Connor Clark & Lunn Investment Management Ltd. grew its stake in shares of Deluxe Co. (NYSE:DLX - Free Report) by 16.5% in the third quarter, according to its most recent filing with the SEC. The fund owned 186,766 shares of the business services provider's stock after acquiring an additional 26,473 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.42% of Deluxe worth $3,640,000 at the end of the most recent reporting period.

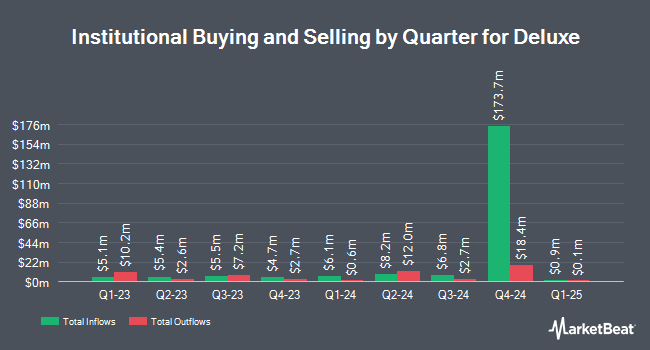

Several other large investors have also modified their holdings of DLX. Quest Partners LLC lifted its holdings in shares of Deluxe by 10.5% during the third quarter. Quest Partners LLC now owns 35,321 shares of the business services provider's stock valued at $688,000 after purchasing an additional 3,369 shares during the last quarter. Empowered Funds LLC lifted its stake in Deluxe by 5.3% during the third quarter. Empowered Funds LLC now owns 220,391 shares of the business services provider's stock valued at $4,295,000 after buying an additional 11,122 shares in the last quarter. Arjuna Capital acquired a new position in shares of Deluxe in the third quarter worth about $1,490,000. Victory Capital Management Inc. increased its position in shares of Deluxe by 4.8% in the third quarter. Victory Capital Management Inc. now owns 99,066 shares of the business services provider's stock worth $1,931,000 after acquiring an additional 4,517 shares in the last quarter. Finally, New York State Teachers Retirement System raised its holdings in shares of Deluxe by 5.9% during the third quarter. New York State Teachers Retirement System now owns 76,563 shares of the business services provider's stock valued at $1,492,000 after acquiring an additional 4,277 shares during the period. 93.90% of the stock is owned by institutional investors.

Insider Activity at Deluxe

In other news, CEO Barry C. Mccarthy bought 2,820 shares of the company's stock in a transaction on Tuesday, September 10th. The shares were bought at an average cost of $19.08 per share, with a total value of $53,805.60. Following the transaction, the chief executive officer now directly owns 178,670 shares in the company, valued at approximately $3,409,023.60. This trade represents a 1.60 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. 4.23% of the stock is currently owned by insiders.

Analyst Ratings Changes

Separately, StockNews.com lowered shares of Deluxe from a "strong-buy" rating to a "buy" rating in a research note on Thursday.

Get Our Latest Analysis on Deluxe

Deluxe Stock Up 1.3 %

NYSE:DLX traded up $0.30 during trading hours on Friday, hitting $23.25. 198,832 shares of the company's stock traded hands, compared to its average volume of 268,523. Deluxe Co. has a twelve month low of $17.60 and a twelve month high of $24.87. The firm has a market cap of $1.03 billion, a P/E ratio of 18.75, a P/E/G ratio of 0.65 and a beta of 1.46. The company has a debt-to-equity ratio of 2.38, a quick ratio of 0.83 and a current ratio of 0.92. The stock's fifty day moving average price is $20.23 and its two-hundred day moving average price is $21.14.

Deluxe Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 2nd. Investors of record on Tuesday, November 19th will be issued a dividend of $0.30 per share. This represents a $1.20 annualized dividend and a dividend yield of 5.16%. The ex-dividend date of this dividend is Tuesday, November 19th. Deluxe's dividend payout ratio is currently 96.77%.

About Deluxe

(

Free Report)

Deluxe Corporation provides technology-enabled solutions to enterprises, small businesses, and financial institutions in the United States, Canada, and Australia. It operates through Merchant Services, B2B Payments, Data Solutions, and Print segments. The Merchant Services offers credit and debit card authorization and payment systems, as well as processing services primarily to small and medium-sized retail and service businesses.

Featured Articles

Before you consider Deluxe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deluxe wasn't on the list.

While Deluxe currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2024, now is the time to give these stocks a look and pump up your 2025 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.