Connor Clark & Lunn Investment Management Ltd. lifted its position in StoneX Group Inc. (NASDAQ:SNEX - Free Report) by 299.1% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 21,894 shares of the company's stock after buying an additional 16,408 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned about 0.07% of StoneX Group worth $1,793,000 as of its most recent filing with the Securities and Exchange Commission.

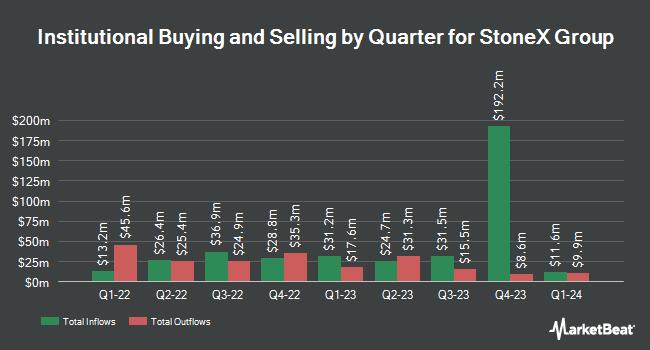

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Vanguard Group Inc. increased its stake in shares of StoneX Group by 1.8% in the 1st quarter. Vanguard Group Inc. now owns 1,909,965 shares of the company's stock valued at $134,194,000 after acquiring an additional 34,112 shares during the last quarter. Van Berkom & Associates Inc. increased its holdings in shares of StoneX Group by 1.6% in the second quarter. Van Berkom & Associates Inc. now owns 1,415,432 shares of the company's stock worth $106,596,000 after acquiring an additional 21,608 shares in the last quarter. American Century Companies Inc. raised its holdings in StoneX Group by 80.3% during the 2nd quarter. American Century Companies Inc. now owns 808,768 shares of the company's stock worth $60,908,000 after buying an additional 360,164 shares during the period. Price T Rowe Associates Inc. MD boosted its holdings in shares of StoneX Group by 0.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 450,770 shares of the company's stock valued at $31,672,000 after buying an additional 1,508 shares during the period. Finally, Assenagon Asset Management S.A. increased its position in shares of StoneX Group by 1.2% during the third quarter. Assenagon Asset Management S.A. now owns 332,573 shares of the company's stock worth $27,231,000 after acquiring an additional 3,822 shares in the last quarter. Institutional investors and hedge funds own 75.93% of the company's stock.

StoneX Group Stock Down 0.2 %

SNEX stock traded down $0.18 during trading hours on Tuesday, reaching $104.38. 132,515 shares of the stock were exchanged, compared to its average volume of 134,759. The company has a market cap of $3.32 billion, a price-to-earnings ratio of 13.14 and a beta of 0.75. The firm's 50-day moving average is $89.32 and its 200-day moving average is $81.32. StoneX Group Inc. has a 12 month low of $59.28 and a 12 month high of $106.77. The company has a debt-to-equity ratio of 1.26, a current ratio of 1.80 and a quick ratio of 1.30.

Insider Buying and Selling

In other StoneX Group news, CEO Sean Michael Oconnor sold 37,500 shares of StoneX Group stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $98.42, for a total value of $3,690,750.00. Following the transaction, the chief executive officer now owns 506,994 shares in the company, valued at $49,898,349.48. The trade was a 6.89 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director John Moore Fowler sold 1,800 shares of StoneX Group stock in a transaction that occurred on Friday, November 22nd. The shares were sold at an average price of $100.14, for a total transaction of $180,252.00. Following the sale, the director now directly owns 81,375 shares in the company, valued at $8,148,892.50. This trade represents a 2.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 16.24% of the stock is currently owned by corporate insiders.

StoneX Group Profile

(

Free Report)

StoneX Group Inc operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem worldwide. The company operates through Commercial, Institutional, Retail, and Global Payments segments. The Commercial segment provides risk management and hedging, exchange-traded and OTC products execution and clearing, voice brokerage, market intelligence, physical trading, and commodity financing and logistics services.

See Also

Before you consider StoneX Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneX Group wasn't on the list.

While StoneX Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.