaceuticals by 19.3% during the third quarter. Harbor Capital Advisors Inc. now owns 39,090 shares of the biopharmaceutical company's stock worth $1,737,000 after acquiring an additional 6,320 shares during the last quarter. Oak Ridge Investments LLC increased its holdings in shares of Agios Pharmaceuticals by 14.6% during the third quarter. Oak Ridge Investments LLC now owns 40,378 shares of the biopharmaceutical company's stock valued at $1,794,000 after acquiring an additional 5,142 shares in the last quarter. Finally, China Universal Asset Management Co. Ltd. raised its position in shares of Agios Pharmaceuticals by 64.0% in the 3rd quarter. China Universal Asset Management Co. Ltd. now owns 10,942 shares of the biopharmaceutical company's stock valued at $486,000 after purchasing an additional 4,272 shares during the last quarter.

Agios Pharmaceuticals Stock Performance

NASDAQ:AGIO opened at $58.66 on Thursday. The firm's fifty day moving average is $47.93 and its two-hundred day moving average is $45.04. The firm has a market cap of $3.35 billion, a price-to-earnings ratio of 5.16 and a beta of 0.75. Agios Pharmaceuticals, Inc. has a one year low of $20.96 and a one year high of $62.58.

Wall Street Analyst Weigh In

Several analysts have weighed in on the stock. Leerink Partnrs downgraded shares of Agios Pharmaceuticals from a "strong-buy" rating to a "hold" rating in a research report on Friday, September 27th. Cantor Fitzgerald reiterated an "overweight" rating on shares of Agios Pharmaceuticals in a research note on Friday, September 20th. Royal Bank of Canada reissued an "outperform" rating and issued a $55.00 target price on shares of Agios Pharmaceuticals in a research report on Friday, November 1st. StockNews.com upgraded Agios Pharmaceuticals from a "sell" rating to a "hold" rating in a research note on Saturday, November 9th. Finally, Scotiabank boosted their price target on Agios Pharmaceuticals from $51.00 to $53.00 and gave the company a "sector outperform" rating in a research note on Friday, November 1st. Five analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $52.33.

View Our Latest Stock Analysis on Agios Pharmaceuticals

Insider Activity

In other Agios Pharmaceuticals news, CFO Cecilia Jones sold 2,542 shares of the business's stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of $49.03, for a total value of $124,634.26. Following the completion of the transaction, the chief financial officer now directly owns 20,158 shares of the company's stock, valued at approximately $988,346.74. The trade was a 11.20 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders own 4.93% of the company's stock.

Agios Pharmaceuticals Company Profile

(

Free Report)

Agios Pharmaceuticals, Inc, a biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States. Its lead product includes PYRUKYND (mitapivat), an activator of wild-type and mutant pyruvate kinase (PK), enzymes for the treatment of hemolytic anemias.

Recommended Stories

Before you consider Agios Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agios Pharmaceuticals wasn't on the list.

While Agios Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.