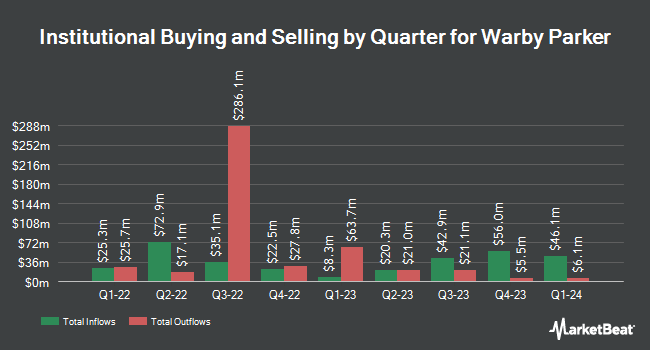

Connor Clark & Lunn Investment Management Ltd. raised its position in Warby Parker Inc. (NYSE:WRBY - Free Report) by 193.8% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 89,620 shares of the company's stock after acquiring an additional 59,121 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.09% of Warby Parker worth $1,463,000 as of its most recent SEC filing.

Several other hedge funds have also made changes to their positions in the business. Janney Montgomery Scott LLC increased its stake in shares of Warby Parker by 3.4% during the third quarter. Janney Montgomery Scott LLC now owns 47,908 shares of the company's stock worth $782,000 after buying an additional 1,556 shares during the period. Advisors Asset Management Inc. increased its holdings in Warby Parker by 79.9% in the first quarter. Advisors Asset Management Inc. now owns 5,125 shares of the company's stock valued at $70,000 after buying an additional 2,276 shares during the last quarter. Hsbc Holdings PLC raised its stake in Warby Parker by 11.5% in the second quarter. Hsbc Holdings PLC now owns 25,696 shares of the company's stock valued at $413,000 after buying an additional 2,651 shares in the last quarter. The Manufacturers Life Insurance Company lifted its holdings in Warby Parker by 7.2% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 44,667 shares of the company's stock worth $717,000 after buying an additional 3,007 shares during the last quarter. Finally, Arizona State Retirement System boosted its position in shares of Warby Parker by 16.0% during the 2nd quarter. Arizona State Retirement System now owns 23,408 shares of the company's stock worth $376,000 after acquiring an additional 3,224 shares in the last quarter. Institutional investors and hedge funds own 93.24% of the company's stock.

Insider Buying and Selling

In other news, CEO Neil Harris Blumenthal sold 50,000 shares of the business's stock in a transaction on Monday, September 9th. The stock was sold at an average price of $13.89, for a total value of $694,500.00. Following the completion of the transaction, the chief executive officer now directly owns 12,177 shares of the company's stock, valued at $169,138.53. The trade was a 80.42 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, CFO Steven Clive Miller sold 15,272 shares of the stock in a transaction on Friday, September 6th. The shares were sold at an average price of $13.00, for a total value of $198,536.00. Following the sale, the chief financial officer now directly owns 184,251 shares in the company, valued at approximately $2,395,263. The trade was a 7.65 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 99,178 shares of company stock worth $1,339,901 in the last three months. Corporate insiders own 26.55% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities analysts recently issued reports on the company. JMP Securities raised Warby Parker from a "market perform" rating to an "outperform" rating and set a $20.00 price target for the company in a report on Friday, August 23rd. BTIG Research boosted their price target on shares of Warby Parker from $18.00 to $20.00 and gave the company a "buy" rating in a research report on Friday, November 1st. Stifel Nicolaus lifted their target price on Warby Parker from $14.00 to $15.00 and gave the stock a "hold" rating in a research report on Friday, August 9th. Piper Sandler upped their price target on shares of Warby Parker from $18.00 to $22.00 and gave the company an "overweight" rating in a research report on Friday, November 8th. Finally, William Blair upgraded Warby Parker from a "market perform" rating to an "outperform" rating in a research note on Thursday, November 7th. Four equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $18.82.

Read Our Latest Stock Report on Warby Parker

Warby Parker Price Performance

WRBY traded down $1.25 during trading on Wednesday, reaching $22.90. 1,647,376 shares of the stock were exchanged, compared to its average volume of 1,431,378. The company has a market capitalization of $2.33 billion, a price-to-earnings ratio of -84.07 and a beta of 1.80. Warby Parker Inc. has a 1 year low of $10.28 and a 1 year high of $24.60. The business's 50 day moving average price is $17.90 and its two-hundred day moving average price is $16.40.

About Warby Parker

(

Free Report)

Warby Parker Inc provides eyewear products in the United States and Canada. The company offers eyeglasses, sunglasses, light-responsive lenses, blue-light-filtering lenses, non-prescription lenses, and contact lenses. It also provides accessories, such as cases, lenses kit with anti-fog spray, pouches, and anti-fog lens spray through its retail stores, website, and mobile apps.

Featured Stories

Before you consider Warby Parker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warby Parker wasn't on the list.

While Warby Parker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.