Connor Clark & Lunn Investment Management Ltd. bought a new position in KT Co. (NYSE:KT - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm bought 38,495 shares of the technology company's stock, valued at approximately $592,000.

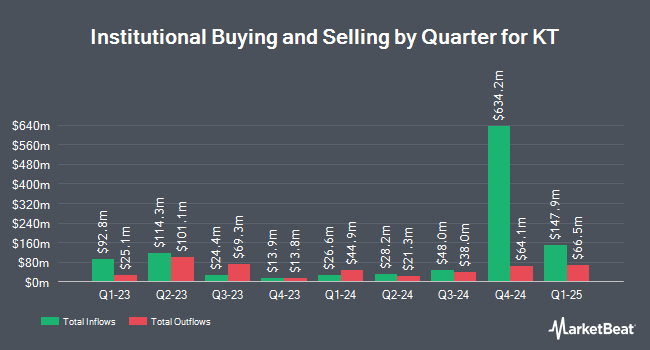

Other hedge funds also recently made changes to their positions in the company. Robeco Institutional Asset Management B.V. raised its holdings in shares of KT by 44.0% during the third quarter. Robeco Institutional Asset Management B.V. now owns 3,608,115 shares of the technology company's stock valued at $55,493,000 after acquiring an additional 1,101,669 shares in the last quarter. Acadian Asset Management LLC grew its holdings in shares of KT by 245.7% during the 2nd quarter. Acadian Asset Management LLC now owns 1,132,607 shares of the technology company's stock worth $15,476,000 after acquiring an additional 804,986 shares during the period. Natixis Advisors LLC raised its position in shares of KT by 383.2% in the 2nd quarter. Natixis Advisors LLC now owns 171,515 shares of the technology company's stock worth $2,345,000 after acquiring an additional 136,021 shares in the last quarter. Assetmark Inc. lifted its stake in shares of KT by 945.1% in the 3rd quarter. Assetmark Inc. now owns 137,383 shares of the technology company's stock valued at $2,113,000 after purchasing an additional 124,237 shares during the period. Finally, Envestnet Asset Management Inc. boosted its position in shares of KT by 31.1% during the second quarter. Envestnet Asset Management Inc. now owns 406,381 shares of the technology company's stock valued at $5,555,000 after purchasing an additional 96,518 shares in the last quarter. 18.86% of the stock is owned by hedge funds and other institutional investors.

KT Stock Down 0.8 %

NYSE:KT traded down $0.14 on Friday, reaching $18.15. 2,525,939 shares of the stock traded hands, compared to its average volume of 843,096. The company has a current ratio of 1.04, a quick ratio of 0.98 and a debt-to-equity ratio of 0.28. The company has a market capitalization of $9.36 billion, a price-to-earnings ratio of 10.20, a PEG ratio of 1.34 and a beta of 0.90. KT Co. has a 12 month low of $12.10 and a 12 month high of $18.45. The company's fifty day simple moving average is $15.73 and its 200 day simple moving average is $14.60.

Wall Street Analyst Weigh In

Several brokerages have commented on KT. New Street Research raised KT to a "strong-buy" rating in a research report on Monday, September 9th. StockNews.com raised shares of KT from a "buy" rating to a "strong-buy" rating in a research report on Saturday, November 16th.

Read Our Latest Stock Report on KT

KT Company Profile

(

Free Report)

KT Corporation provides integrated telecommunications and platform services in Korea and internationally. The company offers mobile voice and data telecommunications services based on 5G, 4G LTE and 3G W-CDMA technology; fixed-line telephone services, including local, domestic long-distance, international long-distance, and voice over Internet protocol telephone services, as well as interconnection services; broadband Internet access service and other Internet-related services; and data communication services, such as fixed-line and leased line services, as well as broadband Internet connection services.

Further Reading

Before you consider KT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KT wasn't on the list.

While KT currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.