Connor Clark & Lunn Investment Management Ltd. purchased a new stake in shares of M/I Homes, Inc. (NYSE:MHO - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund purchased 7,964 shares of the construction company's stock, valued at approximately $1,365,000.

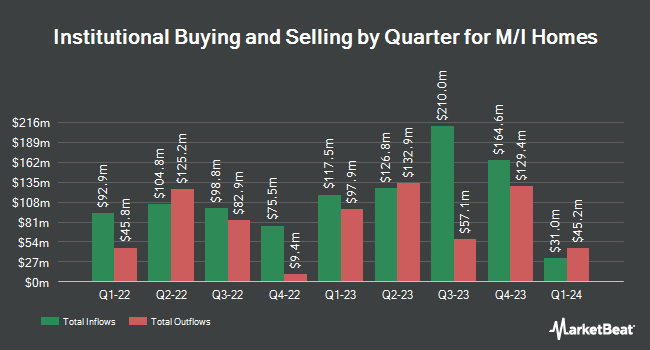

A number of other hedge funds also recently made changes to their positions in the business. Vanguard Group Inc. raised its holdings in M/I Homes by 1.9% during the first quarter. Vanguard Group Inc. now owns 2,096,407 shares of the construction company's stock worth $285,719,000 after purchasing an additional 39,542 shares in the last quarter. Price T Rowe Associates Inc. MD raised its holdings in M/I Homes by 2.3% during the first quarter. Price T Rowe Associates Inc. MD now owns 17,563 shares of the construction company's stock worth $2,394,000 after purchasing an additional 391 shares in the last quarter. Tidal Investments LLC raised its holdings in M/I Homes by 621.1% during the first quarter. Tidal Investments LLC now owns 12,944 shares of the construction company's stock worth $1,764,000 after purchasing an additional 11,149 shares in the last quarter. Boston Partners bought a new stake in M/I Homes during the first quarter worth approximately $1,210,000. Finally, Harbor Capital Advisors Inc. increased its holdings in shares of M/I Homes by 214.7% in the second quarter. Harbor Capital Advisors Inc. now owns 15,123 shares of the construction company's stock valued at $1,847,000 after buying an additional 10,318 shares in the last quarter. Institutional investors own 95.14% of the company's stock.

M/I Homes Trading Down 2.4 %

NYSE MHO opened at $165.13 on Wednesday. M/I Homes, Inc. has a twelve month low of $103.62 and a twelve month high of $176.18. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.60 and a current ratio of 6.81. The stock has a market cap of $4.58 billion, a price-to-earnings ratio of 8.85 and a beta of 2.24. The firm's 50 day moving average price is $162.72 and its two-hundred day moving average price is $147.56.

Insiders Place Their Bets

In other news, CFO Phillip G. Creek sold 20,000 shares of the business's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $160.00, for a total transaction of $3,200,000.00. Following the transaction, the chief financial officer now directly owns 18,545 shares in the company, valued at $2,967,200. The trade was a 51.89 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Corporate insiders own 3.70% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have issued reports on MHO. StockNews.com cut M/I Homes from a "strong-buy" rating to a "buy" rating in a report on Thursday, October 31st. Raymond James upped their price target on M/I Homes from $200.00 to $210.00 and gave the company a "strong-buy" rating in a report on Friday, August 2nd. Finally, Wedbush raised M/I Homes from a "neutral" rating to an "outperform" rating and upped their price target for the company from $155.00 to $185.00 in a report on Monday, November 4th.

Check Out Our Latest Report on M/I Homes

M/I Homes Profile

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Recommended Stories

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.